As he sits stroking his Rip Van Winkle-worthy beard, it’s easy to see how de Grey’s achieved this “kind of a spiritual leader-status,” as he calls it. He dives easily into intricate explanations of two research projects unfolding in the lab down the hall, eagerly describing how one studies mitochondrial mutations, which are thought to cause an increase in oxidative stress. The other looks at atherosclerosis, the narrowing and hardening of artery walls. If we understood more about this buildup, the logic goes, we could better clean it up before too much damage is done.

Though he attends lab meetings and oversees the SENS’s research, his primary task is convincing the general public that death is, in fact, bad and that we should be doing everything we can to stop it. This focus on messaging suits him just fine. “I’m not in this to do science for the sake of doing science,” he says. “I’m in it for the ultimate goal.” He does a “ridiculous” amount of media, he says, and gives around 50 talks a year, from Vietnam to the Czech Republic.

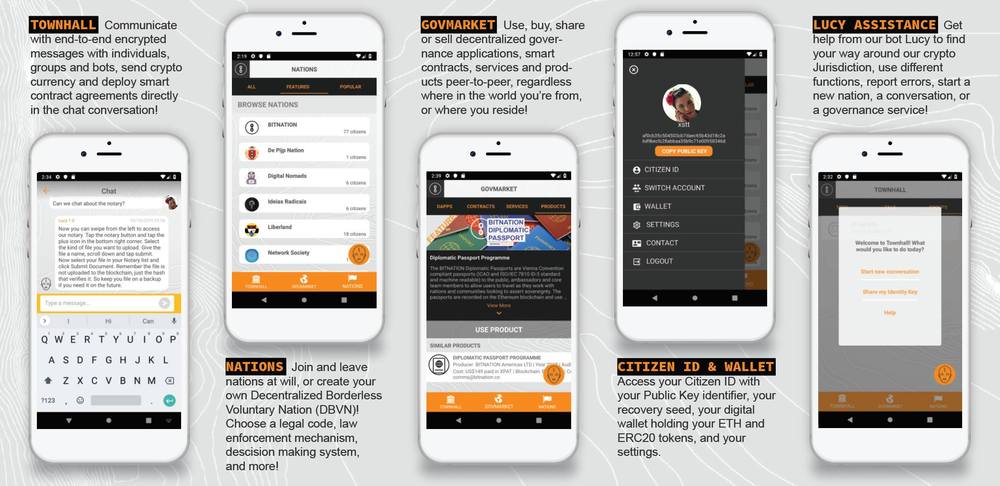

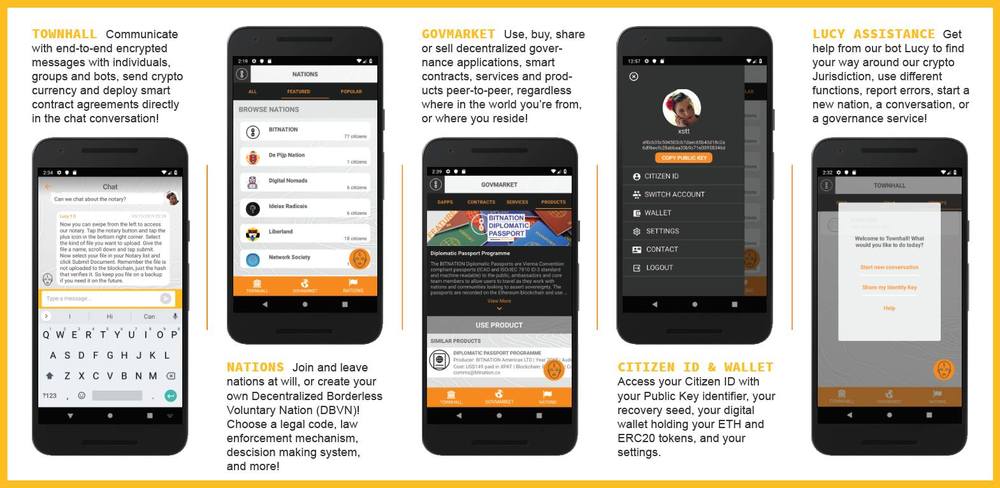

Back in April, at a San Francisco blockchain conference called Block 2 the Future, de Grey began his talk with a disclaimer: “I probably ought to start by emphasizing that I don’t know fuck-all about cryptocurrencies. I am really only here because I have apparently quite a significant fan base in this community, and I am delighted that I do.”