The government should consider giving out monthly Social Security checks—no strings attached.

Category: government – Page 183

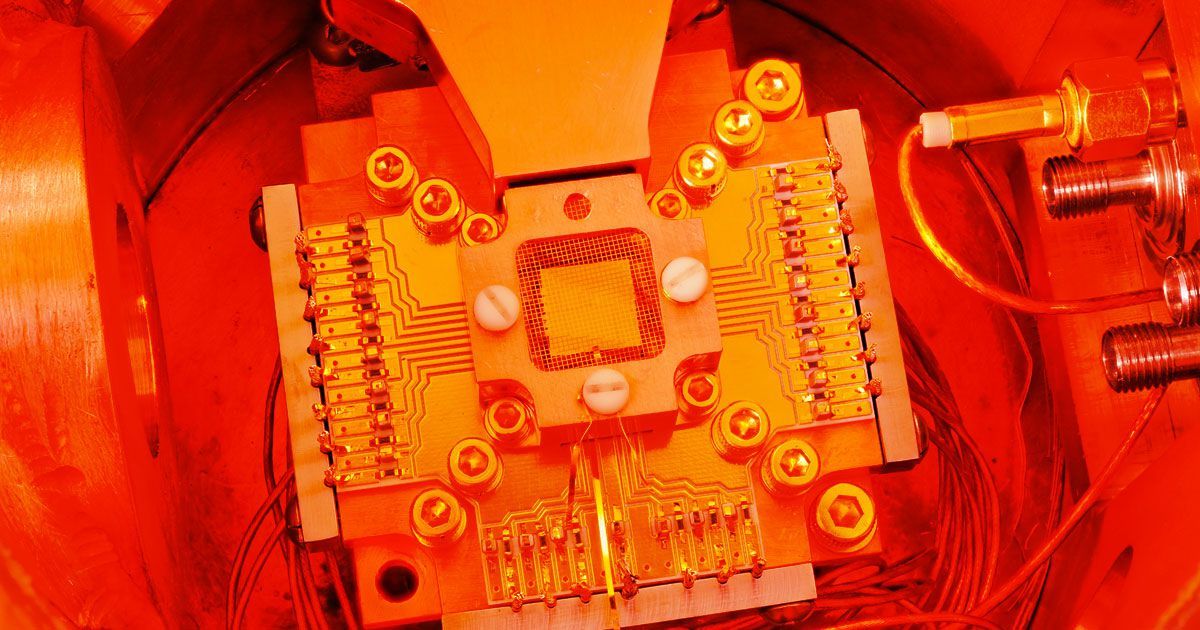

President Trump has signed a $1.2 billion law to boost US quantum tech

This new law was signed just as a partial US government shutdown began.

The new National Quantum Initiative Act will give America a national masterplan for advancing quantum technologies.

The news: The US president just signed into law a bill that commits the government to providing $1.2 billion to fund activities promoting quantum information science over an initial five-year period. The new law, which was signed just as a partial US government shutdown began, will provide a significant boost to research, and to efforts to develop a future quantum workforce in the country.

The background: Quantum computers leverage exotic phenomena from quantum physics to produce exponential leaps in computing power. The hope is that these machines will ultimately be able to outstrip even the most powerful classical supercomputers. Those same quantum phenomena can also be tapped to create highly secure communications networks and other advances.

This Drone Seamlessly Transitions Between Swimming and Flying

It isn’t unreasonable to think of drones as pesky technological nuisances. Our modern digital ecosystem regularly infringes on traditional notions of privacy and bombards our limited attention spans with stimuli. A swarm of drones hovering overhead seems like the physical manifestation of these intrusions and distractions. But we shouldn’t swat them away just yet. Drones still have practical utility and the potential to change industries.

An Expanding Market

The appeal of drones in the consumer market is obvious. They can capture video footage from exciting angles, serving the vanity of a population obsessed with self-documentation. Beyond that, drones also have commercial and civil government applications that include firefighting, farming, construction, deliveries, and insurance claims. According to Goldman Sachs Research, this contributes to a $100 billion market opportunity between 2016 and 2020.

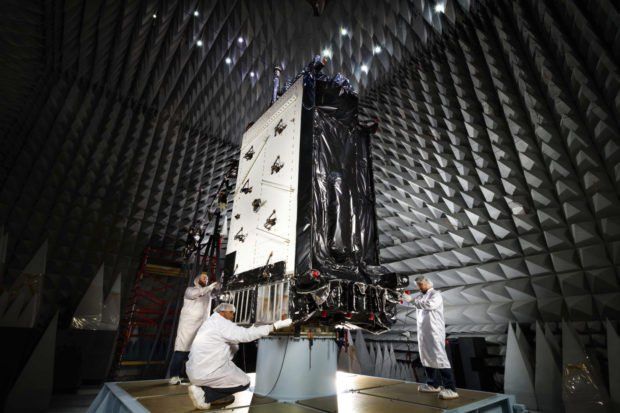

Next-generation of GPS satellites are headed to space

DENVER, United States — After months of delays, the U.S. Air Force is about to launch the first of a new generation of GPS satellites, designed to be more accurate, secure and versatile.

But some of their most highly touted features will not be fully available until 2022 or later because of problems in a companion program to develop a new ground control system for the satellites, government auditors said.

The satellite is scheduled to lift off Tuesday from Cape Canaveral, Florida, aboard a SpaceX Falcon 9 rocket. It’s the first of 32 planned GPS III satellites that will replace older ones now in orbit. Lockheed Martin is building the new satellites outside Denver.

China’s Social Ranking System Will Now Target Rule-Breaking Scientists

To tackle widespread scientific misconduct, the Chinese government has expanded its controversial social credit system to include infractions made by research scientists. The plan could scare some scientists straight—but the potential for abuse is very real.

“Researchers in China who commit scientific misconduct could soon be prevented from getting a bank loan, running a company or applying for a public-service job,” reports science writer David Cyranoski at Nature News.

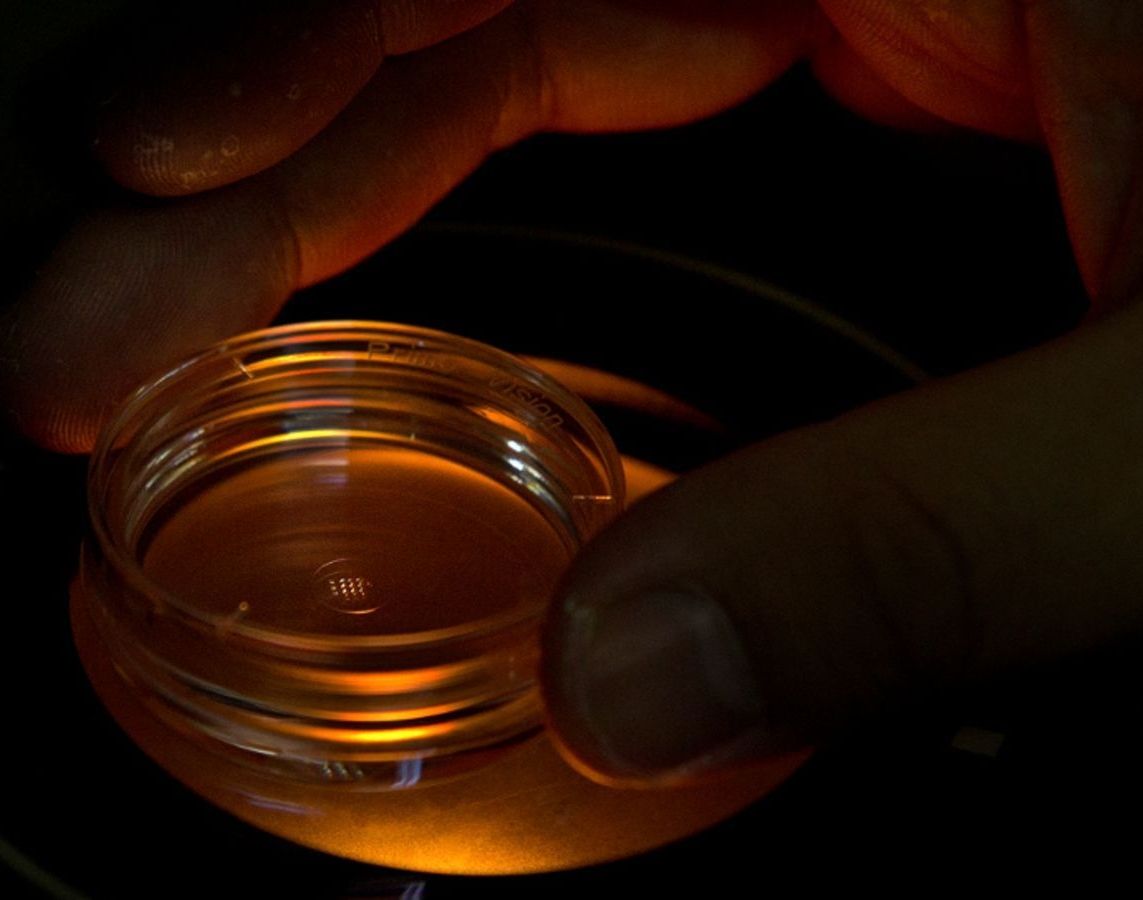

Aubrey de Grey – Clinical Trials in Five Years

In November, Dr. Aubrey de Grey, a graduate of the University of Cambridge, was in Spain to attend the Longevity World Forum in the city of Valencia, and he gave a press conference organized by his friend, MIT engineer José Luis Cordeiro.

Dr. Aubrey de Grey is the scientific director (CSO) and founder of the SENS Research Foundation. In Madrid and Valencia, Dr. de Grey reaffirmed for Tendencias21 one of his most striking statements of 2018: “In the future, there will be many different medicines to reverse aging. In five years, we will have many of them working in early clinical trials.”

The Longevity World Forum is a congress on longevity and genomics in Europe. It is heir to the first congress in Spain, the International Longevity and Cryopreservation Summit, which was held at the CSIC headquarters in Madrid in May 2017, and Dr. de Grey also participated in that event. In Valencia, his presentation was recieved with interest, and Dr. de Grey explained to this select audience that aging will be treated as a medical problem in the near future. Rather than treating its symptoms using the infectious disease model, the root causes of aging will themselves be treated.

Google CEO Sundar Pichai Testifies Before Congress

LIVE: Google CEO Sundar Pichai testifies before Congress on the company’s data collection practices.

Microsoft president calls for government regulation of facial-recognition technology to ‘ensure that the year 2024 doesn’t look like a page from the novel 1984’

Microsoft said Thursday it was adopting a set of ethical principles for the use of its facial recognition technology, and urged the government to follow its lead with regulations barring unlawful discrimination and focusing on transparency.

In a blog post, Microsoft president Brad Smith pushed for the government, as well as tech companies, to regulate facial-recognition technology and ensure it “creates broad societal benefits while curbing the risk of abuse.”

“The facial recognition genie, so to speak, is just emerging from the bottle,” Smith said in the post. “Unless we act, we risk waking up five years from now to find that facial recognition services have spread in ways that exacerbate societal issues.”