Demonstrating the preservation of cells after a living organism is pronounced dead and revived is not a traditional bioart topic. But it is an important one. It is a crucial step for advances in the use of lowered temperatures for sustaining the efficacy of organs and organisms during medical procedures, and especially of preserving neurons for the science cryonics.

My recent bioart research is a breakthrough that will help to build momentum toward more advanced studies on information storage within the brain, as well as short-term behaviors of episodic, semantic, procedural, and working memory.

In this article, I will review how I became involved in this research, the guidance along the way, my initial training at 21st Century Medicine, pitching the research project to Alcor, and submitting my proposal to its Research Center (ARC). I will then take you into the lab, the process of trial and error in our first studies, developing a protocol based on olfactory imprinting and applying several cryopreservation methods, developing the migration index, and the rewards of working with a lab technician who became an admiral colleague.

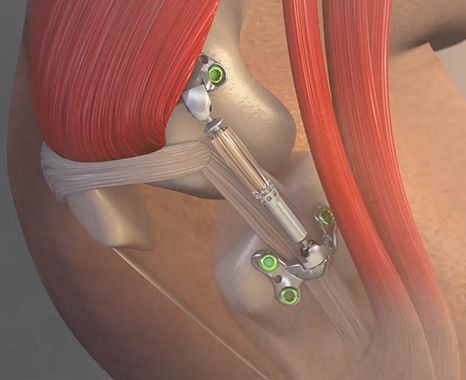

A total knee replacement is usually the result of the cartilage within the joint wearing out due to arthritis. Such surgeries are difficult to perform, require a good deal of rehabilitation, and too often result in sub-optimal outcomes. An implantable shock absorber has now been implanted for the first time in the United States to test whether it can delay the need for total knee replacements, and maybe even avoid such procedures completely in many patients.

A total knee replacement is usually the result of the cartilage within the joint wearing out due to arthritis. Such surgeries are difficult to perform, require a good deal of rehabilitation, and too often result in sub-optimal outcomes. An implantable shock absorber has now been implanted for the first time in the United States to test whether it can delay the need for total knee replacements, and maybe even avoid such procedures completely in many patients.