The emirate believes using the technology to conduct its business will make it more efficient and burnish its business-friendly image.

“Economist and filmmaker Manuel Stagars portrays this exciting technology in interviews with software developers, cryptologists, researchers, entrepreneurs, consultants, VCs, authors, politicians, and futurists from the United States, Canada, Switzerland, the UK, and Australia.”

ES Emerging Technology are delighted to invite you to the second event in our Exponential Series!

Nathan Waters is a futurist, decentralist and entrepreneur. He is the founder of the monthly Ethereum blockchain meetup (SydEthereum) and Australia’s largest independent hackathon (Hackagong).

In this discussion Nathan will be presenting a new project for a blockchain-based economic protocol intended to transition humanity to a post-Capitalist future. We’ll be covering topics such as: runaway automation, technological unemployment, future of work and education, wage slavery, wealth inequality, rising precariat, universal basic income, peer production, platform co-operatives, post-scarcity and decentralised autonomous organisations.

Mar.21 — Arvind Krishna, IBM senior VP of hybrid cloud, sits down with Bloomberg’s Caroline Hyde at IBM InterConnect 2017 to discuss IBM’s new blockchain service.

by Tatiana Moroz

The most moving thing to me about music is it’s ability to change. It changes the mood, the atmosphere, and it fills us with emotion. It can unify mankind in the power of good and triumph over evil regimes. What most struck me was when we saw this in the 60’s and 70’s folk songs that became anthems for the civil rights, equality, and antiwar movements. Even as a little girl, I knew that this core drive and expression for freedom was critical to the success of humanity as we marched ever closer to the nightmarish visions painted in 1984 and Brave New World.

This is a heavy and serious purpose, but one I took to heart as I created songs of hope, sadness, life, beauty and love. I noticed that the music industry seemed averse to this type of meaning based songwriting, and the radio waves were filling with more vapid nonsense by the minute. However, I kept my head down and tried to educate myself on the ways we could organize society for the better.

I joined the Ron Paul movement in late 2011 after I learned about the Federal Reserve system of central banking. I saw that it was one of the biggest obstacles to true liberty. I used storytelling in my music to illustrate the solutions I was finding, but I think we all hit a wall with politics at one point (which is probably how we all know each other in a way as seekers of the truth).

If you told me 6 years ago that I would be involved with “fintech” or technology in general, I would have laughed you out of the room. As soon as I start reading a manual, I disengage, my eyes glaze over, and within 6–8 words, I am daydreaming about something else. Even though my friends teaching me about Bitcoin were able to illustrate the benefits, something didn’t click. I gave them $500 anyway (which was a lot of money to me!) and they bought me some Bitcoins at $11. Eventually as the price went up and I learned more, I became enthusiastic about the possibilities. If my goal was to help “save the world” (for lack of a better term), then there were few inventions in the history of man that could compete with Bitcoin and blockchain technology.

I created the Bitcoin Jingle and became immersed in the community. I soon befriended Adam B. Levine of Let’s Talk Bitcoin, one of the most popular Bitcoin podcasts that also acted as a network home to over a dozen other shows. As content creators, we were the first to experiment with artist tokens and markets based around music, podcasts, and other media that removed the middleman and were secured through the power of the blockchain. In 2014 we created TATIANACOIN, the 1st ever artist cryptocurrency, but creating the coin was just the beginning. Upon launch, we soon realized we had to build the ecosystem for the coin to thrive.

Think of artist coins as a type of token that you can hold in a digital wallet, like store credit. These coins can be sold to your fans that want to support your work, similar to a crowdfund or patronage type platform, but they get back TATIANACOIN that they can spend however they want. It can be redeemed for backstage access, music, merchandise, held onto for future rewards, and the coins can even be traded or sold with other music fans. They allow an artist to gather support from their community through long-term fundraising that gives back real value and engagement. Imagine, as a fan, becoming that much more entwined with the careers of your favorite musicians, visual artists, and other content creators! Artist coins also allow for direct messaging, streaming, and support functions between artists and fans. We see this as a more enriching experience than just your average social media platform.

But so what? We built a platform. What does this have to do with artists and a message? Well, currently artists are paid very little. If your song is played on a streaming platform a million times, you are then paid a measly $1000. When you get a record deal, you are getting, in essence, a bad loan from the record company. Most likely, you have to pay it back over the course of your entire career and you have given control over your music to the record company. There is no transparency, it is inefficient, and rife with human error that slows things down dramatically.

But that’s just one side of the problem. The more glaringly wrong side is the homogenous nature of music we now encounter. Corporations want profit and since the repeat of the same old party music can be more secure and lucrative than an edgy performance, that’s what gets made. But humanity and culture suffer, while a select few accumulate more power over our minds and bodies.

To highlight this, I decided to use a drawing of me made by political prisoner Ross Ulbricht of the Silk Road as my album cover. The drug war is an abysmal failure, and the precedent set by this case effects us all. If I was on a major label, I wouldn’t be able to side with Ross and bring attention to the devastation being wrought worldwide by the US governments overzealous prosecution of non-violent offenders. It’s immoral and as an artist, I have an obligation to stand up and say no more.

Artist coins at their core are about the same thing Bitcoin is about: autonomy and freedom. If we do not have control over our money (in the arts and otherwise), we will have a harder time moving toward more prosperity and enlightenment. We now have the tools to take back our most precious means of communication and create communities based around cryptocurrency and P2P. I believe artistic creativity is essential to mankind’s progress, and I hope others will join me in this pursuit to free the art.

To find out more about Tatiana Coin and to support my new album Keep the Faith out March 31, 2017, please go to www.TatianaMoroz.com

The World Economic Forum has posted an article that hints at something that I have also suggested. (I am not taking credit. Others have suggested the idea too…But advancing tech and credible, continued visibility may help us to finally be taken seriously!)

I am not referring to purchasing and retiring carbon credits. I like that idea too. But here is a blockchain idea that can enable fleets of autonomous, shared, electric vehicles. Benefits to individuals and to society are numerous.

The future is just around the corner. Non-coin applications of the blockchain will support many great things. Goodbye car ownership. Hello clean air! The future of personal transportation.

Read about it at the World Economic Forum.

Philip Raymond co-chairs Crypsa & Bitcoin Event, columnist & board member at Lifeboat, editor

at WildDuck and will deliver the keynote address at Digital Currency Summit in Johannesburg.

This pundit is very cogent, as he criticizes early Bitcoin adopters and evangelists. He believes that they are too wrapped up in the original blockchain implementation, and that what goes up must come down—or, at least, that the earliest implementation of a new technology cannot adapt and become the durable leader in the field that it launched.

It’s the 15-minutes-of fame argument. But, I disagree! There are plenty of reasons to support, repair and expand Bitcoin—rather than fragment goodwill and abandon and a viable, two-sided network into 3,000 altcoins and blockchain startups.

Still, the author is very very bright and defends his position.

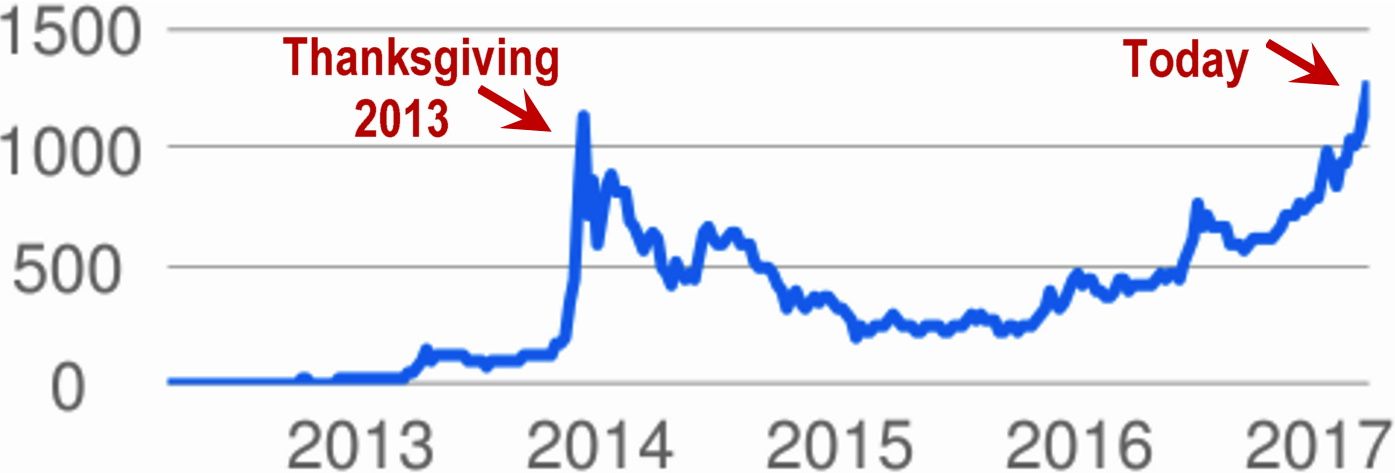

If you follow Bitcoin at all, then you know that its value is spiking. It has already surpassed a massive spike on Thanksgiving night 2013, and it has just surpassed the cost of an ounce of gold. [continue below image]

Like any commodity, the exchange value of Bitcoin is driven by supply and demand. But, unlike most commodities, including the US Dollar, the Euro or even gold, the eventual supply is capped. It is a mathematical certainty. Yet, demand is affected by many factors: Adoption as a payment instrument, early signs that it is being considered as a reserve currency, fascination by Geeks and early adopters and its use as a preferred tool by some criminals.

But chief among reasons for acquiring Bitcoin is speculation. Whether it is buy-and-hold or day trading, speculators still outnumber those who use Bitcoin to settle debts or to buy and sell other products and services. (Earlier this week, I argued that speculation is responsible for 85% of demand and of transactions—but that’s another story).

It’s a bit ironic that speculation—in the early days of a new market—retards organic adoption. It contributes to uncertainty and volatility, and it reduces the fraction available to the markets that make it both useful and liquid. Yet, in free markets, speculation is a necessary and critical antecedent to adoption.

This week, short term speculators have an unusually keen opportunity to profit, especially if they know how to buy a ‘put’ or sell a ‘call’ (i.e. to leverage a bet for or against the direction of Bitcoin, without actually acquiring any). For example, you can bet that an exchange-traded stock will fall, because there is a market for puts & calls. But it’s not as easy to bet against commodities that are not yet listed for options trading.

I am not going to give advice in this article. I am not a licensed investment professional and although I am bullish on long term, organic adoption of Bitcoin, I really don’t have an opinion on the current news or the short term prospects for a pull back. But, if you have an opinion on a current news event, then there is an immediate opportunity for you to make (or lose) a significantly leveraged sum in the next few days…

SEC and ETFs (Alphabet soup of investment banks)

Next weekend, on Saturday March 11, the United States Securities and Exchange Commission (SEC) will approve or deny an application for the first regulated, recognized and significantly backed Bitcoin Exchange Traded Fund (ETF). Why is this significant? Because most investments are not hand picked by individual investors. Investors choose the level of risk or diversification that seems reasonable for their life stage and then leave stock-picking decisions to a formula, a market sector basket, or a fund manager. That is, invest or park their money in a fund rather than betting on Space-X, PayPal or the local electric company. [continue below image]

If approved, an ETF potentially adds massive new demand for a commodity, by offering a financial instrument than can be subscribed by the vast fraction of funds, investors, pensioners and speculators who prefer to leave asset management to an organization, outside broker or formula.

The first ETF application is created and backed by the Winkelvoss Twins. They were Olympic rowers, but found fame & fortune by contracting Marc Zuckerberg to create an early design for Facebook. If their application is approved, a dozen more investment banks, brokers and hedge funds are standing by to jump in with both feet.

This morning, Cointelegraph put the odds that the ETF will be approved at 50%. Some analysts place the chances even higher. But consider that Bitcoin has already spiked dramatically in the past few weeks. The excitement is already reflected in the price. So, where is the opportunity?

The opportunity, as with any speculative decision, is in the dissonance between your research and hunch compared with the overall market expectation reflected in the current price. So, for example, if Bitcoin is accepted as the basis for an ETF (and if it continues to grow in more fundamental adoption), the current price is actually remarkably low. Under these assumptions, it hasn’t even begun its period of rapid ascent. Perhaps more obviously (and even more short-term), if you believe that an ETF will be blocked by regulators, then the recent rise is likely to be reversed quickly, at least in the minutes after the March 11 decision is announced.

So how can you profit from your belief that a commodity will drop in value? I leave that to your personal investment knowledge and research or your financial advisor. My purpose is not to advise, nor even to teach about puts and calls. It is to point out that a few people will win or lose a lot of real money this coming weekend—at least on paper. And it all hinges on whether they can correctly predict the outcome of a regulatory decision process.

Again, Bitcoin is a very limited commodity, There are only 15.2 million coins today, and there will never be more than 21 million coins. This does not present an obstacle to adoption, because the coins can be sliced smaller and smaller as needed. In a noteworthy demonstration of ‘good deflation’, there will always be enough units for everyone—even if the entire world adopts it for every transaction under the sun.

Philip Raymond co-chairs Crypsa & Bitcoin Event, columnist & board member at Lifeboat, editor

at WildDuck and will deliver the keynote address at Digital Currency Summit in Johannesburg.

I use to hate it when my dad insisted that I read something longer than 2 paragraphs. (Something related to his interests, but not to my school work, his career or our family). That’s because it shouldn’t require a 30 minute read to determine if it piques my interest, as it does his.

But I am asking Lifeboat readers to invest 37 minutes in the video linked below. Even if you give it just 5 minutes, it will provide sufficient motive for you to stick around until the end. [continue below video]

I want you view it because we are on the threshold of something bigger than many people realize. Bitcoin and the blockchain is not just a new currency or a way of distributing books among network users. We are becoming involved with a radical experiment in applied game theory that is shockingly simple, but nascent. Opportunities abound, and the individuals who recognize those opportunities or learn to exploit them will benefit themselves as they benefit the global community. Because it is so radical (and because it clashes with deeply ingrained beliefs about authority, control mechanisms, democracy and money), it seems complex and risky—but it’s really not.

I am a Bitcoin educator and columnist. I have taught college seminars in Bitcoin and I will be keynote speaker at the 2017 Digital Currency Summit in Johannesburg. I design online courses for the most popular cryptocurrency self-learning groups. But Antonopolous runs circles around me. He is a Bitcoin evangelist extraordinaire. All of his presentations are superb, but this one provides context. It conveys an understanding that Bitcoin novices and professionals equally appreciate. It answers questions the viewer hadn’t asked, but would have.

There are hundreds of videos and PowerPoint presentations that explain how Bitcoin works. But they rarely provide context. Few of them convey why it is such an important development and why it has overtaken biotech & pharmaceuticals as the focus of VCs . Few can explain why an ethereal Bitcoin (a unit that you cannot hold) has just surpassed the value of a unit of gold. And few people realize that volatility has been abating as the increase in value and adoption is surging.

As you watch Antonopolous, you are certain to think about things that you did not previously know—or at least, that you did not reflect upon. My purpose in asking you to view it, is not to sell you on Bitcoin or the blockchain, but to provide the context that may help you to code, consult, write articles, teach, begin trading, start saving, and more.

Philip Raymond co-chairs Crypsa & Bitcoin Event, columnist & board member at Lifeboat, editor

at WildDuck and will deliver the keynote address at Digital Currency Summit in Johannesburg.

At Quora, I occasionally play, “Ask the expert”. Several hundred of my Quora answers are linked here. Today, I was asked “How much of Bitcoin’s value is driven by speculation”. This is my answer…

This is a great question! While the value of any commodity is determined by supply and demand, speculation is one component of demand. Another is the unique utility value inherent in a product or process. This is sometimes called ‘intrinsic value’.

It’s ironic that when a high fraction of value is driven by speculation, short-term value becomes volatile and long-term value becomes less certain—and less likely to produce returns for those same speculators.

Editor’s Note: In the past few weeks, a significant spike in Bitcoin’s value and trading volume relates to a pending regulatory decision expected at the end of next week. This activity is certainly driven by speculation. But for this article, I am considering periods in which the demands of individual events are less clear.

The value of Bitcoin is influenced by:

Here’s the rub: Bitcoin will not become a store of value unto itself (i.e. a currency), and it will not gain a significant fraction of the payment instrument market until the transaction volume of the first to user categories in the above list are overtaken by the the ones further down. Likewise, Bitcoin will not enter its biggest growth spurt until the last two items swamps the others as the largest motive for acceptance and use.

Put another way: Long term value must ultimately be driven by organic adoption from actual users (people who are buying and spending Bitcoin on other things.

In another article, I expand on the sequence of events that must take place before Bitcoin grows into its potential. But make no mistake. These things will happen. In tribute to the brilliance of Satoshi, the dominoes are already falling.

In another article, I expand on the sequence of events that must take place before Bitcoin grows into its potential. But make no mistake. These things will happen. In tribute to the brilliance of Satoshi, the dominoes are already falling.

In response to the question, I estimate that at the beginning of 2017, 85% of Bitcoin value is still driven by speculators. I have not analyzed wallet holding periods compared against the addresses of known vendors. Furthermore, it would be difficult to understand the relationship between the number of speculative transactions and the overall effect on value. Therefore, my figure is more of a WAG than an calculated estimate. But it’s an educated WAG.

The fraction of speculative transactions will drop significantly in the coming months—even as late speculators jump on board. That’s because uptake from consumers and businesses is already taking off. The series of reactions that lead toward ubiquitous, utilitarian applications has begun. Bitcoin’s value will ultimately be driven by use as a payment instrument and in commerce.

Because it is a pure supply-demand instrument, Bitcoin will eventually be recognized as currency itself. That is, it needn’t be backed by precious metal, pegged convertibility or a redemption promise. When that happens, you will no longer ask about  Bitcoin’s value. That would be a circular question, since its value will be intrinsic. Instead, you will wonder about the value of the US dollar, the Euro and the Yen.

Bitcoin’s value. That would be a circular question, since its value will be intrinsic. Instead, you will wonder about the value of the US dollar, the Euro and the Yen.

As a growing fraction of groceries, gasoline and computers that you buy are quoted in BTC, you will begin to think of it as a rock, rather than a moving target. One day in the future, there will be a sudden spike or drop in the exchange rate with your national currency. At that time, you won’t ask “What happened to Bitcoin today? Why did it rise in value by 5% this morning?” Instead, you will wonder “What happened to the US dollar today? Why did it drop in value by 5%?”

Philip Raymond co-chairs Crypsa & Bitcoin Event, columnist & board member at Lifeboat, editor

at WildDuck and will deliver the keynote address at Digital Currency Summit in Johannesburg.