Practice teams are urged to share details with clients about this canine longevity study, whose long-term goal is to help pets and people live longer, healthier lives.

The rapidly falling cost of getting into orbit has spurred a boom in the space industry as a host of new applications become economical. Now a secretive startup plans to slash the cost to just $250,000 by flinging rockets into space rather than firing them.

Over the last decade, the pioneering work done by SpaceX has shown that getting stuff into orbit doesn’t need to be so expensive and that there are viable business opportunities to be had in the private space industry. Combined with advances in satellite technology, there’s now a thriving market for small, inexpensive spacecraft in low- E arth orbit doing everything from remote sensing to delivering broadband internet access.

But while costs have fallen dramatically, the cheapest option for reaching low-Earth orbit —a rideshare on SpaceX’s Falcon 9—still starts at $1 million, and launches only happen twice a month at best. California-based startup SpinLaunch says its technology will allow up to five launches a day for as little as $250,000.

An international collaboration between researchers at Deargen and Dankook University in the Republic of Korea, and Emory University in the United States, have published a prediction model for antiviral drugs that may be effective on 2019-nCoV.

The work is published in the article “Predicting commercially available antiviral drugs that may act on the novel coronavirus (2019-nCoV), Wuhan, China, through a drug-target interaction deep learning model” posted on the bioRxiv preprint server.

When an international team used an AI model to suggest available drugs that could be used against 2019-nCoV, the top candidates targeted viral proteinases.

You don’t need a big laser to make laser-induced graphene (LIG). Scientists at Rice University, the University of Tennessee, Knoxville (UT Knoxville) and Oak Ridge National Laboratory (ORNL) are using a very small visible beam to burn the foamy form of carbon into microscopic patterns.

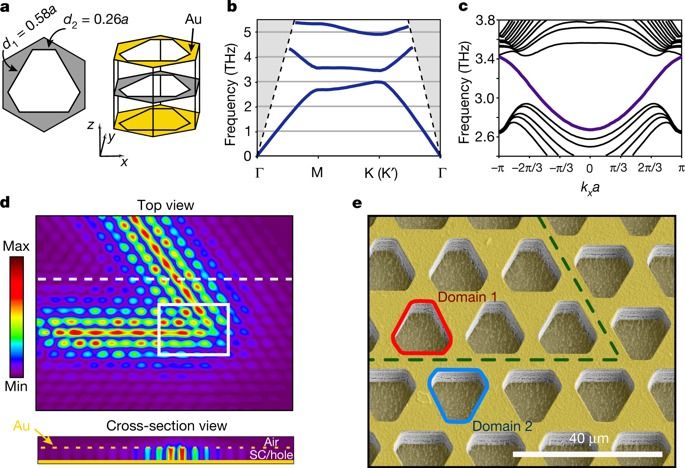

Scientists record the formation of foamy laser-induced graphene made with a small laser mounted to a scanning electron microscope. The reduced size of the conductive material may make it more useful for flexible electronics.

Quantum cascade lasers are compact, electrically pumped light sources in the technologically important mid-infrared and terahertz region of the electromagnetic spectrum1,2. Recently, the concept of topology3 has been expanded from condensed matter physics into photonics4, giving rise to a new type of lasing5,6,7,8 using topologically protected photonic modes that can efficiently bypass corners and defects4. Previous demonstrations of topological lasers have required an external laser source for optical pumping and have operated in the conventional optical frequency regime5,6,7,8. Here we demonstrate an electrically pumped terahertz quantum cascade laser based on topologically protected valley edge states9,10,11. Unlike topological lasers that rely on large-scale features to impart topological protection, our compact design makes use of the valley degree of freedom in photonic crystals10,11, analogous to two-dimensional gapped valleytronic materials12. Lasing with regularly spaced emission peaks occurs in a sharp-cornered triangular cavity, even if perturbations are introduced into the underlying structure, owing to the existence of topologically protected valley edge states that circulate around the cavity without experiencing localization. We probe the properties of the topological lasing modes by adding different outcouplers to the topological cavity. The laser based on valley edge states may open routes to the practical use of topological protection in electrically driven laser sources.

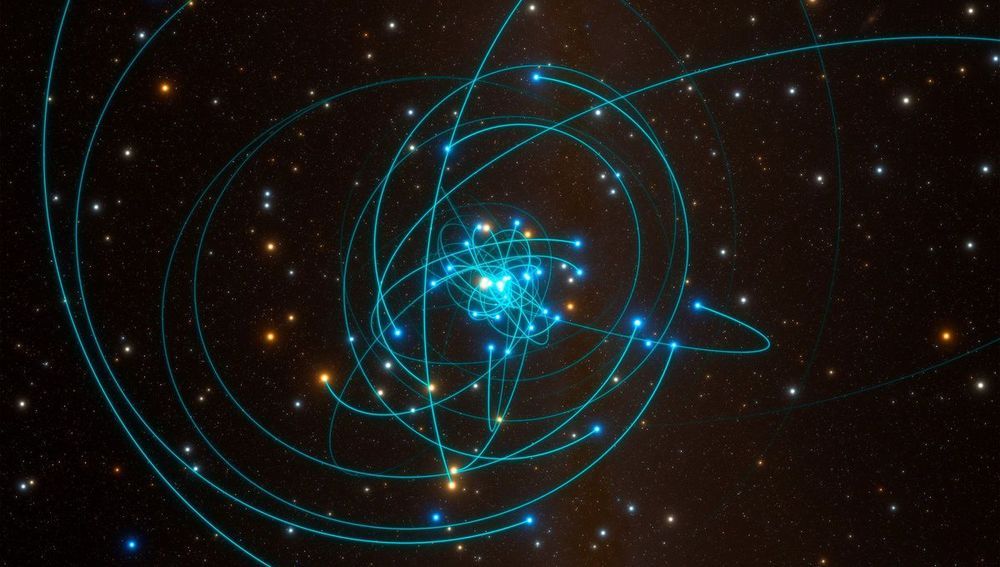

At the center of our galaxy lies Sgr A — a supermassive black hole. With over 4 million times the Sun’s mass, you can see why it gets that moniker.

One reason we know its mass is that there’s a cluster of young, luminous stars orbiting around it. These are called S stars, and they form a group around the black hole about a quarter of a light year across — a few trillion kilometers. One of these stars, S2, has an elliptical orbit that takes it to a distance of just 16 billion kilometers from the black hole as it travels on its elliptical orbit. Until recently, that star had the closest encounter we knew of.

The idea is to use AI to develop a platform for detecting biomarkers from neural data. Then long-life neural interfaces (connections that allow computers to read and write neural data directly to and from the body) could be combined with a deep intelligence system trained to assess biomarkers directly from neural data.

If the AI platform is able to understand the “language” of the nervous system it could be used in closed-loop experiments to test neuromodulation therapy on new targets. This could accelerate the development of treatments for a number of chronic conditions and would also be a big step closer to real-world clinical applications of AI within the body. This progress could create a new way to investigate medical conditions, accelerate the detection of neural biomarkers, and open the door to a new generation of AI-based neural medical procedures.

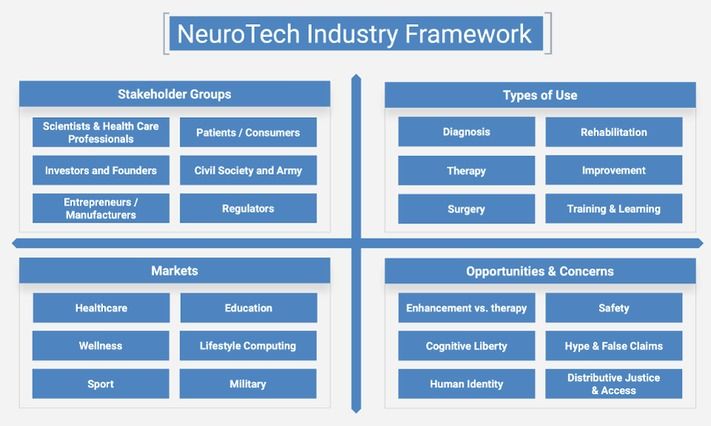

NeuroTech is one of the most promising areas of BioTech. In the last 20 years private capital funds invested more than $19 billion in the sector, and annual growth of investment in the sector is 31%. Some NeuroTech subsectors are already well-established with practical implementations and products on the market. Over the next several years, many early-stage startups will evolve into mature companies and bring new NeuroTech products to market. Advances in AI and increased integration of computers and biology could lead to improved brain health for people all over the world.