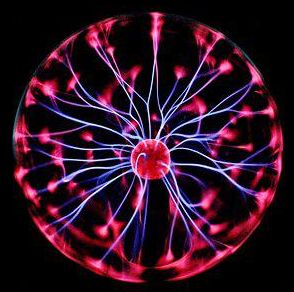

The “Cold Plasma” market report offers a thought with perspective by the improved information related to Cold Plasma market. The Cold Plasma market report gives a broad platform offering different gateways for different associations, firms, collaborations, and new startups. This Cold Plasma report also incorporates approved estimations to build up a superior comprehension of the associations. The Cold Plasma market reports give the point to point data about the definitively settled Cold Plasma market players Miller’s Total Comfort, Atmospheric plasma technology, Air Oasis, Lenntech, ECOAIR, GPS, Primozone, Terraplasma, Plasma Air, Plasma Technology Systems near to the present relationship in the market concerning the business, open market momentum, products, services, and the organization.

Click here to access the report: www.marketresearchstore.com/report/global-cold-plasma-market…uestSample

The Cold Plasma market report examines the market division {Cold Plasma air purification equipment, Cold Plasma Water purification equipment, Others}; {Air purification, Water purification, Others} concerning the product and association type, end-customer applications, and market plans. The Cold Plasma market report gives the real headway segments and separate territories that strikingly sway the market improvement outlined out information about the diverse conditions of the Cold Plasma market altogether. The Cold Plasma market report besides unites an assessed effect of governments principles and plans over the market. The Cold Plasma market report includes different demonstrative philosophies, for example, SWOT examination to get the data with respect to the estimates budget vulnerabilities identified with the surge of the market, which relies upon the present information.