“The White House has asked whether Zipline’s drones, pioneered in Rwanda, could fly much-needed drugs and blood to Americans.”

Category: government – Page 234

The Evolution of Antimatter Propulsion

Thinking about Eugen Sänger’s photon rocket concept inevitably calls to mind his Silbervogel design. The ‘Silverbird’ had nothing to do with antimatter but was a demonstration of the immense imaginative power of this man, who envisioned a bomber that would be launched by a rocket-powered sled into a sub-orbital trajectory. There it would skip off the upper atmosphere enroute to its target. The Silbervogel project was cancelled by the German government in 1942, but if you want to see a vividly realized alternate world where it flew, have a look at Allen Steele’s 2014 novel V-S Day, a page-turner if there ever was one.

I almost said that it was a shame we don’t have a fictionalized version of the photon rocket, but as we saw yesterday, there were powerful reasons why the design wouldn’t work, even if we could somehow ramp up antimatter production to fantastic levels (by today’s standards) and store and manipulate it efficiently. Energetic gamma rays could not be directed into an exhaust stream by the kind of ‘electron gas mirror’ that Sänger envisioned, although antimatter itself maintained its hold on generations of science fiction writers and scientists alike.

Enter the Antiproton

Sänger’s presentation at the International Astronautical Congress in 1953 came just two years ahead of the confirmation of the antiproton, first observed at the Berkeley Bevatron in 1955. Now we have something we can work with, at least theoretically. For unlike the annihilation of electrons and positrons, antiprotons and protons produce pi-mesons, or pions, when they meet. Pions don’t live long, with charged pions decaying into muons and muon neutrinos, while neutral pions decay into gamma rays. Those charged pions, however, turn out to be helpful indeed.

Futurist-linked groups talking at the Mont Order

The following is a selection of points of interest to futurism and forecasts of the political future from the recent Mont Order Conference of July 2016:

STATEMENT 1: NEW SECRET WIKI CREATED

The Mont Order’s secret wiki created via PBworks holds information on the origin and literature of the Mont Order as well as our current structure, ranks and members. Members will be invited via email and will be able to contribute pages or post comments and questions on this literature. The public will not have access to it.

STATEMENT 3: FRIENDS OF THE MONT ORDER GROUP IS EFFECTIVE

The Friends of the Mont Order group created by Raincoaster at Facebook has seen a surprising growth in membership. Our hope is that it will reach a point where members can confidently post to the group and a minimal amount of admin involvement is needed. Due to the continued growth in its membership and the high amount of activity there, the group can be deemed a success so far.

STATEMENT 8: ON ANTI-ISLAM MEDIA AND POLICIES IN EUROPE AND THE US

“Integration”, humiliation of Muslims by the state, and blaming Islam for violence are non-answers to terrorist threats. These steps will only deepen tensions and extremist views on all sides in European countries, where terrorist incidents have occurred. We have noted that incidents in Europe are beginning to resemble a more American pattern of “mass shootings” but similar tragedies have curiously not been occurring in the UK. In addition, editorial policies of Western media clearly follow a pattern of only describing attacks as “terrorist” after an attacker is described to be a Muslim.

POLL ALSO TAKING PLACE

(Vote Here) From a MONT member: “All funding of religious groups by non-citizens should be banned” (expanded: “Religions should be treated the same way as political parties”). Justified by the way Saudi Arabia uses mosque financing to spread its political power and extremism particularly in Europe. Might also bring states and authorities to account for spreading extremism rather than blaming communities. Might also allow Muslim communities to take control of their own future rather than taking orders from foreign clerics. Should this be advocated as law? (NOTE: The UK already bans political parties from getting foreign funds. What is being advocated in the UK context is only that religious groups be also added to these lists of groups. In the context of other countries, they would copy the above element of UK law and then add the religious groups to the lists.)

The Mont Order, often just called Mont, is an information society of writers and networks based in different countries who collaborate to broaden their influence. To date, this has been achieved mainly through the internet.

The Mont Order has held online audio conferences since February 2015.

Shared website: lordre.net

Shared Twitter timeline: @MontOrder

Subscribe to updates from this society: feeds.feedburner.com/lordre/tajQ

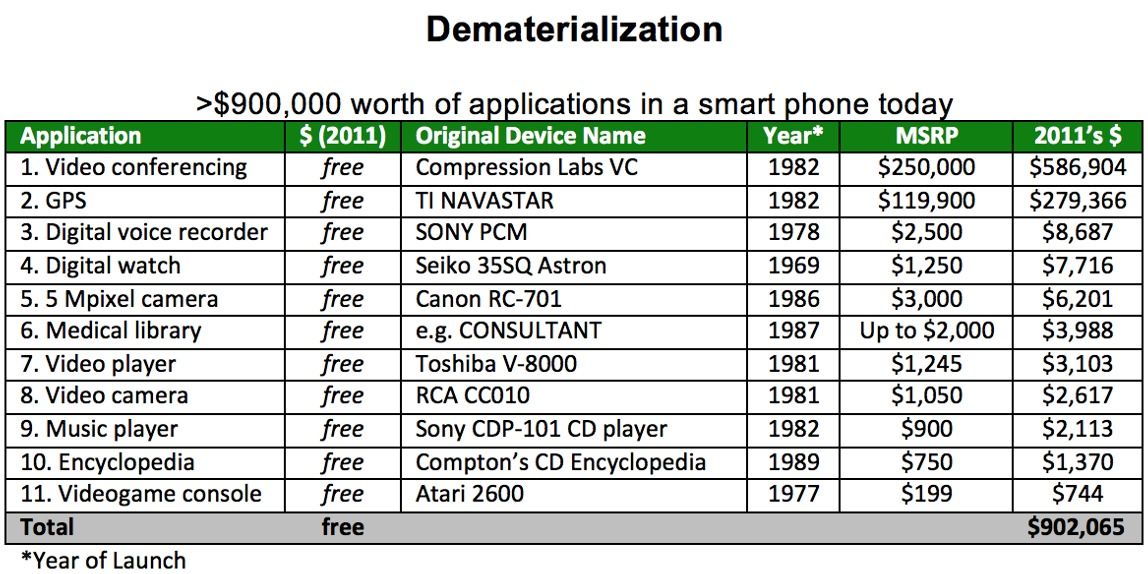

Demonetized Cost of Living

People are concerned about how AI and robotics are taking jobs and destroying livelihoods… reducing our earning capacity, and subsequently destroying the economy.

In anticipation, countries like Canada, India and Finland are running experiments to pilot the idea of “universal basic income” — the unconditional provision of a regular sum of money from the government to support livelihood independent of employment.

But what people aren’t talking about, and what’s getting my attention, is a forthcoming rapid demonetization of the cost of living.

White House’s “ADVANCING QUANTUM INFORMATION SCIENCE: NATIONAL CHALLENGES AND OPPORTUNITIES”

Nice paper on QC from the Obama Administration. While reading this paper; I also kept in mind why the US, Europe, Canada, etc. all must accelerate our efforts on QC which is government backed hackers in China, etc. especially since China will have a Quantum Internet and have also accelerated their efforts on QC with their partnership with Australia’s QC efforts which many discoveries on QC has happened.

Chinese satellite is one giant step for the quantum internet

Chinese Government launches in the coming weeks their new Quantum Satellite which advances their networks, communications, etc. The question remaining is with Chinese Government backed hackers; what will they do on this technology.

Discussion in ‘China & Far East’ started by onebyone, Jul 27, 2016 at 8:26 PM.

How eco-friendly communes could change the future of housing — By Autumn Spanne | The Guardian

“An increasing number of US landowners want to build commune-style villages that are completely self-sufficient and have a low carbon footprint”

Russia Ready To Build Nuke-Powered Aircraft Carrier For India

Russia has agreed to build a nuclear-powered aircraft carrier jointly with India.

According to sources close to the Indian Navy, Kremlin recently sent a letter to the Indian Defence Ministry in which the offer was made. A senior Navy officer told the press: “A Russian military delegation offered India the Project 23000E ‘Storm’ (E stands for export-oriented, Eksportny) heavy aircraft carrier several weeks ago.” The officer, who wished to remain anonymous, said that the Narendra Modi government was considering the offer and would make a final decision soon.

Speaking at a press conference in the Indian capital a couple of days ago, the officer said: “The surface combatant is known to have a full displacement of about 100,000 tonnes and a price of about USD 5.7 billion. The proposed carrier has been jointly developed by the Krylov State Research Centre (KGNC) and the Nevskoye Design Bureau (NPKB), a subsidiary of the United Shipbuilding Corporation. The building of the Project 23300 ‘Storm’ aircraft carrier is supposed to take about 10–11 years.”

Why the Cost of Living Is Poised to Plummet in the Next 20 Years

Powered by developments in exponential technologies, the cost of housing, transportation, food, health care, entertainment, clothing, education and so on will fall, eventually approaching, believe it or not, zero.

People are concerned about how AI and robotics are taking jobs, destroying livelihoods, reducing our earning capacity, and subsequently destroying the economy.

In anticipation, countries like Canada, India and Finland are running experiments to pilot the idea of “universal basic income” — the unconditional provision of a regular sum of money from the government to support livelihood independent of employment.

But what people aren’t talking about, and what’s getting my attention, is a forthcoming rapid demonetization of the cost of living.