Researchers at the University of Texas at Austin have demonstrated a cobalt-free, high-energy, lithium-ion battery.

Choi and other researchers have also tried to use lithium-ion battery electrodes to pull lithium directly from seawater and brines without the need for first evaporating the water. Those electrodes consist of sandwichlike layered materials designed to trap and hold lithium ions as a battery charges. In seawater, a negative electrical voltage applied to a lithium-grabbing electrode pulls lithium ions into the electrode. But it also pulls in sodium, a chemically similar element that is about 100,000 times more abundant in seawater than lithium. If the two elements push their way into the electrode at the same rate, sodium almost completely crowds out the lithium.

Lithium is prized for rechargeables because it stores more energy by weight than other battery materials. Manufacturers use more than 160,000 tons of the material every year, a number expected to grow nearly 10-fold over the next decade. But lithium supplies are limited and concentrated in a handful of countries, where the metal is either mined or extracted from briny water.

Lithium’s scarcity has raised concerns that future shortages could cause battery prices to skyrocket and stymie the growth of electric vehicles and other lithium-dependent technologies such as Tesla Powerwalls, stationary batteries often used to store rooftop solar power.

Seawater could come to the rescue. The world’s oceans contain an estimated 180 billion tons of lithium. But it’s dilute, present at roughly 0.2 parts per million. Researchers have devised numerous filters and membranes to try to selectively extract lithium from seawater. But those efforts rely on evaporating away much of the water to concentrate the lithium, which requires extensive land use and time. To date such efforts have not proved economical.

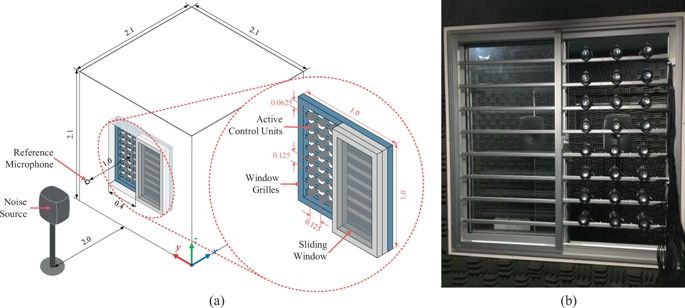

Shutting the window is usually the last resort in mitigating environmental noise, at the expense of natural ventilation. We describe an active sound control system fitted onto the opening of the domestic window that attenuates the incident sound, achieving a global reduction in the room interior while maintaining natural ventilation. The incident sound is actively attenuated by an array of control modules (a small loudspeaker) distributed optimally across the aperture. A single reference microphone provides advance information for the controller to compute the anti-noise signal input to the loudspeakers in real-time. A numerical analysis revealed that the maximum active attenuation potential outperforms the perfect acoustic insulation provided by a fully shut single-glazed window in ideal conditions. To determine the real-world performance of such an active control system, an experimental system is realized in the aperture of a full-sized window installed on a mockup room. Up to 10-dB reduction in energy-averaged sound pressure level was achieved by the active control system in the presence of a recorded real-world broadband noise. However, attenuation in the low-frequency range and its maximum power output is limited by the size of the loudspeakers.

Unlimited Clean Energy with The Wavestar machine. Harness the Power of Wave Energy with the World’s Strongest Wave Power Concept. Oceans cover more than 70% of Earth’s surface and ocean waves carry enormous power. By utilizing the largest source of untapped clean energy, it could supply a substantial part of the world’s electricity. Wave energy is more predictable compared to wind power, the waves come and go slowly and can be forecasted 24 hours ahead. Also the production continues 6–8 hours after the wind settles. This makes wave energy an ideal complement for wind turbines and could satisfy the continuously increasing demand for renewable energy in the grid.

The concept was invented by sailing enthusiasts Niels and Keld Hansen in 2000. The challenge was to create a regular output of energy from ocean swells and waves that are 5–10 seconds apart. This was achieved with a row of half-submerged buoys, which rise and fall in turn as the wave passes, forming the iconic part of Wavestar’s design. This allows energy to be continually produced despite waves being periodic.

The machine’s unique storm protection system, one of the many patented aspects of the design, guarantees the machine’s sea survivability and represents a real milestone in the development of wave energy machines. Wave energy will play a crucial role in securing our energy future, but only machines that can withstand the strongest storms will survive.

Environmental issues demand swift diversification to multiple renewable sources in order for us to fulfill our future energy needs. Wavestar will work in harmony with other clean energy methods to support the alternative energy movement and ensure a continuous supply of clean energy. Imagine what we can do together.

Music: Svadhisthana (Dance Mix) by Dhruva Aliman

https://dhruvaaliman.bandcamp.com/album/hello-moon

http://www.dhruvaaliman.com/

Investment in U.S. offshore wind projects are set to hit $78 billion (€69 billion) this decade, in contrast with an estimated $82 billion for U.S. offshore oil and gasoline projects, Wood Mackenzie data shows. This would be a remarkable feat only four years after the first offshore wind plant — the 30 megawatt (MW) Block Island Wind Farm off the coast of Rhode Island — started operating in U.S. waters.

According to the Department of Energy (DOE), there are 28 US offshore wind projects in the planning stage, with the biggest clusters along the East Coast, from Massachusetts to Virginia. There are also 15 active commercial leases for offshore wind development in the U.S. and if they are fully built, there is the potential to support approximately 25 GW of offshore wind capacity.

The center of our very own galaxy might be one of the Universe’s most mysterious places. Astronomers have to probe through thick dust to see what’s going on there.

All that dust makes life difficult for astronomers who are trying to understand all the radiation in the center of the Milky Way, and what exactly its source is.

A new study based on 20 years of data – and a hydrogen bubble where there shouldn’t be one – is helping astronomers understand all that energy.

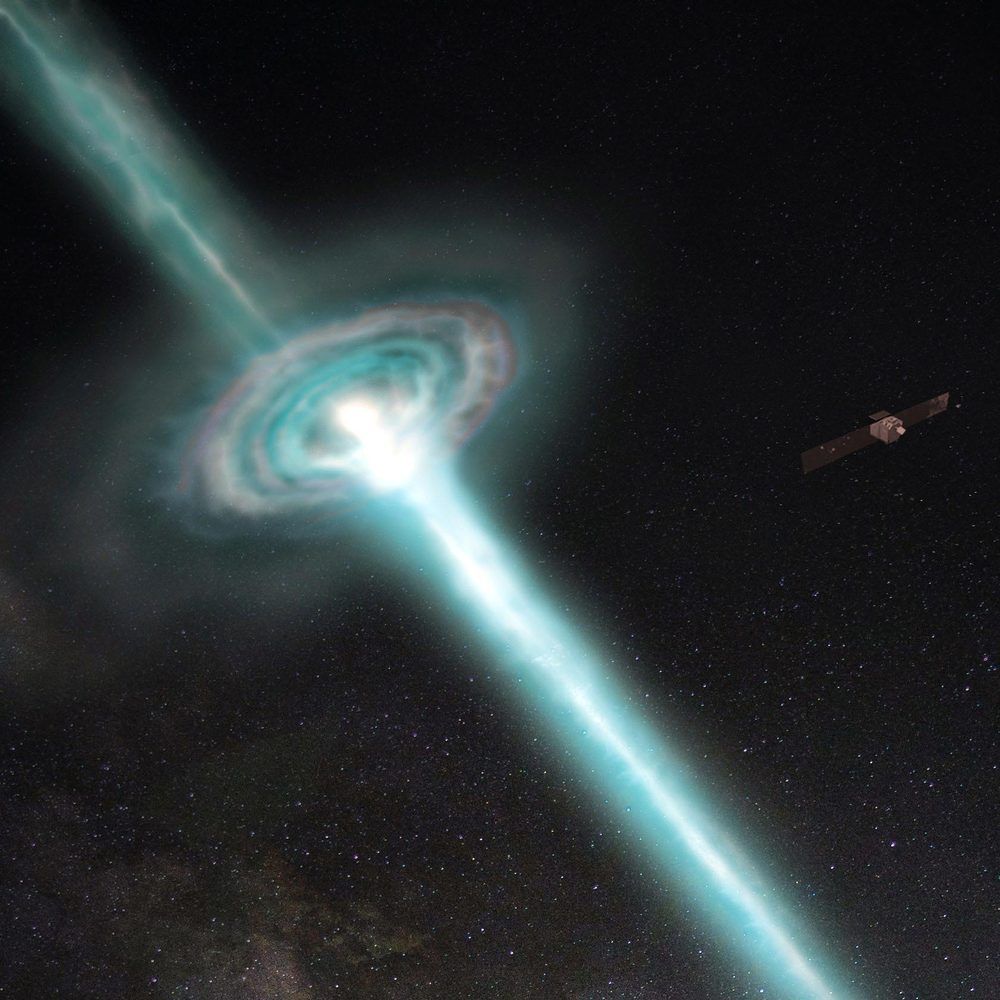

In 2019, the MAGIC telescopes detected the first Gamma Ray Burst at very high energies. This was the most intense gamma-radiation ever obtained from such a cosmic object. But the GRB data have more to offer: with further analyses, the MAGIC scientists could now confirm that the speed of light is constant in vacuum — and not dependent on energy. So, like many other tests, GRB data also corroborate Einstein’s theory of General Relativity. The study has now been published in Physical Review Letters.

Einstein’s general relativity (GR) is a beautiful theory that explains how mass and energy interact with space-time, creating a phenomenon commonly known as gravity. GR has been tested and retested in various physical situations and over many different scales, and, postulating that the speed of light is constant, it always turned out to outstandingly predict the experimental results. Nevertheless, physicists suspect that GR is not the most fundamental theory, and that there might exist an underlying quantum mechanical description of gravity, referred to as quantum gravity (QG).

Some QG theories consider that the speed of light might be energy dependent. This hypothetical phenomenon is called Lorentz invariance violation (LIV). Its effects are thought to be too tiny to be measured, unless they are accumulated over a very long time. So how to achieve that? One solution is using signals from astronomical sources of gamma rays. Gamma-ray bursts (GRBs) are powerful and far away cosmic explosions, which emit highly variable, extremely energetic signals. They are thus excellent laboratories for experimental tests of QG. The higher energy photons are expected to be more influenced by the QG effects, and there should be plenty of those; these travel billions of years before reaching Earth, which enhances the effect.

A federal court on Friday upheld a regulation that removes barriers to electric grid-level batteries that store electricity.

The regulation in question requires that grid operators treat storage similar to the way power plants are treated. It was promulgated in 2018 by the Federal Energy Regulatory Commission (FERC).

The Berkshire Hathaway-owned utility’s largest-ever clean energy procurement opens up huge opportunities in Northwest and Rocky Mountain states.