Do you feel squeamish about eating a burger that didn’t come from a cow? Most Americans don’t when confronted with how bad meat is for the environment.

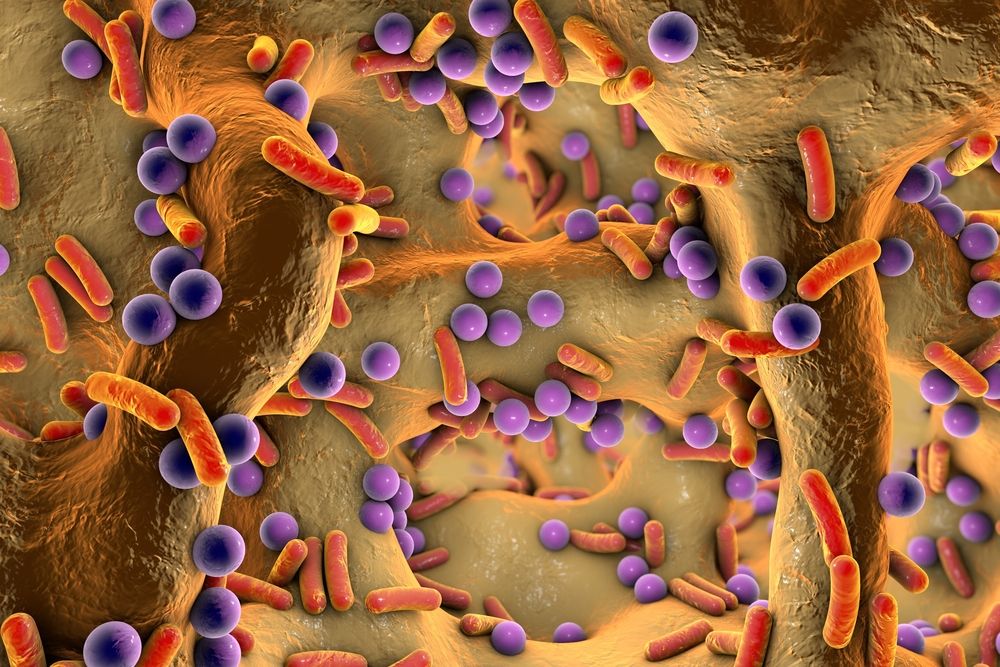

Depleting gut microbiome in mice leads to better insulin sensitivity.

Somewhat serendipitously, Salk Institute researchers discovered that depleting the microbiomes of mice causes the animals to have lower levels of blood glucose as well as improved insulin sensitivity [1].

Abstract

Antibiotic-induced microbiome depletion (AIMD) has been used frequently to study the role of the gut microbiome in pathological conditions. However, unlike germ-free mice, the effects of AIMD on host metabolism remain incompletely understood. Here we show the effects of AIMD to elucidate its effects on gut homeostasis, luminal signaling, and metabolism. We demonstrate that AIMD, which decreases luminal Firmicutes and Bacteroidetes species, decreases baseline serum glucose levels, reduces glucose surge in a tolerance test, and improves insulin sensitivity without altering adiposity.

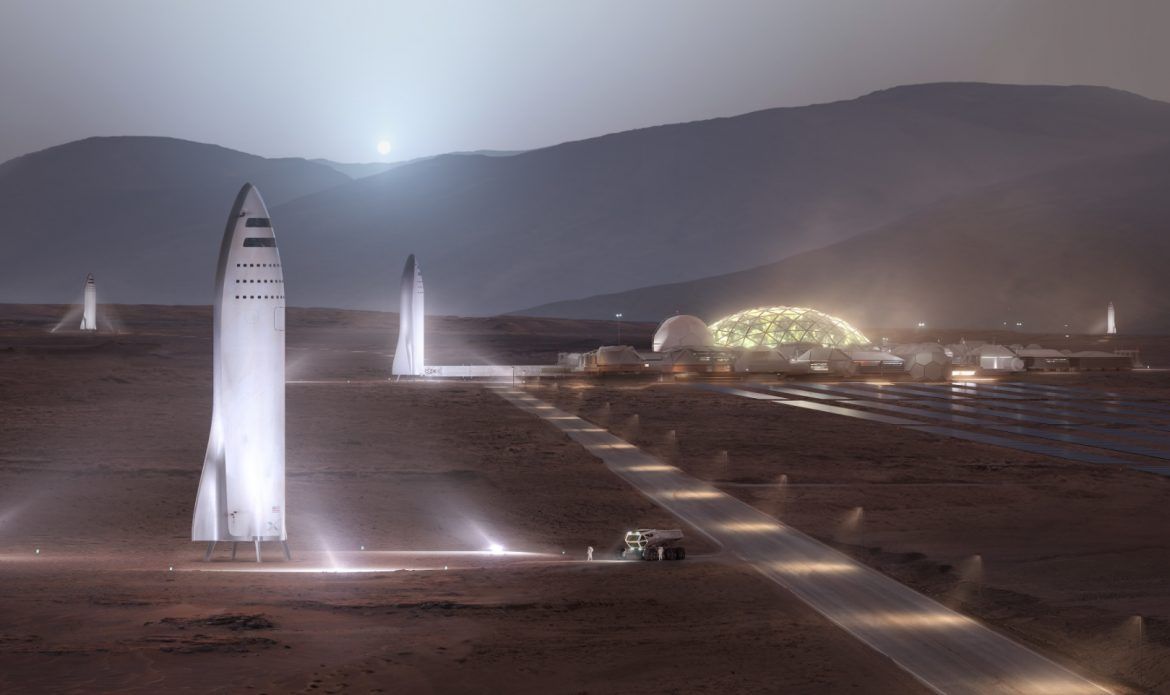

On September 29th, 2017, SpaceX CEO Elon Musk unveiled detailed plans of the Big Falcon Rocket at the 68th International Astronautical Congress in Adelaide, Australia. It was a follow-up speech to the prior year’s presentation when he first discussed the architecture of what was then called the Interplanetary Transport System. In his highly anticipated speech, Musk laid out the detailed plans for a two stage rocket to enable the colonization of Mars, a moon base, and hypersonic long-distance travel on Earth.

The design featured an enormous Booster that would be powered by 31 Raptor engines, planned to be the world’s most advanced and highest pressure chemical rocket engine. Following stage separation, the booster would return to Earth and land near or on the launch pad.

There were three variants of the rocket’s second stage planned: a Spaceship, Tanker and Cargo Lifter. The primary of which, the BFR Spaceship, was also the colonization vehicle and that could carry up to 100 passengers and a hundred tonnes of cargo. One possible use of the Spaceship was as the world’s first hypersonic passenger transport vehicle, which would enable travel between any two points on Earth in under an hour. Its primary envisioned mission, however, was to be a colonization vehicle for the Moon, Mars and beyond.

The Earth discovered it was living in a new slice of time called the Meghalayan Age in July 2018. But the announcement by the International Union of Geological Sciences (IUGS) confused and angered scientists all around the world.

In the 21st century, it claimed, we are still officially living in the Holocene Epoch, the warm period that began 11,700 years ago after the last ice age. But not only that: within the Holocene, we are also living in this new age – the Meghalayan – and it began 4,250 years ago.

Over the past decade, more and more scientists have agreed that human impact on Earth is so significant that we have entered a completely new geological phase, called the Anthropocene, including a group convened to agree a formal definition. The world of science was expecting an official announcement acknowledging this Anthropocene Epoch, not the unheard-of Meghalayan Age. It was so unexpected it turned up zero hits on Google when first reported. So what’s going on?

But the grand work-changing projects of A.I., like self-driving cars and humanoid robots, are not yet commercial products. A more humble version of the technology, instead, is making its presence felt in a less glamorous place: the back office.

Artificial intelligence software is making its presence felt in subtle ways, in an unglamorous place: the back office.

Thirteen companies, including Boeing and Amazon billionaire Jeff Bezos’ Blue Origin space venture, will be doing studies for NASA on the future of commercial human spaceflight in low Earth orbit.

All of the studies are due in December, and are supposed to cost no more than $1 million each. NASA still has to negotiate the contract amounts with the study groups, but it expects the total cost of the effort to come in at around $11 million.

This may be the nerdiest thing I’ve ever seen and I love it.

Over a million satellites working together to unlock the mysteries of the universe.