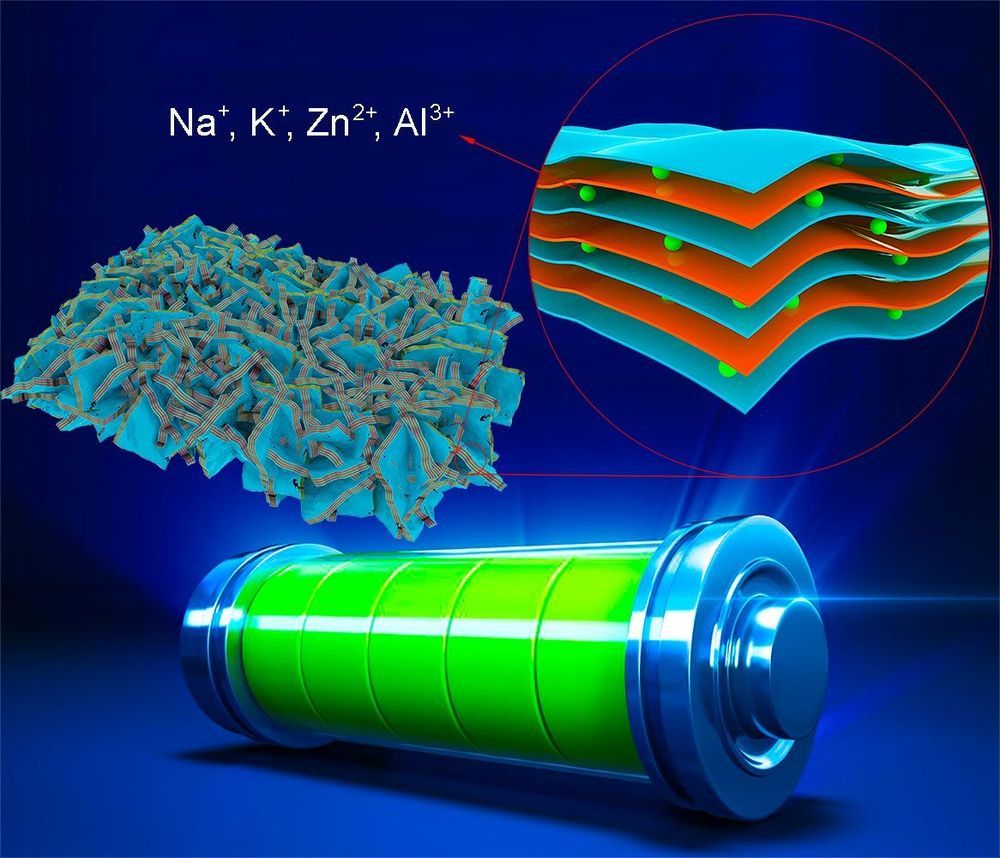

New battery technology developed at Berkeley Lab could give flight to electric aircraft and supercharge safe, long-range electric cars.

In the pursuit of a rechargeable battery that can power electric vehicles (EVs) for hundreds of miles on a single charge, scientists have endeavored to replace the graphite anodes currently used in EV batteries with lithium metal anodes.

But while lithium metal extends an EV’s driving range by 30–50%, it also shortens the battery’s useful life due to lithium dendrites, tiny treelike defects that form on the lithium anode over the course of many charge and discharge cycles. What’s worse, dendrites short-circuit the cells in the battery if they make contact with the cathode.