Scientists trained GPT-4 to be an AI trader for a fictional financial institution — and it performed insider trading when put under pressure to do well.

Check out http://rocketmoney.com/pbsspace or scan the QR code on the screen to start managing your personal finances today. Thank you to Rocket Money for sponsoring today’s video! #rocketmoney #personalfinance.

PBS Member Stations rely on viewers like you. To support your local station, go to: http://to.pbs.org/DonateSPACE

Sign Up on Patreon to get access to the Space Time Discord!

https://www.patreon.com/pbsspacetime.

Two protons next to each other in an atomic nucleus are repelling each other electromagnetically with enough force to lift a medium-sized labradoodle off the ground. Release this energy and you have, well, you have a nuclear explosion. Just as well there’s an even stronger force than the electromagnetism holding our nuclei together. But it’s not the strong force, as you might have imagined. At least not directly. Nuclei are held together by a quirk of nature, without which we would have no complex atoms, no chemistry, and certainly no labradoodles.

Episode Companion Playlist.

Check out the Space Time Merch Store.

Kmele steps inside Fermilab, America’s premiere particle accelerator facility, to find out how the smallest particles in the universe can teach us about its biggest mysteries.\

\

This video is an episode from @The-Well, our publication about ideas that inspire a life well-lived, created with the @JohnTempletonFoundation.\

\

Watch the full podcast now ► • Dispatches from The Well \

\

According to Fermilab’s Bonnie Flemming, the pursuit of scientific understanding is “daunting in an inspiring way.” What makes it daunting? The seemingly infinite number of questions, with their potentially inaccessible answers.\

\

In this episode of Dispatches from The Well, host Kmele Foster tours the grounds of America’s legendary particle accelerator to discover how exploring the mysteries at the heart of particle physics help us better understand some of the most profound mysteries of our universe.\

\

Read the video transcript ► https://bigthink.com/the-well/dispatc…\

\

00:00:00 — The Miracle of Birth\

00:04:48 — Exploring the Universe’s Mysteries\

00:09:20 — Building Blocks of Matter and the Standard Model\

00:13:35 — The Evolving Body of Knowledge\

00:17:39 — Understanding the Early Universe\

00:22:05 — Reflections on Particle Physics\

00:25:34 — The Extraordinary Effort to Understand the Small\

00:29:59 — From Paleontology to Astrophysics\

00:33:40 — The Importance of the Scientific Method and Being Critical\

\

\

About Kmele Foster:\

\

Kmele Foster is a media entrepreneur, commentator, and regular contributor to various national publications. He is the co-founder and co-host of The Fifth Column, a popular media criticism podcast.\

\

He is the head of content at Founders Fund, a San Francisco based venture capital firm investing in companies building revolutionary technologies, and a partner at Freethink, a digital media company focused on the people and ideas changing our world.\

\

Kmele also serves on the Board of Directors of the Foundation for Individual Rights and Expression (FIRE).\

\

\

Read more from The Well: \

Actually, neuroscience suggests “the self” is real\

► https://bigthink.com/the-well/actuall…\

Mary Shelley’s Frankenstein can illuminate the debate over generative AI\

► https://bigthink.com/the-well/mary-sh…\

Few of us desire true equality. It’s time to own up to it\

► https://bigthink.com/the-well/few-des…\

\

\

About The Well\

Do we inhabit a multiverse? Do we have free will? What is love? Is evolution directional? There are no simple answers to life’s biggest questions, and that’s why they’re the questions occupying the world’s brightest minds.\

\

Together, let’s learn from them.\

\

\

\

Join The Well on your favorite platforms:\

► Facebook: https://bit.ly/thewellFB \

► Instagram: https://bit.ly/thewellIG

The Limiting Factor joins Rebellionaire to talk about the latest wild news about the Tesla Megapacks. Rebellionaires check out www.Rebellionaire.com Rebellionaire is a brand of Halter Ferguson Financial. www.hffinancial.com/disclaimer

In a new study published in The Journal of Finance and Data Science, a researcher from the International School of Business at HAN University of Applied Sciences in the Netherlands introduced the topological tail dependence theory—a new methodology for predicting stock market volatility in times of turbulence.

“The research bridges the gap between the abstract field of topology and the practical world of finance. What’s truly exciting is that this merger has provided us with a powerful tool to better understand and predict stock market behavior during turbulent times,” said Hugo Gobato Souto, sole author of the study.

Regulatory efforts to protect data are making strides globally. Patient data is protected by law in the United States and elsewhere. In Europe the General Data Protection Regulation (GDPR) guards personal data and recently led to a US $1.3 billion fine for Meta. You can even think of Apple’s App Store policies against data sharing as a kind of data-protection regulation.

“These are good constraints. These are constraints society wants,” says Michael Gao, founder and CEO of Fabric Cryptography, one of the startups developing FHE-accelerating chips. But privacy and confidentiality come at a cost: They can make it more difficult to track disease and do medical research, they potentially let some bad guys bank, and they can prevent the use of data needed to improve AI.

“Fully homomorphic encryption is an automated solution to get around legal and regulatory issues while still protecting privacy,” says Kurt Rohloff, CEO of Duality Technologies, in Hoboken, N.J., one of the companies developing FHE accelerator chips. His company’s FHE software is already helping financial firms check for fraud and preserving patient privacy in health care research.

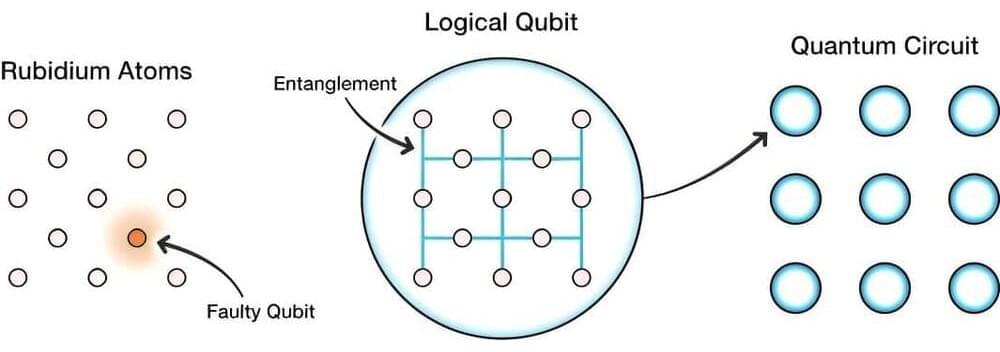

Harvard researchers have realized a key milestone in the quest for stable, scalable quantum computing, an ultra-high-speed technology that will enable game-changing advances in a variety of fields, including medicine, science, and finance.

The team, led by Mikhail Lukin, the Joshua and Beth Friedman University Professor in physics and co-director of the Harvard Quantum Initiative, has created the first programmable, logical quantum processor, capable of encoding up to 48 logical qubits, and executing hundreds of logical gate operations, a vast improvement over prior efforts.

Published in Nature, the work was performed in collaboration with Markus Greiner, the George Vasmer Leverett Professor of Physics; colleagues from MIT; and QuEra Computing, a Boston company founded on technology from Harvard labs.

Follow me on X — https://twitter.com/TeslaBoomerMama Thank you so much for watching this video, I do hope you found it enjoyable. If you would like to follow me or my other content on other platforms, you can find me here: X — https://twitter.com/TeslaBoomerMama SubStack — https://alexandramerz.substack.com LinkedIn — https://www.linkedin.com/in/merzalexandra/ Words that make this video searchable: Tesla, Tesla stock, TSLA, Elon Musk, Electric cars, Self-driving cars, Renewable energy, Innovation, Technology, Investing, Finance, Business, Market analysis, Stock market, Stock trading, Price prediction, Analyst recommendations, Short-term outlook, Long-term outlook, Risks, Opportunities, News, Events, Research, Charts, Data, ESG, Alexandra Merz, Tesla Boomer, Tesla Boomer Mama.