If our current laws of physics can’t predict what will happen, even probabilistically, we need something new.

Mitochondrial dysfunction is associated with many mitochondrial diseases, most of which are the result of dysfunctional mitochondrial oxidative phosphorylation (OXPHOS). Mitochondrial OXPHOS accounts for the generation of most of the cellular adenosine triphosphate (ATP) in a cell. The OXPHOS function largely depends on the coordinated expression of the proteins encoded by both nuclear and mitochondrial genomes. The human mitochondrial genome encodes for 13 polypeptides of the OXPHOS, and the nuclear genome encodes the remaining more than 85 polypeptides required for the assembly of OXPHOS system. Mitochondrial DNA (mtDNA) depletion impairs OXPHOS that leads to mtDNA depletion syndromes (MDSs)1, 2. The MDSs are a heterogeneous group of disorders, characterized by low mtDNA levels in specific tissues. In different target organs, mtDNA depletion leads to specific pathological changes. MDS results from the genetic defects in the nuclear-encoded genes that participate in mtDNA replication, and mitochondrial nucleotide metabolism and nucleotide salvage pathway1, 4,5,6,7,8,9,10. mtDNA depletion is also implicated in other human diseases such as mitochondrial diseases, cardiovascular11, 12, diabetes13,14,15, age-associated neurological disorders16,17,18, and cancer19,20,21,22,23,24,25.

A general decline in mitochondrial function has been extensively reported during aging26,27,28,29,30,31,32,33. Furthermore, mitochondrial dysfunction is known to be a driving force underlying age-related human diseases16,17,18, 34,35,36. A mouse that carries elevated mtDNA mutation is also shown to present signs of premature aging37, 38. In addition to mutations in mtDNA, studies also suggest a decrease in mtDNA content and mitochondrial number with age27, 29, 32, 33, 39. Notably, there is an age-related mtDNA depletion in a number of tissues40,41,42. mtDNA depletion is also frequently observed among women with premature ovarian aging43. Low mtDNA copy number is linked to frailty and, for a multiethnic population, is a predictor of all-cause mortality44. A recent study revealed that humans on an average lose about four copies of mtDNA every ten years. This study also identified an association of decrease in mtDNA copy number with age-related physiological parameters39.

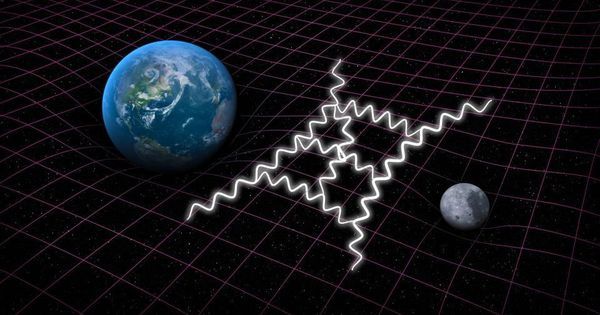

To help define the role of mtDNA depletion in aging and various diseases, we created an inducible mouse expressing, in the polymerase domain of POLG1, a dominant-negative (DN) mutation that induces depletion of mtDNA in the whole animal. Interestingly, skin wrinkles and visual hair loss were among the earliest and most predominant phenotypic changes observed in these mice. In the present study, we demonstrate that mtDNA depletion-induced phenotypic changes can be reversed by restoration of mitochondrial function upon repletion of mtDNA.

UK-based Moltex Energy will build a demonstration SSR-W (Stable Salt Reactor – Wasteburner) at the Point Lepreau nuclear power plant site in Canada under an agreement signed with the New Brunswick Energy Solutions Corporation and NB Power.

The agreement provides CAD5.0 million (USD3.8 million) of financial support to Moltex for its immediate development activities and Moltex will open its North American headquarters in Saint John and build its development team there. It also calls for Moltex to deploy its first SSR-W at the Point Lepreau nuclear power plant site before 2030.

Stable Salt Reactors build on the fundamental safety and simplicity breakthrough of molten salt fuel in essentially standard nuclear fuel tubes. Stable Salt Reactors are modular in construction. Their rectangular cores can be extended module by module to create reactors from 150MW to 1200MW power.

According to engineers, root vegetables aren’t only good for the body. Their fibres could also help make concrete mixtures stronger and more eco-friendly.

Construction projects have a significant impact on our environment. To combat this, stakeholders in the academic and industrial sectors have been looking for ways to make the industry more environment friendly. The EU-funded project B-SMART will be contributing to these efforts by focusing on concrete and the more culpable of its ingredients: cement.

Led by Lancaster University in the United Kingdom, the project will be investigating how nanoplatelets extracted from the fibres of root vegetables can make concrete mixtures more robust and more environment friendly. So far, initial tests have shown that adding nanoplatelets from sugar beet or carrot to these mixtures greatly enhances the mechanical properties of concrete.

Not long ago, getting a virus was about the worst thing computer users could expect in terms of system vulnerability. But in our current age of hyper-connectedness and the emerging Internet of Things, that’s no longer the case. With connectivity, a new principle has emerged, one of universal concern to those who work in the area of systems control, like João Hespanha, a professor in the departments of Electrical and Computer Engineering, and Mechanical Engineering at UC Santa Barbara. That law says, essentially, that the more complex and connected a system is, the more susceptible it is to disruptive cyber-attacks.

“It is about something much different than your regular computer virus,” Hespanha said. “It is more about cyber physical systems—systems in which computers are connected to physical elements. That could be robots, drones, smart appliances, or infrastructure systems such as those used to distribute energy and water.”

In a paper titled “Distributed Estimation of Power System Oscillation Modes under Attacks on GPS Clocks,” published this month in the journal IEEE Transactions on Instrumentation and Measurement, Hespanha and co-author Yongqiang Wang (a former UCSB postdoctoral research and now a faculty member at Clemson University) suggest a new method for protecting the increasingly complex and connected power grid from attack.

The race to produce safe, powerful and affordable solid-state lithium batteries is accelerating and recent announcements about game-changing research using a solid non-flammable ceramic electrolyte known as garnet has some in the race calling it revolutionary.

“This is a paradigm shift in energy storage,” said Kelsey Hatzell, assistant professor of mechanical engineering. A paper – “The Effect of Pore Connectivity on Li Dendrite Propagation Within LLZO Electrolytes Observed with Synchrotron X-ray Tomography” – describing her novel research on the failure points of a garnet electrolyte was published online in March in the American Chemical Society’s Energy Letters, which was among the most read ACS Letters articles that month.

Lithium-ion batteries typically contain a liquid organic electrolyte that can catch fire. The fire risk is eliminated by the use of a non-flammable garnet-based electrolyte. Replacing liquid electrolytes with a solid organic like garnet also potentially lowers the cost by increasing battery life.

For the first time, scientists from Lawrence Livermore National Laboratory (LLNL) and five other organizations have shown that human influences significantly impact the size of the seasonal cycle of temperature in the lowest layer of the atmosphere.

To demonstrate this, they applied a so-called “fingerprint” technique. Fingerprinting seeks to separate human and natural influences on climate. It relies on patterns of climate change—typically patterns that are averaged over years or decades. But in the new research appearing in the July 20 edition of the journal Science, the team studied seasonal behavior, and found that human-caused warming has significantly affected the seasonal temperature cycle.

The researchers focused on the troposphere, which extends from the surface to roughly 16 kilometers in the atmosphere at the tropics and 13 kilometers at the poles. They considered changes over time in the size of the seasonal cycle of tropospheric temperature at different locations on the Earth’s surface. This pattern provides information on temperature contrasts between the warmest and coldest months of the year.

Australia announced plans Friday to explore concepts such as firing salt into clouds and covering swathes of water with a thin layer of film in a bid to save the embattled Great Barrier Reef.

The UNESCO World Heritage-listed reef, about the size of Japan or Italy, is reeling from two straight years of bleaching as sea temperatures rise because of climate change.

Experts have warned that the 2,300-kilometre (1,400-mile) long area could have suffered irreparable damage.

Though more router manufacturers are making routers easier to set up and configure—even via handy little apps instead of annoying web-based interfaces—most people probably don’t tweak many options after purchasing a new router. They log in, change the name and passwords for their wifi networks, and call it a day.

While that gets you up and running with (hopefully) speedy wireless connectivity, and the odds are decent that your neighbor or some random evil Internet person isn’t trying to hack into your router, there’s still a lot more you can do to boost the security of your router (and home network).