Under current climate policies, 79 per cent of the world’s glaciers will disappear by 2100, endangering the water supply for 2 billion people and raising sea levels dramatically

Check out Lokendens’ film, created in the style of found footage.

Nvidia on Monday revealed the third generation of its “Nemotron” large-language models aimed at writing, coding and other tasks. The smallest of the models, called Nemotron 3 Nano, was being released Monday, with two other, larger versions coming in the first half of 2026.

Nvidia, which has become the world’s most valuable listed company, said that Nemotron 3 Nano was more efficient than its predecessor — meaning it would be cheaper to run — and would do better at long tasks with multiple steps.

Nvidia is releasing the models as open-source offerings from Chinese tech firms such as DeepSeek, Moonshot AI and Alibaba Group Holdings are becoming widely used in the tech industry, with companies such as Airbnb disclosing use of Alibaba’s Qwen open-source model.

A simple instrument like mass spectrometer can revolutionize how unknown samples are investigated in the future.

A new method developed by researchers at the Los Alamos National Laboratory (LANL) can spot the origins of illegal nuclear material in just 30 minutes. Requiring only a relatively simple instrument, such as a mass spectrometer, the method can help identify the source of any nuclear material outside regulatory control.

According to the International Atomic Energy Agency (IAEA), theft or improper disposal can result in nuclear and radiological material falling out of regulatory control. In 2,024,124 such incidents were reported to the IAEA, of which at least three were linked to “trafficking or malicious use”

Earlier this year, a leader of a crime syndicate pleaded guilty to trafficking nuclear material in a New York court. The accused had discussed sale of yellowcake uranium with an undercover agent.

Researchers have uncovered a fast, structural mechanism that allows neurons to stabilize communication when synaptic function is disrupted.

Instead of relying on electrical activity, the brain uses physical rearrangements of postsynaptic receptors to signal the sending neuron to boost neurotransmitter release.

This rapid correction restores balance within milliseconds, ensuring that circuits supporting movement, learning, and memory remain functional.

The findings shed new light on how the brain maintains stability when communication falters.

Neurons can rapidly rebalance their communication using a structural signal rather than electrical activity, overturning long-held assumptions about how synapses maintain stability.

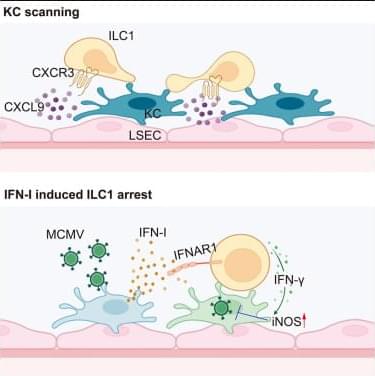

Zhang et al. reveal that hepatic ILC1s rapidly transition from intravascular patrolling to motility arrest upon encountering infected Kupffer cells (KCs) during viremia. This behavioral switch, driven by cell intrinsic type I IFN signaling and coupled to ILC1 activation, fortifies the antiviral function of KCs to restrict systemic viral dissemination.

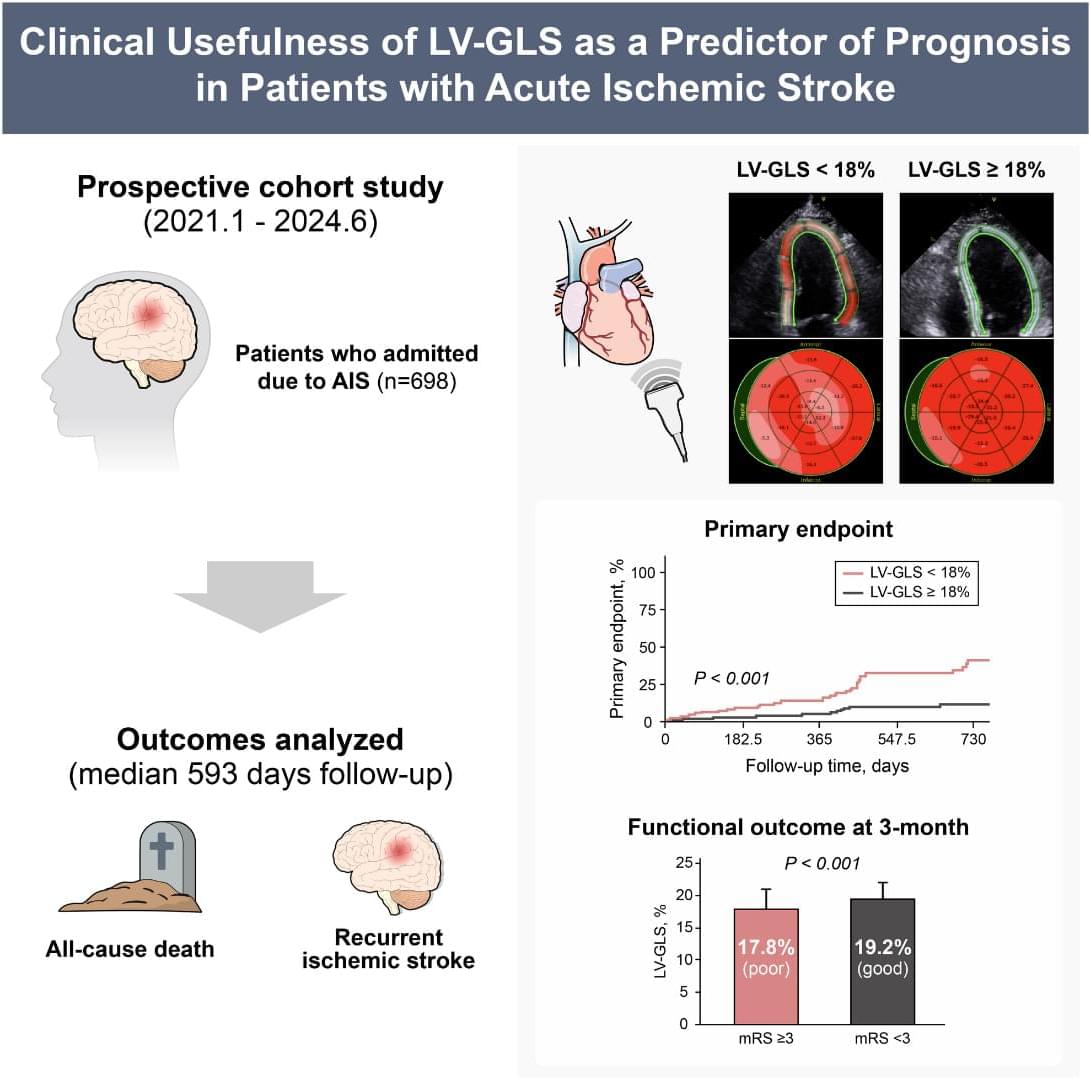

LV‐GLS 18% predicts mortality, recurrent stroke, and poor mRS-based functional outcome after acute ischemic stroke. @Minkwan_Kim84

LV‐GLS Globally, stroke is the second‐leading cause of death and the third most common cause of combined death and disability.1 Over the past decade, stroke‐related death has been steadily declining; however, health care expenditures associated with stroke have continued to increase.1, 2 Recurrence of ischemic stroke adversely affects patient prognosis and increases the mortality rate.3 Previous studies have identified several clinical factors contributing to the occurrence and recurrence of ischemic stroke, including stroke subtype, age, hypertension, atrial fibrillation (AF), heart failure (HF), and diabetes.2, 4

HF is also a risk factor for stroke and is associated with stroke recurrence and death.5, 6 Left ventricular (LV) global longitudinal strain (LV‐GLS), a measure of myocardial deformation along the long axis of the left ventricle, is assessed using the speckle‐tracking method. It is a sensitive measure of myocardial fiber shortening and has become a reliable parameter for evaluating subtle systolic dysfunction.7 In patients with acute HF, LV‐GLS is frequently reduced regardless of the LV ejection fraction (LVEF), the traditional measure of LV systolic function. LV‐GLS has also been shown to be a superior prognostic marker for death than LVEF.8 Furthermore, in severe mitral regurgitation and severe aortic stenosis, LV‐GLS has proven useful as a predictor of postoperative outcomes and a tool for identifying patients who may benefit from early surgical intervention.9, 10 Recent research has demonstrated that LV‐GLS can effectively predict incident strokes in patients who are stroke naïve.11 However, to date, no study has evaluated the prognostic implications of LV‐GLS in patients with acute ischemic stroke (AIS) about subsequent cardiovascular outcomes. In this study, we aimed to investigate the prognostic utility of LV‐GLS, a novel marker of subclinical LV dysfunction, in patients with AIS.

Analysis of a large dataset from the Tokyo Stock Exchange validates a universal power law relating the price of a traded stock to the traded volume.

One often hears that economics is fundamentally different from physics because human behavior is unpredictable and the economic world is constantly changing, making genuine “laws” impossible to establish. In this view, markets are never in a stable state where immutable laws could take hold. I beg to differ. The motion of particles is also unpredictable, and many physical systems operate far from equilibrium. Yet, as Phil Anderson argued in a seminal paper [1], universal laws can still emerge at the macroscale from the aggregation of widely diverse microscopic behaviors. Examples include not only crowds in stadiums or cars on highways but also economic agents in markets.

Now Yuki Sato and Kiyoshi Kanazawa of Kyoto University in Japan have provided compelling evidence that one such universal law governs financial markets. Using an unprecedentedly detailed dataset from the Tokyo Stock Exchange, they found that a single mathematical law describes how the price of every traded stock responds to trading volume [2] (Fig. 1). The result is a striking validation of physics-inspired approaches to social sciences, and it might have far-reaching implications for how we understand market dynamics.