Researchers have discovered that nitrous oxide can safely enhance the delivery of gene therapy to the brain by making the blood-brain barrier (BBB) more permeable when paired with focused ultrasound (FUS).

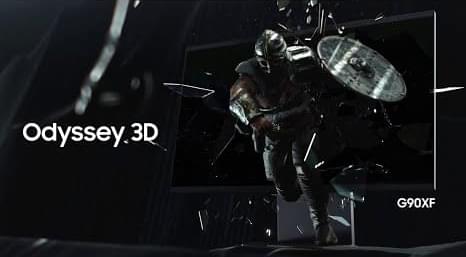

The new gaming dimension is here. The Odyssey 3D brings stunning glasses-free 3D experience to life – making games feel more real and the action more exciting.

Discover more at http://www.samsung.com.

• Glasses-free 3D experience.

• AI 3D Video Conversion.

• 165Hz refresh rate and 1ms response time (GtG)

• Nvidia G-Sync Compatible.

#Odyssey #3D #G90XF #Gamingmonitor #Gaming #Samsung

In recent years, scientists discovered something strange: When mice with Alzheimer’s disease inhale menthol, their cognitive abilities improve.

It seems the chemical compound can stop some of the damage done to the brain that’s usually associated with the disease.

In particular, researchers noticed a reduction in the interleukin-1-beta (IL-1β) protein, which helps to regulate the body’s inflammatory response – a response that can offer natural protection but one that leads to harm when it’s not controlled properly.

Fr. Michael Baggot joins the podcast to provide a Catholic perspective on transhumanism and superintelligence. We also discuss the meta-narratives, the value of cultural diversity in attitudes toward technology, and how Christian communities deal with advanced AI.

You can learn more about Michael’s work here:

https://catholic.tech/academics/faculty/michael-baggot.

Timestamps:

00:00 Meta-narratives and transhumanism.

15:28 Advanced AI and religious communities.

27:22 Superintelligence.

38:31 Countercultures and technology.

52:38 Christian perspectives and tradition.

01:05:20 God-like artificial intelligence.

01:13:15 A positive vision for AI.

Who i am and all my stuff here: https://hey.link/w8yiD ✅🎁🚀

Wanna watch more Free audiobook? Click here: • The Future is Matrix: AI, Virtual Worlds,… ✅

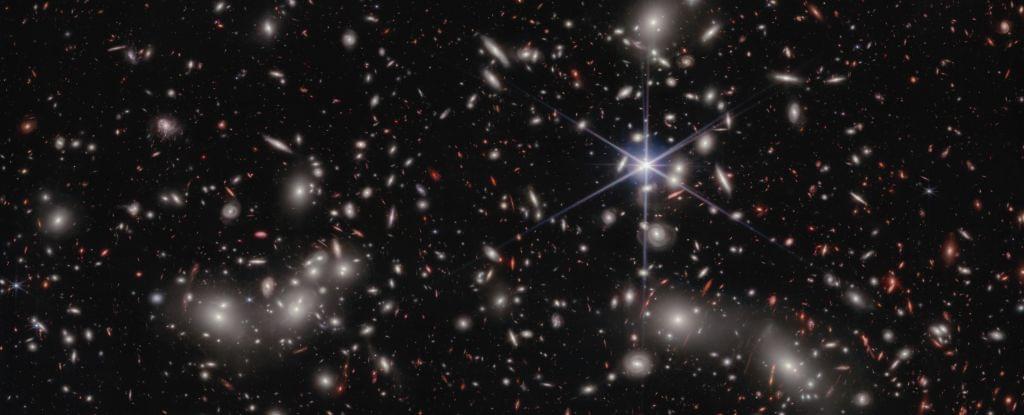

The Physics of Space Travel: Exploring Faster-Than-Light Travel is an exhilarating journey into the world of cutting-edge science and theoretical physics. Imagine a future where interstellar travel is not just a dream, but a reality. In this comprehensive and accessible guide, you’ll dive deep into the science behind faster-than-light travel, exploring concepts like Einstein’s theory of relativity, wormholes, warp drives, and quantum tunneling.

Whether you’re a space enthusiast, a science fiction fan, or simply curious about the future of space exploration, this book breaks down complex ideas into engaging, easy-to-understand chapters. Discover the latest theories in space travel technology, the role of dark matter and dark energy, and the tantalizing possibility of time travel. Along the way, we’ll explore the search for advanced extraterrestrial civilizations and how their discoveries could guide our own journey to the stars.

With vivid explanations, real scientific insights, and thought-provoking possibilities, The Physics of Space Travel is your essential guide to understanding how humanity might one day break the light-speed barrier and unlock the mysteries of the cosmos.

We finally know what brought light to the dark and formless void of the early Universe.

According to data from the Hubble and James Webb Space Telescopes, the origins of the free-flying photons in the early cosmic dawn were small dwarf galaxies that flared to life, clearing the fog of murky hydrogen that filled intergalactic space. A paper about the research was published in February 2024.

“This discovery unveils the crucial role played by ultra-faint galaxies in the early Universe’s evolution,” said astrophysicist Iryna Chemerynska of the Institut d’Astrophysique de Paris.

#AbSciCon22 — Origins and Exploration: From Stars to CellsAbSciCon, the conference brings the astrobiology community together every two years to share resear…

New research shows your brain can reshape your gut bacteria in just 2 hours — here’s what it means for stress, immunity, mood, and biohacking

Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be deterministic in principle. The name comes from the Monte Carlo Casino in Monaco, where the primary developer of the method, mathematician Stanisław Ulam, was inspired by his uncle’s gambling habits.

Monte Carlo methods are mainly used in three distinct problem classes: optimization, numerical integration, and generating draws from a probability distribution. They can also be used to model phenomena with significant uncertainty in inputs, such as calculating the risk of a nuclear power plant failure. Monte Carlo methods are often implemented using computer simulations, and they can provide approximate solutions to problems that are otherwise intractable or too complex to analyze mathematically.

Monte Carlo methods are widely used in various fields of science, engineering, and mathematics, such as physics, chemistry, biology, statistics, artificial intelligence, finance, and cryptography. They have also been applied to social sciences, such as sociology, psychology, and political science. Monte Carlo methods have been recognized as one of the most important and influential ideas of the 20th century, and they have enabled many scientific and technological breakthroughs.