“Bloomberg, an entrepreneur and former mayor of New York City, and Pope, a lifelong environmental leader, approach climate change from different perspectives, yet they arrive at similar conclusions.”

“Bloomberg, an entrepreneur and former mayor of New York City, and Pope, a lifelong environmental leader, approach climate change from different perspectives, yet they arrive at similar conclusions.”

In fact, when speaking with many AI experts across academia and industry, the consensus was unanimous: the development of AI cannot benefit only the few.

Income inequality is a well recognized problem. The gap between the rich and poor has grown over the last few decades, but it became increasingly pronounced after the 2008 financial crisis. While economists debate the extent to which technology plays a role in global inequality, most agree that tech advances have exacerbated the problem.

In an interview with the MIT Tech Review, economist Erik Brynjolfsson said, “My reading of the data is that technology is the main driver of the recent increases in inequality. It’s the biggest factor.”

Which begs the question: what happens as automation and AI technologies become more advanced and capable?

World-first transplant to treat macular degeneration could augur rise of iPS cell banks.

Hedge funds have been trying to teach computers to think like traders for years.

Now, after many false dawns, an artificial intelligence technology called deep learning that loosely mimics the neurons in our brains is holding out promise for firms. WorldQuant is using it for small-scale trading, said a person with knowledge of the firm. Man AHL may soon begin betting with it too. Winton and Two Sigma are also getting into the brain game.

The prospect that artificial intelligence (AI) might one day surpass human intelligence is one that many people, including a number of notable personalities, are terrified of. And it’s not hard to see where that fear is coming from.

As it is, deep learning machines have already shown a number of ways where they outperform humans. So far, they can play video games, recognize faces, and even do stock market trading. There’s one area, though, where humans are still superior, and that’s the speed at which we learn.

Right now, humans learn at a rate that’s 10 times faster than that of a deep learning machine. And it is this ‘superiority’ that has kept that ‘AI taking over humans’ apocalyptic view in the background. Thanks (or no thanks?) to Google, however, this status quo is about to change.

Tech to aid video search, detection of disease and of fraud.

Artificial intelligence has been the secret sauce for some of the biggest technology companies. But technology giant Alphabet Inc.’s Google is betting big on ‘democratising’ artificial intelligence and machine learning and making them available to everyone — users, developers and enterprises.

From detecting and managing deadly diseases, reducing accident risks to discovering financial fraud, Google said that it aimed to improve the quality of life by lowering entry barriers to using these technologies. These technologies would also add a lot of value to self-driving cars, Google Photos’ search capabilities and even Snapchat filters that convert the images of users into animated pictures.

by Tatiana Moroz

The most moving thing to me about music is it’s ability to change. It changes the mood, the atmosphere, and it fills us with emotion. It can unify mankind in the power of good and triumph over evil regimes. What most struck me was when we saw this in the 60’s and 70’s folk songs that became anthems for the civil rights, equality, and antiwar movements. Even as a little girl, I knew that this core drive and expression for freedom was critical to the success of humanity as we marched ever closer to the nightmarish visions painted in 1984 and Brave New World.

This is a heavy and serious purpose, but one I took to heart as I created songs of hope, sadness, life, beauty and love. I noticed that the music industry seemed averse to this type of meaning based songwriting, and the radio waves were filling with more vapid nonsense by the minute. However, I kept my head down and tried to educate myself on the ways we could organize society for the better.

I joined the Ron Paul movement in late 2011 after I learned about the Federal Reserve system of central banking. I saw that it was one of the biggest obstacles to true liberty. I used storytelling in my music to illustrate the solutions I was finding, but I think we all hit a wall with politics at one point (which is probably how we all know each other in a way as seekers of the truth).

If you told me 6 years ago that I would be involved with “fintech” or technology in general, I would have laughed you out of the room. As soon as I start reading a manual, I disengage, my eyes glaze over, and within 6–8 words, I am daydreaming about something else. Even though my friends teaching me about Bitcoin were able to illustrate the benefits, something didn’t click. I gave them $500 anyway (which was a lot of money to me!) and they bought me some Bitcoins at $11. Eventually as the price went up and I learned more, I became enthusiastic about the possibilities. If my goal was to help “save the world” (for lack of a better term), then there were few inventions in the history of man that could compete with Bitcoin and blockchain technology.

I created the Bitcoin Jingle and became immersed in the community. I soon befriended Adam B. Levine of Let’s Talk Bitcoin, one of the most popular Bitcoin podcasts that also acted as a network home to over a dozen other shows. As content creators, we were the first to experiment with artist tokens and markets based around music, podcasts, and other media that removed the middleman and were secured through the power of the blockchain. In 2014 we created TATIANACOIN, the 1st ever artist cryptocurrency, but creating the coin was just the beginning. Upon launch, we soon realized we had to build the ecosystem for the coin to thrive.

Think of artist coins as a type of token that you can hold in a digital wallet, like store credit. These coins can be sold to your fans that want to support your work, similar to a crowdfund or patronage type platform, but they get back TATIANACOIN that they can spend however they want. It can be redeemed for backstage access, music, merchandise, held onto for future rewards, and the coins can even be traded or sold with other music fans. They allow an artist to gather support from their community through long-term fundraising that gives back real value and engagement. Imagine, as a fan, becoming that much more entwined with the careers of your favorite musicians, visual artists, and other content creators! Artist coins also allow for direct messaging, streaming, and support functions between artists and fans. We see this as a more enriching experience than just your average social media platform.

But so what? We built a platform. What does this have to do with artists and a message? Well, currently artists are paid very little. If your song is played on a streaming platform a million times, you are then paid a measly $1000. When you get a record deal, you are getting, in essence, a bad loan from the record company. Most likely, you have to pay it back over the course of your entire career and you have given control over your music to the record company. There is no transparency, it is inefficient, and rife with human error that slows things down dramatically.

But that’s just one side of the problem. The more glaringly wrong side is the homogenous nature of music we now encounter. Corporations want profit and since the repeat of the same old party music can be more secure and lucrative than an edgy performance, that’s what gets made. But humanity and culture suffer, while a select few accumulate more power over our minds and bodies.

To highlight this, I decided to use a drawing of me made by political prisoner Ross Ulbricht of the Silk Road as my album cover. The drug war is an abysmal failure, and the precedent set by this case effects us all. If I was on a major label, I wouldn’t be able to side with Ross and bring attention to the devastation being wrought worldwide by the US governments overzealous prosecution of non-violent offenders. It’s immoral and as an artist, I have an obligation to stand up and say no more.

Artist coins at their core are about the same thing Bitcoin is about: autonomy and freedom. If we do not have control over our money (in the arts and otherwise), we will have a harder time moving toward more prosperity and enlightenment. We now have the tools to take back our most precious means of communication and create communities based around cryptocurrency and P2P. I believe artistic creativity is essential to mankind’s progress, and I hope others will join me in this pursuit to free the art.

To find out more about Tatiana Coin and to support my new album Keep the Faith out March 31, 2017, please go to www.TatianaMoroz.com

As I’m sure many in the technology industry have thought today, there should have been a way to avoid the Oscars Envelopegate. But, is artificial intelligence the answer to all of our human error problems? A recent Accenture report found that the introduction and further development of AI could boost labor productivity by 40% by 2035. It seems as if banks have already picked up on this, as was seen last year with RBS’ replacement of human employees with automated services. News announced this week also suggests that artificial intelligence will become a central part of anything a technology organisation will do in the future. Will we see the same in the financial technology sector?

The relationship between man and machine is expected to be the naissance of a type of work that could potentially double annual economic growth, according to Accenture. Chief technology officer Paul Daugherty highlighted that “AI is poised to transform business in ways we’ve not seen since the impact of computer technology in the late 20th century.” He went on to explain in the report that artificial intelligence, with the help of cloud computing and analytics, is already starting to change the way that people work.

The weekend saw the UK government announce that they are planning to launch a review into the value of robotics in the country’s aim to become world technology leader. £17.3 million would be invested into university research of AI technologies such as Apple’s Siri, Amazon’s Alexa and driverless cars, as reported by The Independent. The article also drew from the Accenture report and said that artificial intelligence could add around £654 billion to the UK economy.

The workplace is going to look drastically different ten years from now. The coming of the Second Machine Age is quickly bringing massive changes along with it. Manual jobs, such as lorry driving or house building are being replaced by robotic automation, and accountants, lawyers, doctors and financial advisers are being supplemented and replaced by high level artificial intelligence (AI) systems.

So what do we need to learn today about the jobs of tomorrow? Two things are clear. The robots and computers of the future will be based on a degree of complexity that will be impossible to teach to the general population in a few short years of compulsory education. And some of the most important skills people will need to work with robots will not be the things they learn in computing class.

There is little doubt that the workforce of tomorrow will need a different set of skills in order to know how to navigate a new world of work. Current approaches for preparing young people for the digital economy are based on teaching programming and computational thinking. However, it looks like human workers will not be replaced by automation, but rather workers will work alongside robots. If this is the case, it will be essential that human/robot teams draw on each other’s strengths.

Biometrics – technology that can recognise individuals based on physical and behavioural traits such as their faces, voices or fingerprints – are becoming increasingly important to combat financial fraud and security threats. This is because traditional approaches, such as those based on PIN numbers or passwords, are proving too easily compromised. For example, Barclays has introduced TouchID, whereby customers can log onto internet banking using fingerprint scanners on mobile phones.

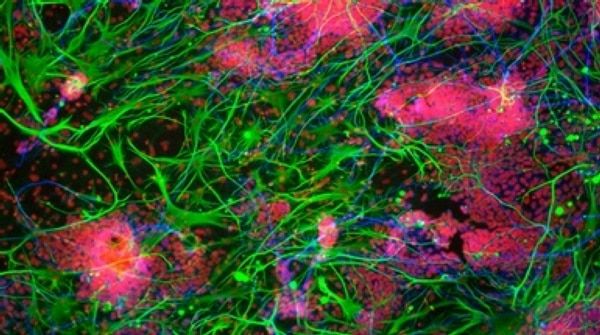

However, this is not foolproof either – it is possible to forge such biometrics. Fingers can after all be chopped off and placed by impostors to gain fraudulent access. It has also been shown that prints lifted from glass using cellophane tape can be used with gelatine to create fake prints. So there is a real need to come up with more advanced biometrics that are difficult or impossible to forge. And a promising alternative is the brain.

Emerging biometric technology based on the electrical activity of the brain have indeed shown potential to be fraud resistant. Over the years, a number of research studies have found that “brainprints” (readings of how the brain reacts to certain words or tasks) are unique to individuals as each person’s brain is wired to think differently. In fact, the brain can be used to identify someone from a pool of 102 users with more than 98% accuracy at the moment, which is very close to that of fingerprints (99.8% accuracy).