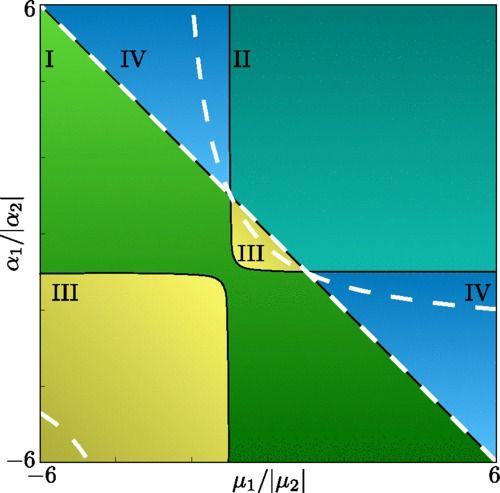

We study the nonequilibrium interaction of two isotropic chemically active particles taking into account the exact near-field chemical interactions as well as hydrodynamic interactions. We identify regions in the parameter space wherein the dynamical system describing the two particles can have a fixed point—a phenomenon that cannot be captured under the far-field approximation. We find that, due to near-field effects, the particles may reach a stable equilibrium at a nonzero gap size or make a complex that can dissociate in the presence of sufficiently strong noise. We explicitly show that the near-field effects originate from a self-generated neighbor-reflected chemical gradient, similar to interactions of a self-propelling phoretic particle and a flat substrate.