Brain stimulation, also known as neural modulation, is emerging as a promising treatment for a wide range of diseases from depression to chronic pain to epilepsy.

Popular spit-in-a-tube genetics-testing companies like Ancestry and 23andMe can — and frequently do — sell your data to drugmakers. But on Wednesday, one of those partnerships became much more explicit, when the pharmaceutical giant GlaxoSmithKline announced it was acquiring a $300 million stake in 23andMe.

As part of a four-year deal between the two companies, GlaxoSmithKline will comb 23andMe’s genetic data to look for new drugs to develop, also referred to as drug targets. It will also use the genetic data to inform how patients are selected for clinical trials.

If that news has you thinking about how your own genetic material is being used for research, know that though the DNA you submit to these services is ostensibly anonymized, leaks can happen, and privacy advocates say that such incidents could allow your data to find its way elsewhere, perhaps without your knowledge.

In this interview, Dr. Leonid Peshkin offers insights on aging, the pitfalls of excessive optimism, and the role of machine learning in studying age-related disease.

Determined but not complacent, grounded but hopeful, Dr. Leonid Peshkin is one of the scientists working on understanding aging so that it may one day be treated like we treat any other ailment.

As he revealed in an interview with the Boston Globe in mid-2018, the idea of having to lose oneself and one’s loved ones to aging never made any sense to him, and ever since he was a child, he has been preoccupied with aging and the fear that it might take away his father, who was almost 60 when Leon was 10 and, sadly, passed away in July 2018 at the age of 96.

Dr. Peshkin, a 48-year-old from Moscow, Russia, possesses a master’s degree in applied mathematics and a Ph.D. in machine learning. He currently works at the Systems Biology Department at Harvard Medical School; his primary interests are embryology, evolution, and aging, which he has studied for over a decade.

Magic Whale Formula

Posted in business, cryptocurrencies, finance

The 3 key ingredients for attracting investors to your crowdfunding (ICO/STO) campaign

Below is a redacted and slightly edited and updated version of a memo provided to a client regarding how to attract investors to their business, in mid 2017. For background, they’re a 5 year old private investment firm, whose stock is traded OTC and who invest in startups focused on blockchain tech. To further this model they were exploring additional ways to raise capital, specifically to acquire more startups. Below is a high level framework of what investor “whales” are looking for. This is not investment advice. These are redacted insights into what you should be considering if you’re looking to also engage potential investors in your business enterprise.

If you don’t have time to read it all, I’ll summarize: It still takes money to make money.

Note — all crowdfunding campaigns (regardless of if you call them ICOs / STOs) require a legitimate business model, tangible solutions to real problems, market size worth investing in and the potential for 100x returns. Otherwise, whales aren’t interested in 10x returns.

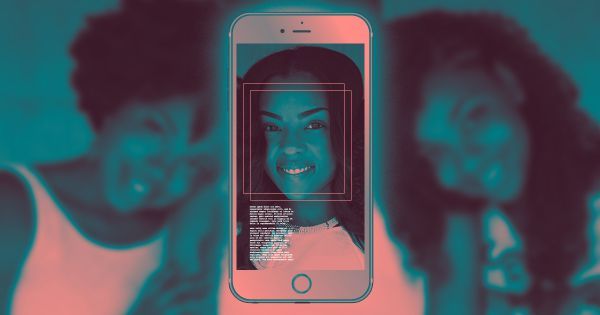

SocialRecall says it deletes obsolete user data on the event version of the app, and that data for the other version is only stored on a user’s phone.

But privacy experts are still concerned that the app represents a mainstream rollout of technology that could have profound implications for the future of public spaces — and that it’s difficult to adequately inform users about the long-term risks of a technology that’s still so new.

“The cost to everyone whom you are surveilling with this app is very, very high,” New York University law professor Jason Schultz told Scientific American, “and I don’t think it respects the consent politics involved with capturing people’s images.”