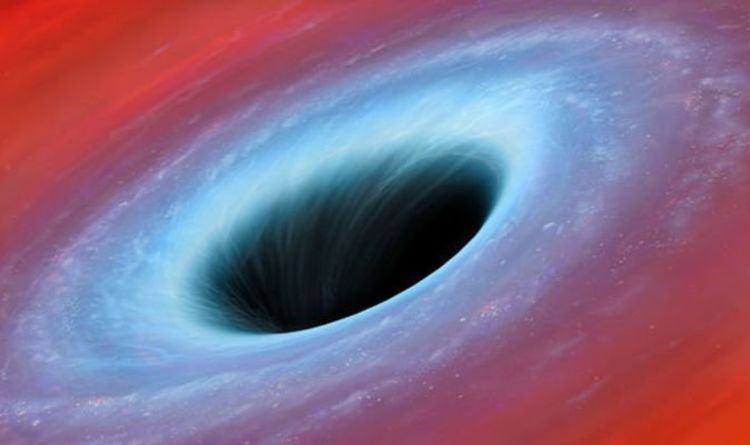

BLACK holes are the most mysterious objects in the universe, but scientists have come one small step closer to understanding the impossibly powerful phenomena.

We are making tangible progress in America’s return to the Moon’s surface to stay. The innovation of America’s aerospace companies, wedded with our goals in science and human exploration are going to help us achieve amazing things on the Moon and feed forward to Mars.

Nine U.S. companies now are eligible to bid on NASA delivery services to the lunar surface through Commercial Lunar Payload Services (CLPS) contracts, as one of the first steps toward long-term scientific study and human exploration of the Moon and eventually Mars.

These companies will be able to bid on delivering science and technology payloads for NASA, including payload integration and operations, launching from Earth and landing on the surface of the Moon. NASA expects to be one of many customers that will use these commercial landing services.

“Today’s announcement marks tangible progress in America’s return to the Moon’s surface to stay,” said NASA Administrator Jim Bridenstine. “The innovation of America’s aerospace companies, wedded with our big goals in science and human exploration, are going to help us achieve amazing things on the Moon and feed forward to Mars.”

A bipedal breakthrough.

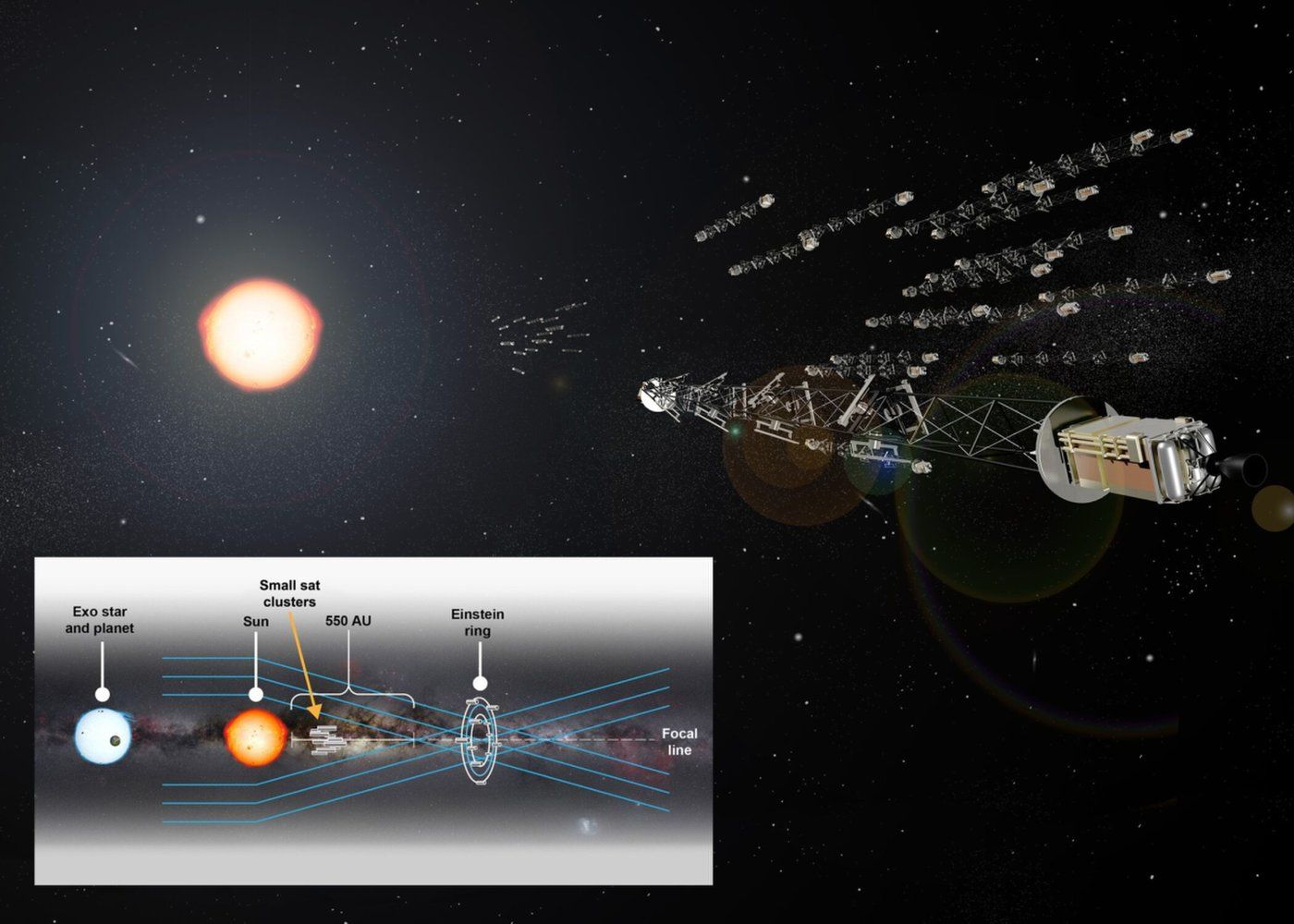

An innovative deep-space concept that relies on a solar gravity lens (SGL) to enable enhanced viewing of exoplanets is under study by researchers at NASA’s Jet Propulsion Laboratory (JPL) and The Aerospace Corporation.

The SGL would provide 100-billion-fold optical magnification, allowing it to show details as small as 6 miles (10 kilometers) across — similar to being able to spot something the size of New York City on an exoplanet, study team members said.

As detailed in a press statement from The Aerospace Corporation, according to Einstein’s theory of relativity, light traveling through space will bend if it passes near sufficiently massive objects. This means that distant light will bend around the periphery of the sun, eventually converging toward a focal region as if it had passed through a lens. [13 Ways to Hunt Intelligent Aliens].

Our orbiting laboratory is a unique place – a convergence of science, technology and human innovation that demonstrates new technologies and makes research breakthroughs not possible on Earth. Unpack its architecture here: https://go.nasa.gov/2FzkBtf #SpaceStation20th

The day of clean, limitless energy from nuclear fusion has taken another step closer thanks to China’s Experimental Advanced Superconducting Tokamak (EAST). During a four-month experiment, the “Chinese artificial sun” reached a core plasma temperature of over 100 million degrees Celsius – that’s more than six times hotter than the interior of the Sun – and a heating power of 10 MW, enabling the study of various aspects of practical nuclear fusion in the process.

Bill Gates thinks toilets are a serious business, and he’s betting big that a reinvention of this most essential of conveniences can save a half million lives and deliver $200 billion-plus in savings.

The billionaire philanthropist, whose Bill & Melinda Gates Foundation spent $200 million over seven years funding sanitation research, showcased some 20 novel toilet and sludge-processing designs that eliminate harmful pathogens and convert bodily waste into clean water and fertilizer.

“The technologies you’ll see here are the most significant advances in sanitation in nearly 200 years,” Gates, 63, told the Reinvented Toilet Expo in Beijing on Tuesday.