Imagine having your government declare fast internet a basic human right.

Category: internet – Page 294

China’s latest plans to dominate robot, smart car and railway industries by 2020

China has unveiled three-year plans to increase the country’s economic competitiveness by developing “key technologies” in nine industrial sectors, from robotics to railways.

Other areas include smart cars, robotics, advanced shipbuilding and maritime equipment, modern agricultural machinery, advanced medical devices and drugs, new materials, smart manufacturing and machine tools.

The aim is “to make China a powerful manufacturing country” and upgrade the nation’s industrial power through “the internet, big data and artificial intelligence”, the commission said.

To achieve that goal, the agency has laid out specific targets to develop key technologies and guide research and the flow of funds in each sector.

How a Machine That Can Make Anything Would Change Everything

But the dream of the nanofabricator is not yet dead. What is perhaps even more astonishing than the idea of having such a device—something that could create anything you want—is the potential consequences it could have for society. Suddenly, all you need is light and raw materials. Starvation ceases to be a problem. After all, what is food? Carbon, hydrogen, nitrogen, phosphorous, sulphur. Nothing that you won’t find with some dirt, some air, and maybe a little biomass thrown in for efficiency’s sake.

Equally, there’s no need to worry about not having medicine as long as you have the recipe and a nanofabricator. After all, the same elements I listed above could just as easily make insulin, paracetamol, and presumably the superior drugs of the future, too.

What the internet did for information—allowing it to be shared, transmitted, and replicated with ease, instantaneously—the nanofabricator would do for physical objects. Energy will be in plentiful supply from the sun; your Santa Clause machine will be able to create new solar panels and batteries to harness and store this energy whenever it needs to.

With FCC Net Neutrality Ruling, the U.S. Could Lose Its Lead in Online Consumer Protection

The internet may be an international system of interconnecting networks sharing a rough global consensus about the technical details of communicating through them – but each country manages its own internet environment independently. As the U.S. debate about the role of government in overseeing and regulating the internet continues, it’s worth looking at how other countries handle the issue.

As the U.S. weakens its protections for internet users, it risks falling behind the rest of the world.

- By Sascha Meinrath, Nathalia Foditsch, The Conversation US on December 14, 2017

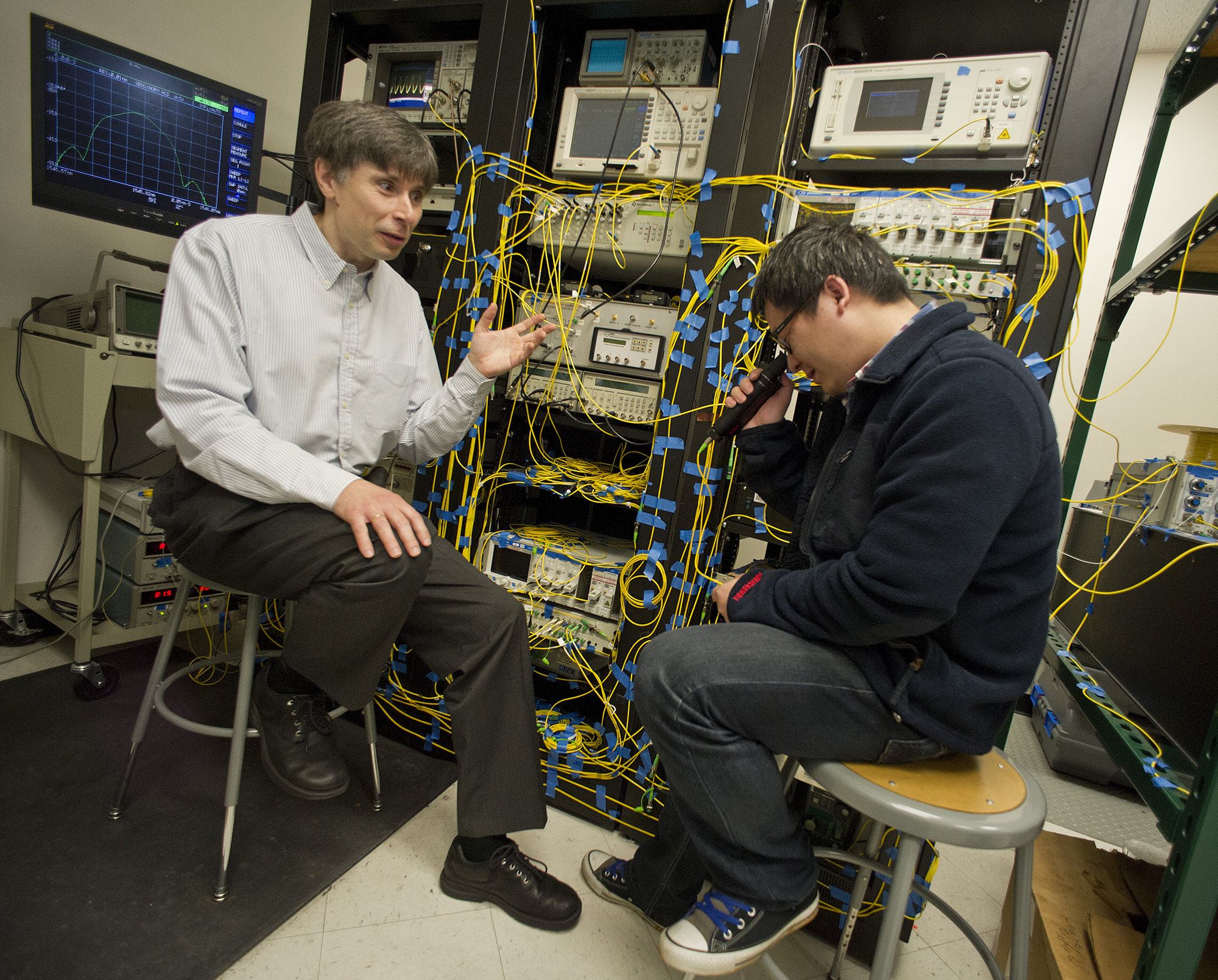

Discovery could reduce cost, energy for high-speed Internet connections

Breakthrough research from The University of Texas at Arlington and The University of Vermont could lead to a dramatic reduction in the cost and energy consumption of high-speed internet connections.

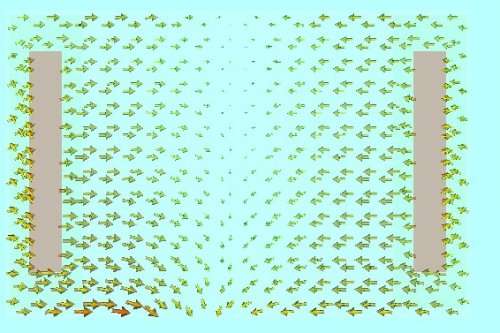

Nonlinear-optical effects, such as intensity-dependent refractive index, can be used to process data thousands of times faster than what can be achieved electronically. Such processing has, until now, worked only for one optical beam at a time because the nonlinear-optical effects also cause unwanted inter-beam interaction, or crosstalk, when multiple light beams are present.

An article published in the prestigious Nature Communications journal, by the research group of Michael Vasilyev, an electrical engineering professor at UTA, in collaboration with Taras I. Lakoba, a mathematics professor at UVM, detailed an experimental demonstration of an optical medium in which multiple beams of light can autocorrect their own shapes without affecting one another.

UK ISP creates 3.5 Mbps broadband internet connection using wet string

An experiment that created a 3.5 Mbps broadband internet connection won’t sound very impressive to most of us, especially since the average download speed in the US is about 75 megabits per second. But the surprising part is that it was established using a 6ft 7in piece of wet string.

While broadband connections tend to rely on wires made of materials such as copper, engineers at a small British internet service provider called Andrews and Arnold wanted to see if it was possible to send data through something less conventional.

They soaked the long piece of twine in a salt water as it’s a good conductor of electricity, though it had to be re-soaked every half an hour, and used a pair of alligator clips to establish the connection. “The upkeep of these wet string connections is very hard; in our tests, we had to continually re-wet the string approximately every 30 minutes to avoid a complete loss of sync, and this process was always disruptive to the signals,” wrote Adrian Kennard, the ISP’s director, in a blog post.

Software enables robots to be controlled in virtual reality

Even as autonomous robots get better at doing things on their own, there will still be plenty of circumstances where humans might need to step in and take control. New software developed by Brown University computer scientists enables users to control robots remotely using virtual reality, which helps users to become immersed in a robot’s surroundings despite being miles away physically.

The software connects a robot’s arms and grippers as well as its onboard cameras and sensors to off-the-shelf virtual reality hardware via the internet. Using handheld controllers, users can control the position of the robot’s arms to perform intricate manipulation tasks just by moving their own arms. Users can step into the robot’s metal skin and get a first-person view of the environment, or can walk around the robot to survey the scene in the third person—whichever is easier for accomplishing the task at hand. The data transferred between the robot and the virtual reality unit is compact enough to be sent over the internet with minimal lag, making it possible for users to guide robots from great distances.

“We think this could be useful in any situation where we need some deft manipulation to be done, but where people shouldn’t be,” said David Whitney, a graduate student at Brown who co-led the development of the system. “Three examples we were thinking of specifically were in defusing bombs, working inside a damaged nuclear facility or operating the robotic arm on the International Space Station.”

Scientists Have Created Plastic Objects That Can Connect to Wi-Fi Without Any Electronics

Scientists have developed new 3D-printed plastic objects that can hook up to Wi-Fi without the aid of any electronics or batteries, meaning household devices could get a lot smarter in the future without the need for any circuitry.

If that’s not blowing your mind just yet, think about this: the tech could be used to make a laundry bottle that orders a refill online as soon as it runs out, or a simple volume slider that connects to your speakers without any cabling or even a power source.

So how is this possible? To achieve this, a team from the University of Washington built a system comprising a plastic switch, spring, gear, and antenna, which when activated with a press or other movement can absorb or reflect passing Wi-Fi signals in order to communicate.

Optically tunable microwave antennas for 5G applications

Multiband tunable antennas are a critical part of many communication and radar systems. New research by engineers at the University of Bristol has shown significant advances in antennas by using optically induced plasmas in silicon to tune both radiation patterns and operation frequency.

Conventional antenna tuning is performed with diodes or Micro-Electro-Mechanical Systems (MEMS) switches. However, these approaches have significant drawbacks as systems become more complex and move to higher frequencies, which is anticipated for 5G systems.

The first paper, published in IET Optoelectronics, co-authored by Dr Chris Gamlath, Research Associate in RF Engineering during his PhD, shows how a silicon superstrate placed over a slotted microstrip patch can be used to tune radiation patterns.