Click on photo to start video.

These Japanese hotels are run almost entirely by robots — and they want to expand to 100 more locations.

This metal never ceases to amaze. Look what it does to this pot!

For step-by-step instructions of this experiment go here: https://goo.gl/7BVQ1z

For MEL Science safe experiments subscription go here: https://goo.gl/dWTTXk

This kind of technology is ideal for sharing data with clients.

This could change the way we build just about anything.

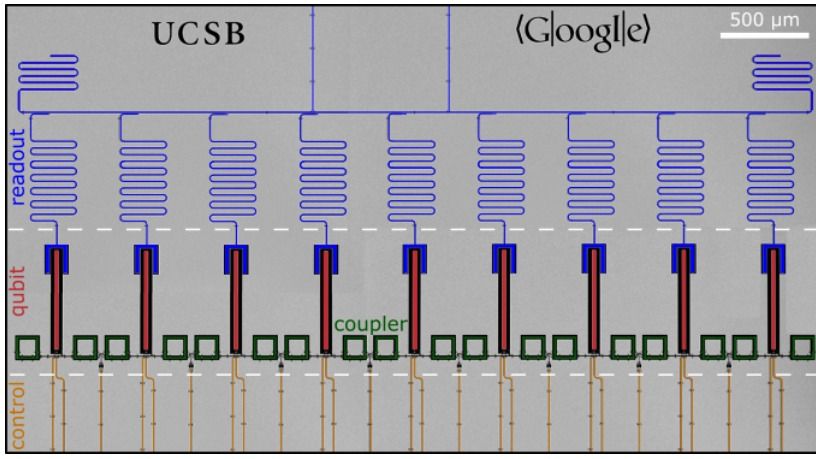

China may have the clear lead in the development of artificial intelligence (AI) systems in the region, but Japan’s government, realising how vital the sector is to its economic future, has intervened in the hopes of levelling the playing field.

Japan announced in late August that it is planning to invest billions of yen to fund next-generation semiconductors and other technologies critical to AI development.

Billions of yen in public investment could help firms innovate, but analysts say the nation may never catch up with China and the US, global tech leaders that show no signs of slowing down.

By Julian Ryall

0 Share

Planetary Resources’ Exploration Mission.

Planetary Resources is embarking on the world’s first commercial deep space exploration mission. The purpose is to identify and unlock the critical water resources necessary for human expansion in space.

Sourcing water is the first step to creating a civilization in space. Water is used for life support functions and can also be refined into rocket propellant. The initial mission will identify the asteroids that contain the best source of water, and will simultaneously provide the vital information needed to build a commercial mine which will harvest water for use in space.

We are using A.I. and Computer Vision Techniques to Determine Age and Assess the Effect of Therapies Against Aging in Mice, Increasing the Pace of Life Extension Research. Please subscribe, share, and fund our campaign today! ►Campaign Link: https://www.lifespan.io/mouseage ►Subscribe: https://www.youtube.com/user/LifespanIO?sub_confirmation=1

MouseAGE is working to develop the first photographic biomarker of aging in mice to help validate potential anti-aging interventions, save animal lives, and greatly speed up the pace of longevity research.

To create it we will harness the power of an area of artificial intelligence called Machine Learning, and in particular Deep Learning.

Machine Learning, where a computer system can train itself to become better at a task without explicit programming, has already showed great performance in areas such as human facial recognition, autonomous driving, medical image processing, recommendation engines and many others. While these results are powerful, building up the necessary Neural Networks, or algorithms inspired by the human brain, requires a large dataset of images to use for training: thousands of them.

Due to this, the first stage of the project will be to build a simple instrument for data collection, implemented in a mobile application. This will be distributed among numerous mouse breeding facilities and research universities all over the world to rapidly collect and properly annotate image data for analysis.

The Annual Cost of Gun Violence Exceeds $229 Billion. #MAGA

The True Cost of Gun Violence in America The data the NRA doesn’t want you to see.

Our latest Master Investor Magazine lines up hard-hitting experts offering you FREE advice on how to profit from it.

👉 Download your copy today: https://masterinvestor.co.uk/magazine