Eleven months after sharing plans to develop and implement a new series of EV charging hubs across North America, Mercedes-Benz, with the help of ChargePoint, has opened its very first location in the US, complete with a driver lounge and powered using 100% renewable energy.

This past January, Mercedes-Benz announced plans for the new network of fast charging hubs during a press conference at CES alongside its new partner, ChargePoint.

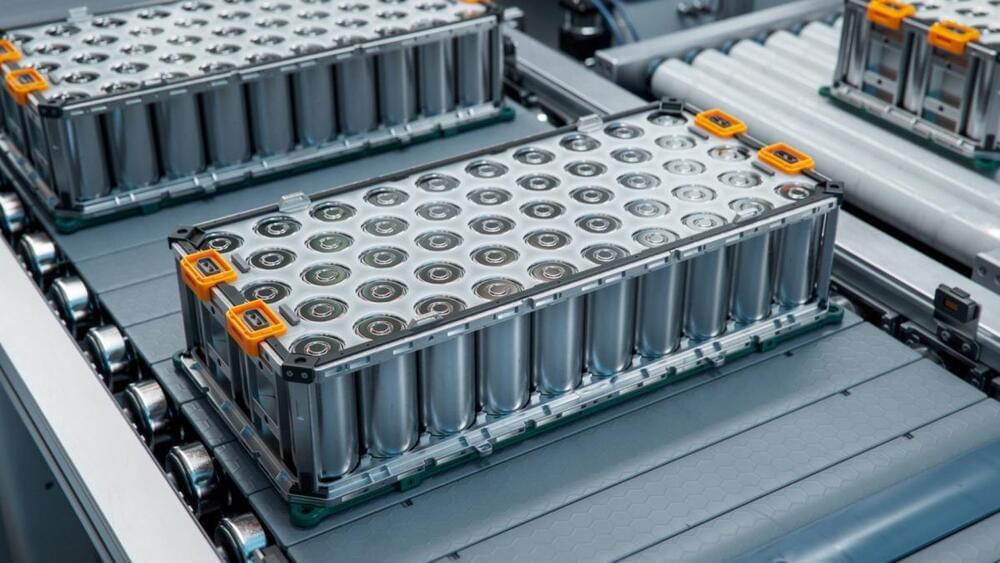

At the time, we learned that both MN8 Energy and Mercedes-Benz would finance and jointly operate the network of over 400 planned charging hubs, becoming home to over 2,500 ChargePoint DC fast charging piles across the US and Canada.