A multi-institution research team has developed an optical chip that can train machine learning hardware. Their research is published today in Optica.

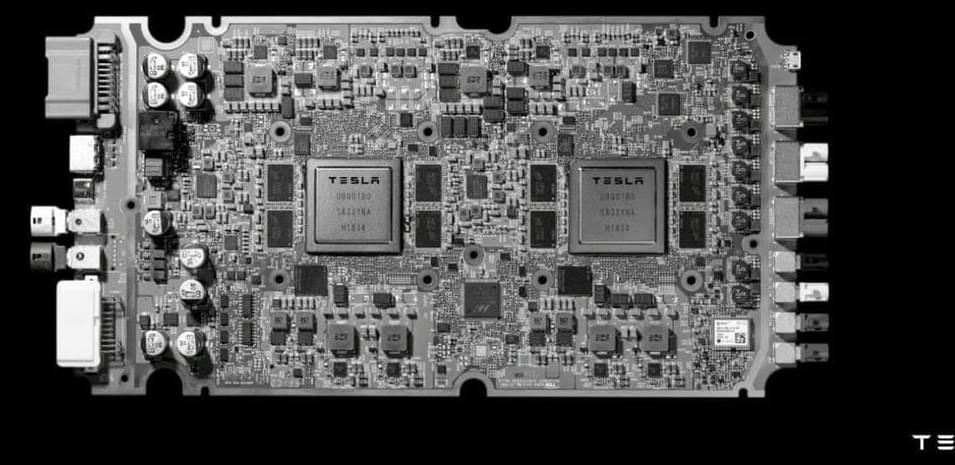

Machine learning applications have skyrocketed to $165 billion annually, according to a recent report from McKinsey. But before a machine can perform intelligence tasks such as recognizing the details of an image, it must be trained. Training of modern-day artificial intelligence (AI) systems like Tesla’s autopilot costs several million dollars in electric power consumption and requires supercomputer-like infrastructure.

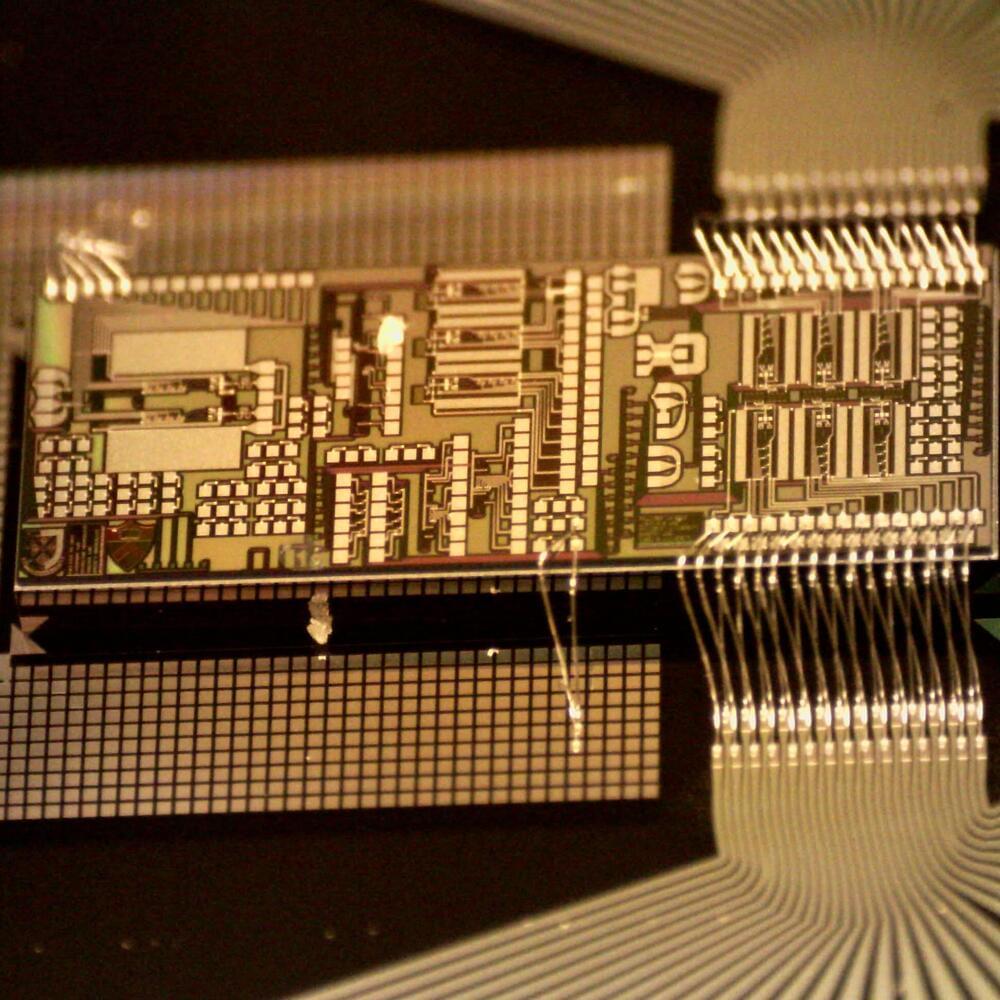

This surging AI “appetite” leaves an ever-widening gap between computer hardware and demand for AI. Photonic integrated circuits, or simply optical chips, have emerged as a possible solution to deliver higher computing performance, as measured by the number of operations performed per second per watt used, or TOPS/W. However, though they’ve demonstrated improved core operations in machine intelligence used for data classification, photonic chips have yet to improve the actual front-end learning and machine training process.