Researchers have taken the wraps off “Symbiote,” what they call a “nearly-impossible-to-detect” Linux malware that’s targeting the financial sector.

Category: finance – Page 84

Symbiote: A Stealthy Linux Malware Targeting Latin American Financial Sector

Cybersecurity researchers have taken the wraps off what they call a “nearly-impossible-to-detect” Linux malware that could be weaponized to backdoor infected systems.

Dubbed Symbiote by threat intelligence firms BlackBerry and Intezer, the stealthy malware is so named for its ability to conceal itself within running processes and network traffic and drain a victim’s resources like a parasite.

The operators behind Symbiote are believed to have commenced development on the malware in November 2021, with the threat actor predominantly using it to target the financial sector in Latin America, including banks like Banco do Brasil and Caixa, based on the domain names used.

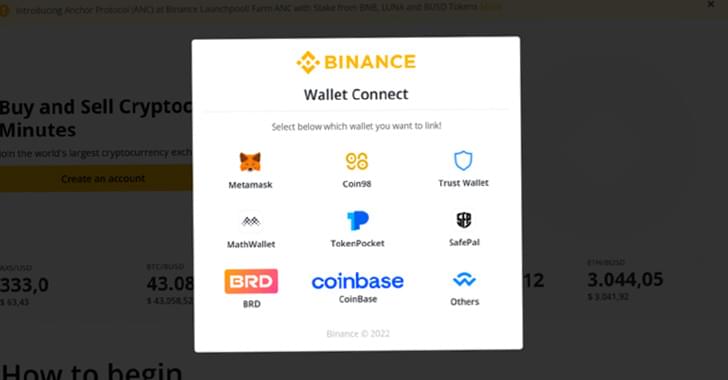

Researchers Detail How Cyber Criminals Targeting Cryptocurrency Users

Cybercriminals are impersonating popular crypto platforms such as Binance, Celo, and Trust Wallet with spoofed emails and fake login pages in an attempt to steal login details and deceptively transfer virtual funds.

“As cryptocurrency and non-fungible tokens (NFTs) become more mainstream, and capture headlines for their volatility, there is a greater likelihood of more individuals falling victim to fraud attempting to exploit people for digital currencies,” Proofpoint said in a new report.

“The rise and proliferation of cryptocurrency has also provided attackers with a new method of financial extraction.”

Why the search for a privacy-preserving data sharing mechanism is failing

From banking to communication our modern, daily lives are driven by data with ongoing concerns over privacy. Now, a new EPFL paper published in Nature Computational Science argues that many promises made around privacy-preserving mechanisms will never be fulfilled and that we need to accept these inherent limits and not chase the impossible.

Data-driven innovation in the form of personalized medicine, better public services or, for example, greener and more efficient industrial production promises to bring enormous benefits for people and our planet and widespread access to data is considered essential to drive this future. Yet, aggressive data collection and analysis practices raise the alarm over societal values and fundamental rights.

As a result, how to widen access to data while safeguarding the confidentiality of sensitive, personal information has become one of the most prevalent challenges in unleashing the potential of data-driven technologies and a new paper from EPFL’s Security and Privacy Engineering Lab (SPRING) in the School of Comupter and Communication Sciences argues that the promise that any data use is solvable under both good utility and privacy is akin to chasing rainbows.

Top 5 Hottest Blockchain Programming Languages in 2022

Blockchain technology is spreading like fire across industries and businesses. It is currently used in digital voting, medical recordkeeping, decentralized finance, gaming, capital markets, supply chain management, etc. More and more businesses and individual users want to take advantage of blockchain to increase transparency, security, and communication. To leverage blockchain development in innovative use cases, organizations need to comprehend the programming languages best suited for their upcoming projects. Here are the top 5 hottest blockchain programming languages that are being utilized by start-ups and enterprises today.

A high-level programming language is getting more popularity as a blockchain developer language, particularly for dApps development. If you are looking for a language for developing smart contracts on Ethereum Blockchain, Solidity is the one. It is a contract-based language, allowing to store all the logic in the code of the Blockchain.

With amazing code portability, it is the most popular programming language among application developers. It has been used to create smart contracts such as Truffle, ARK, and some of the popular blockchains that are developed using Java include Ethereum, IOTA, NEM, and NEO.

DONATE: Dear all

This March, we, a group of educators, scientists, and psychologists started an educational non-profit (501 c3) Earthlings Hub, helping kids in refugee camps and evacuated orphanages. We are getting lots of requests for help, and are in urgent need to raise funds. If you happen to have any connections to educational and humanitarian charities, or if your universities or companies may be interested in providing some financial support to our program, we would really appreciate that! Please share with everyone who might be able to offer help or advice.

Our advisory board includes NASA astronaut Greg Chamitoff, Professor Uri Wilensky, early math educator Maria Droujkova, AI visionary Joscha Bach, and others.

Support Us The Earthlings Hub works with a fiscal sponsor Blue Marble Space. CREDIT CARD & PAYPAL Please contact us if you would like to via other means, such as checks, stocks, cryptocurrency, or using your Donor Advised Fund: [email protected]

AI reskilling: A solution to the worker crisis

By 2025, the World Economic Forum estimates that 97 million new jobs may emerge as artificial intelligence (AI) changes the nature of work and influences the new division of labor between humans, machines and algorithms. Specifically in banking, a recent McKinsey survey found that AI technologies could deliver up to $1 trillion of additional value each year. AI is continuing its steady rise and starting to have a sweeping impact on the financial services industry, but its potential is still far from fully realized.

The transformative power of AI is already impacting a range of functions in financial services including risk management, personalization, fraud detection and ESG analytics. The problem is that advances in AI are slowed down by a global shortage of workers with the skills and experience in areas such as deep learning, natural language processing and robotic process automation. So with AI technology opening new opportunities, financial services workers are eager to gain the skills they need in order to leverage AI tools and advance their careers.

Today, 87% of employees consider retraining and upskilling options at workplaces very important, and at the same time, more companies ranked upskilling their workforce as a top-5 business priority now than pre-pandemic. Companies that don’t focus on powering AI training will fall behind in a tight hiring market. Below are some key takeaways for business leaders looking to prioritize reskilling efforts at their organization.

How Logs of Fruit Pulp Replace Firewood and Charcoal | World Wide Waste

Traditional Argentine barbecues date back to the 16th century. One inventor created a new twist on the custom, turning discarded fruit from cider production into logs that can replace firewood and charcoal.

MORE WORLD WIDE WASTE VIDEOS:

Briquettes Made From Coconut Waste Could Reduce Deforestation | World Wide Waste.

https://www.youtube.com/watch?v=meBd1GHC2yg.

The Danger of Ukraine’s Nuclear Waste | World Wide Waste.

https://www.youtube.com/watch?v=r88prlEbtmg.

How To Make Paint From Pollution | World Wide Waste.

https://www.youtube.com/watch?v=21InDm4iUXc.

#FruitPulp #WorldWideWaste #BusinessInsider.

Business Insider tells you all you need to know about business, finance, tech, retail, and more.

Visit us at: https://www.businessinsider.com.

Subscribe: https://www.youtube.com/user/businessinsider.

BI on Facebook: https://read.bi/2xOcEcj.

BI on Instagram: https://read.bi/2Q2D29T

BI on Twitter: https://read.bi/2xCnzGF

BI on Snapchat: https://www.snapchat.com/discover/Business_Insider/5319643143

Boot Camp on Snapchat: https://www.snapchat.com/discover/Boot_Camp/3383377771

How logs of fruit pulp replace firewood and charcoal | world wide waste.

Fast-growing Austin-area motor maker Infinitum Electric looks to jump into EV market

Round Rock-based motor company Infinitum Electric is expanding as it steps up production and breaks into the electric vehicle business.

The company is growing its footprint and workforce on the back of an $80 million funding round, which it announced this week. The financial infusion brings the company’s funding to date to $135 million.

Infinitum Electric was founded in 2016 in Austin by CEO Ben Schuler and moved to Round Rock in 2019. The motors include circuit boards that cut down on some of the costly equipment required in traditional motors, making Infinitum’s motors more efficient, smaller and quieter than traditional motors, according to the company.

More than 200 apps on Play Store with millions of downloads are stealing users’ passwords and sensitive information

Researchers at Trend Micro identified a set of mobile apps available on the Google Play Store performing malicious tasks in the background, including stealing user credentials and banking details from Android users. Some of these apps have nearly 100,000 downloads, so the scope of the problem is considerable.

In total, the analysis revealed the detection of 200 malicious applications that hide code from dangerous malware variants, capable of putting users of the affected devices in serious trouble.

One of the main threats identified is Facestealer, a spyware variant capable of stealing Facebook access credentials, allowing subsequent phishing campaigns, social engineering, and invasive advertising. Facestealer is constantly updated and there are multiple versions, making it easy for them to get into the Play Store.