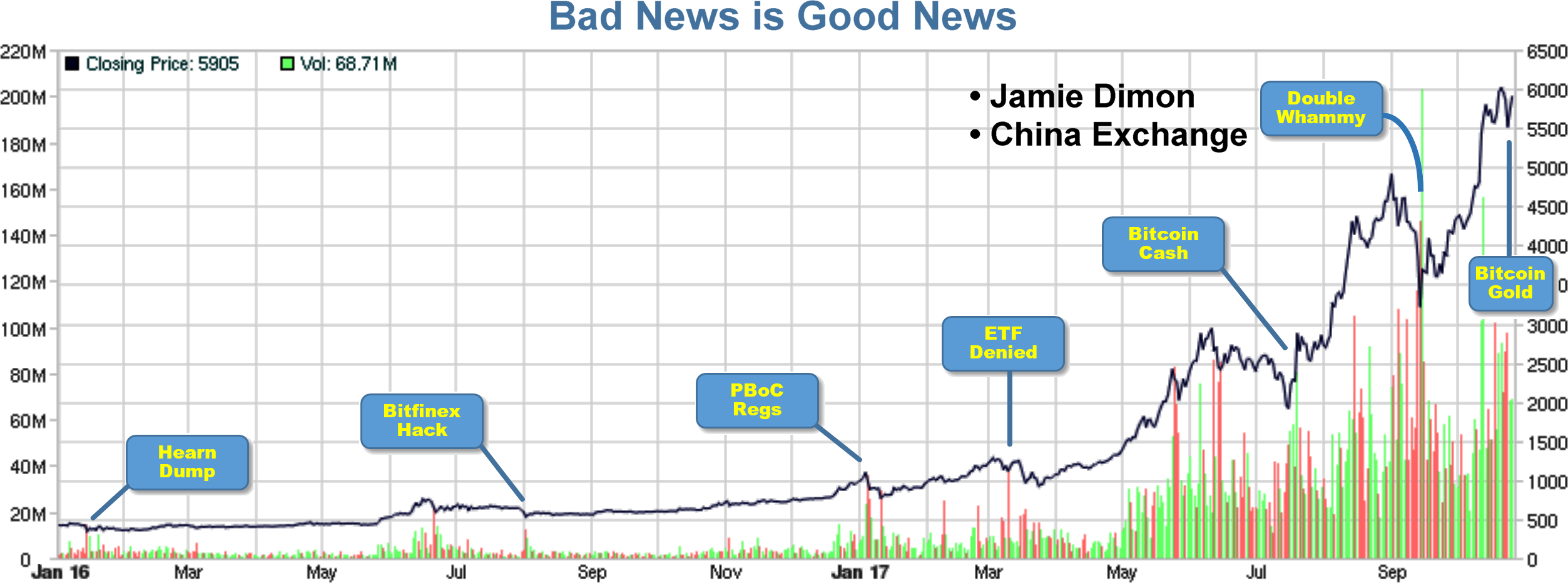

Bitcoin was hit by a double whammy this week. On Tuesday, Jamie Dimon of JP Morgan declared that Bitcoin is a fraud that will “blow up”. Then, just this morning, a Bitcoin exchange in China announced that it would shut its doors in response to verbal pressure from regulators and an uncertain regulatory environment.

Don’t ya just love it when bad news breaks on Bitcoin? I sure do! It creates a buying opportunity. After all, just look at what happened after the last five bouts of bad news: [updated Oct 2017—Click to reverse colors & enlarge]

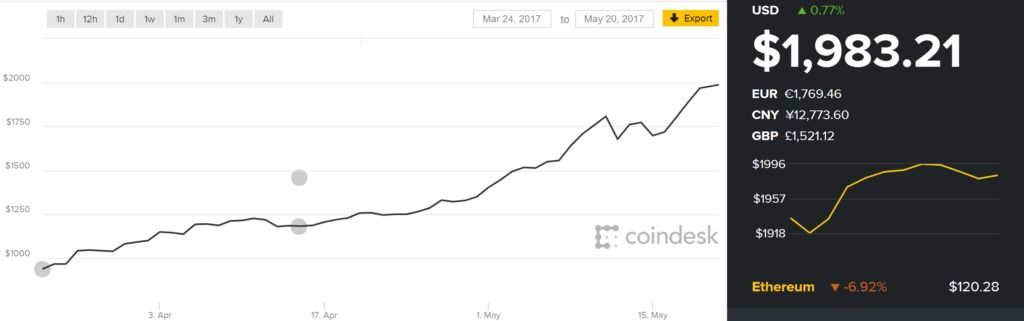

In each case, the Bitcoin exchange rate dropped—very briefly—and then climbed higher with renewed vigor. Heck it, doubled from $2400 to $4800 in just the past month! But here’s a the real question: Does either bad news events have legs? Does it spell the end of Bitcoin adoption and enthusiasm, at least for now?

After all, if it were discovered that the math behind Bitcoin were flawed, and that anyone could create forged coins, the empire would come tumbling down. In my book, this would constitute a crisis. But what about now? Do these two damning events—and a 35% correction in the past week—constitute a long-term crisis? To answer, we must first determine if public fears over these two events are credible…

China and JP Morgan: (a) A frightened authority (b) Simple Ignorance

Like most governments, the Chinese are concerned that the growing flight to Bitcoin is impacting liquidity of their national currency. [A superb presentation by Andreas Antonopoulos—Click it, after you read this article]. They are also concerned about the large number of Bitcoin exchanges that operate outside of a tight regulatory framework. They obscure the flow of money in and out of the country and they are a clear scapegoat for tax evasion or other criminal activity. Like any agency charged with financial regulation, the Chinese seek to reign in and regulate these maverick exchanges.

It is interesting to note that the Chinese government is not discouraging Bitcoin mining or even personal savings—only the proliferation of unlicensed exchanges and quasi-anonymous users. After all, More than 50% of all mining is done in China, and it helps to balance the loss of liquidity in the national currency.

Bitcoin is experiencing increased adoption—not just as a payment mechanism—but as a new form of stored value. Is this is a bad thing for governments? Surprise! When a government loses control over its own reserve and monetary policy, it may present more of an opportunity than a threat—for both citizens and governments. Gradually, economists, treasury secretaries, reserve board governors and monetary tsars will are coming to the same conclusion. But regardless of your position on this point of debate, here is a fact that is less controversial…

When governments attempt to restrict an activity that cannot be economically monitored or enforced—or at least when they attempt to do it in a way that leaves no relief valve for hobbyists, business, commerce, research or NGOs—they ultimately fuel the activity that they set out to stifle. Ultimately, if the public cannot discern a reasonable basis for government censorship or excessive restrictions, it leads to interest, innovation, adoption and the emergence of hot new markets.

Consider, again, the graph of Bitcoin price –vs- Bad news events at the top of this page.

On each date highlighted above, there was a damning piece of information that should cause early adopters to reconsider their enthusiasm for Bitcoin. In fact, the Hearn Dump really should have ended the whole party. A core developer sold off his entire BTC savings and claimed that the experiment was a failure. He published an article with his reasons for believing that Bitcoin was dead. Likewise, the SEC decision to prohibit the creation of an exchange traded fund (the Winkelvoss ETF), it sent a clear signal that governments really didn’t consider cryptocurrencies to be an asset at all.

On each date highlighted above, there was a damning piece of information that should cause early adopters to reconsider their enthusiasm for Bitcoin. In fact, the Hearn Dump really should have ended the whole party. A core developer sold off his entire BTC savings and claimed that the experiment was a failure. He published an article with his reasons for believing that Bitcoin was dead. Likewise, the SEC decision to prohibit the creation of an exchange traded fund (the Winkelvoss ETF), it sent a clear signal that governments really didn’t consider cryptocurrencies to be an asset at all.

But the graph demonstrates that each piece of “bad news” fueled a miniature rally. That’s because Bitcoin has none of the elements of a pyramid scheme. It is not an MLM and it cannot be manufactured or controlled by any organization. Rather, it is an exercise in pure supply, demand and market recognition. It is pure adoption mechanism that leads to a two-sided network. It’s benefits multiply as more users join the party.

What about Jamie Dimon at JP Morgan? He says that Bitcoin will crash.

Bitcoin has had a rocky road these first 8 years. Major exchanges have been bankrupt or worse, enormous criminal conspiracies were among the early adopters, the SEC has prohibited the creation of an ETF based on cryptocurrency, rogue spin-off coins are driving a wedge among users, and there are serious problems related to scaling and governance. A casual observer might wonder who is in control and who can be held responsible? After all, the idea of an economic mechanism that is altered by democratic—but decentralized—factors is new and radical. How can Bitcoin evolve, adapt and grow in the absence of an authority at its heart?

This confusion arises from the newness and unfamiliarity of blockchain architecture. Skepticism is natural. Indeed, Bitcoin is guided by an authority, but it doesn’t reside at the center of the network. It resides at the edges. This is the concept behind Proof-of-Stake and Proof-of-Work. Unlike a classic authority, your will matters just as much as anyone else’s. It is exceptionally democratic, self-enforcing, and resistant to gaming.

This is a difficult concept to wrap our heads around, because it is so different than we were taught and it is different than we have experienced for centuries. For this reason, Jamie Dimon’s statement that there is nothing behind Bitcoin presents a buy opportunity for individuals who were late to the table. Jamie may not yet understand intrinsic value, but we can educate ourselves. Bitcoin has more standing behind it than the US dollar.

… But don’t take this as investment advice. Bitcoin should not be thought of as an investment. It is the future of money. Speculation (both day trading and long term buy-&-hold) act to retard the eventual adoption of Bitcoin as a serious monetary instrument. Although I have Bitcoin, I do not encourage people to think of it as an investment. It is more important that it be used for ordinary business and commerce:

- Products and services

- Loans and debt settlement

- Stored value transfer (gift cads & prepaid services)

- Escrow

- Quotations and price guarantees

- Interbank exchange

- Smart contracts

- Liens and letters of credit

When the fraction of Bitcoin transactions servicing these consumer and business activities exceeds the fraction driven by savers and speculators, the dominos will begin to fall rapidly.

Articles about Jamie Dimon and JP Morgan…

- Jamie Dimon: Bitcoin Is A Fraud

- John McAfee: I challenge Jamie Dimon’s bitcoin skepticism

- Crypto Is Here to Stay (Whatever Jamie Dimon Might Say)

Can we draw a conclusion? Certainly, we can. And, we can toss in a prediction. It’s not even a high risk prediction. The recent pullback has no fundamental basis. No legs at all. The two “bad news” are not just a  red herring—they present a buying opportunity. If I were allowed to give investor advice (I am not; and I don’t), I would express my opinion with more verve and obvious conviction.

red herring—they present a buying opportunity. If I were allowed to give investor advice (I am not; and I don’t), I would express my opinion with more verve and obvious conviction.

Caveat Emptor (Everything comes with a disclaimer)…

I am a Bitcoin educator, proponent, early adopter and blockchain consultant. But here is the contradiction: Although I am also a Bitcoin investor, I discourage others from treating Bitcoin as an investment. Use it, but please don’t save it!

Why do I discourage others from investing in Bitcoin?

It’s not that I don’t believe that Bitcoin will increase in exchange value. It will rise spectacularly, as adoption grows. But Bitcoin will not become ubiquitous and trusted until the majority of coins are recycled into the market for payments, settlement, loans, interbank transfers, escrow, contract settlement, etc. That is, its use for business and commerce must exceed the fraction of trades that are driven by savers and speculators. Until this happens, Bitcoin will remain volatile. It will be the subject of suspicion. It won’t be used for large settlements and it won’t become the money itself.

Speculation acts against fluidity. It won’t block the eventual acceptance of Bitcoin as a global currency. Hoarding is not a deal stopper. But It retards momentum and delays the inevitable.

Philip Raymond co-chairs CRYPSA, produces The Bitcoin Event, edits A Wild Duck and is moderator of LinkedIN Bitcoin P2P, the largest discussion group of it’s kind. He is keynote at this year’s Digital Currency Summit in Johannesburg and sits on the New Money Systems board at Lifeboat Foundation. Use the contact form to inquire about a live presentation or consulting engagement.

but adoption that mirrors the shift in our very understanding of bookkeeping, trust and transparency.

but adoption that mirrors the shift in our very understanding of bookkeeping, trust and transparency.

I am neither an arbitrage player nor a day trader. These are just a few warning bells that come to mind when I think about such activity. You can be sure that this list of risks only scratches the surface. Bitcoin is remarkably fluid and many people flaunt regulations. For this reason, I am confident that opportunities for profitable arbitrage are rare and very tiny (small gain for a big risk).

I am neither an arbitrage player nor a day trader. These are just a few warning bells that come to mind when I think about such activity. You can be sure that this list of risks only scratches the surface. Bitcoin is remarkably fluid and many people flaunt regulations. For this reason, I am confident that opportunities for profitable arbitrage are rare and very tiny (small gain for a big risk).