This is an important post because where I live people are protesting because of over taxation because of government fraud.

New tools to oversee public sector finance and identify abuses.

Richie Etwaru is Co-founder & CEO at Mobeus. He’s also a former CTO, CDO & CIO at Fortune 500 firms in Financial Services and Healthcare.

Although generative artificial intelligence (GenAI) has been making headlines, another of today’s most tantalizing and controversial topics is the concept of artificial general intelligence (AGI). The idea of AGI —a machine with “the ability to understand, learn, and apply knowledge across a wide range of tasks,” much like a human—has captured the imaginations of scientists, entrepreneurs and science fiction writers alike. However, despite the allure of creating such a machine, a growing body of evidence suggests that AGI will never be realized.

Human intelligence is fundamentally collective and constantly evolving. As individuals, we contribute to a vast pool of knowledge that grows exponentially over time. This collective intelligence isn’t merely the sum of all human knowledge but a complex, interconnected web of ideas, insights and innovations that continuously build upon one another. I’m deliberately excluding human instincts from the dialogue, as this requires another article.

OpenAI has acquired Rockset, which builds tools to drive real-time search and data analytics.

In a post on its official blog, OpenAI said that it would integrate Rockset’s technology to “power [its] infrastructure across products.” Members of Rockset’s team will join OpenAI, and Rockset’s existing customers will be transitioned off of Rockset’s platform “gradually.”

The financial terms weren’t disclosed.

McDonald’s (MCD) will put an end to its AI drive-thru partnership with IBM (IBM) in late July as many customer complaints over botched orders began to mount. The fast-food chain does have plans to continue implementing AI into its business model down the line.

The Morning Brief Anchors Brad Smith and Seana Smith break down the latest developments for McDonald’s and what it means for the company moving forward.

About Yahoo Finance:

Yahoo Finance provides free stock ticker data, up-to-date news, portfolio management resources, comprehensive market data, advanced tools, and more information to help you manage your financial life.

- Get the latest news and data at finance.yahoo.com.

- Download the Yahoo Finance app on Apple (https://apple.co/3Rten0R) or Android (https://bit.ly/3t8UnXO)

Watch June’s edition of Inside SingularityNET, featuring exciting news and insightful updates on our AGI R\&D, decentralized AI platform development, progressive decentralization, and broader ecosystem developments.

00:00 — Intro | AI Twin — Dr. Ben Goertzel.

00:48 — Dr. Matt Iklé | CSO — SingularityNET

04:09 — Sergey Shalyapin | CTO — SingularityNET

08:07 — Vita Potapova | Hyperon Project Manager — SingularityNET

13:19 — Alex Blagirev | SIO — SingularityNET

19:10 — Haley Lowy | Marketing Lead — SingularityNET

24:57 — Jan Horlings | CEO — Deep Funding.

31:23 — Esther Galfalvi | Decentralization Program Lead — SingularityNET

34:11 — Peter Elfrink | Community Lead — SingularityNET

35:52 — Stacey Engle | CEO — Twin Protocol.

39:45 — Jennifer Bourke | Marketing and Community Lead — NuNet.

45:02 — Jerry Hall | Marketing Lead — HyperCycle.

47:21 — Patrik Gudev l CEO — Jam Galaxy.

52:23 — Robin Spottiswoode l CTO — Jam Galaxy.

54:40 — Rebekah Pennington | Partnerships and Community — Yaya Labs.

56:03 — Kennedy Schaal | CEO — Rejuve. BIO

#AI #DecentralizedAI #AGI

MeTTa website: https://metta-lang.dev/

Decentralization website: http://decentralizing.singularitynet.io.

Artificial Superintelligence Alliance: https://superintelligence.io/

Rejuve. Bio Crowdsale: http://bit.ly/rjvbcrowdfund.

Disclaimer: Videos published by SingularityNET are meant for informational purposes only and are not intended to serve as a recommendation to buy or sell any security in a self-directed account and are not an offer or sale of a security. Any investment is not directly managed by SingularityNET or Rejuve. Bio. All investments involve risk, and the past performance of a security or financial product does not guarantee future results or returns. Potential investors should seek professional advice and carefully review all documentation before making any investment decisions.

SingularityNET was founded by Dr. Ben Goertzel with the mission of creating a decentralized, democratic, inclusive, and beneficial Artificial General Intelligence (AGI). An AGI is not dependent on any central entity, is open to anyone, and is not restricted to the narrow goals of a single corporation or even a single country.

Enel Green Power Australia has announced that it has secured project financing for a $190 million solar and battery hybrid project it plans to build in western NSW.

The Quorn Park hybrid project will combine a 98 MW (dc) solar farm with a 20 MW, 40 MWh battery that will be built around 10kms north west of Parkes. Construction will commence within the next few months and it will be operational in 2026.

The new hybrid is one of the first to be announced since new rules were introduced that allow wind or solar farms to be truly “paired” with a battery storage facility, rather than operating and dispatching as separate units. This may impose some restrictions on operations, but can save on connection and other costs.

A connection between time-varying networks and transport theory opens prospects for developing predictive equations of motion for networks.

Many real-world networks change over time. Think, for example, of social interactions, gene activation in a cell, or strategy making in financial markets, where connections and disconnections occur all the time. Understanding and anticipating these microscopic kinetics is an overarching goal of network science, not least because it could enable the early detection and prevention of natural and human-made disasters. A team led by Fragkiskos Papadopoulos of Cyprus University of Technology has gained groundbreaking insights into this problem by recasting the discrete dynamics of a network as a continuous time series [1] (Fig. 1). In doing so, the researchers have discovered that if the breaking and forming of links are represented as a particle moving in a suitable geometric space, then its motion is subdiffusive—that is, slower than it would be if it diffused normally.

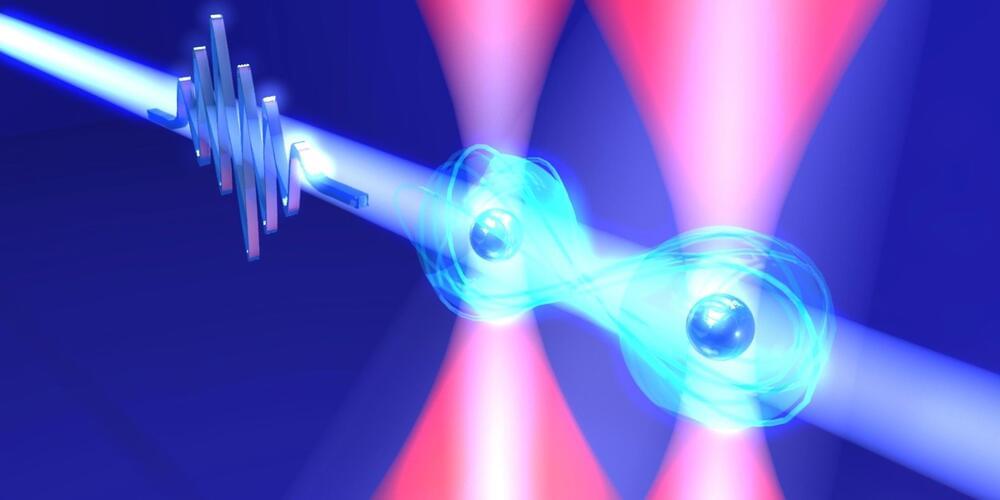

The Institute for Molecular Science has launched a Commercialization Preparatory Platform, in collaboration with 10 industry partners, to accelerate the development of “cold (neutral) atom” quantum computers.

Institute for Molecular Science (IMS), National Institutes of Natural Sciences, has established a “Commercialization Preparatory Platform (PF)” to accelerate the development of novel quantum computers, based on the achievement of a research group led by Prof. Kenji Ohmori. The launch of the PF was made possible by collaboration with 10 industry partners, including companies and financial institutions.

The 10 partners that joined the PF include (listed alphabetically): blueqat Inc., Development Bank of Japan Inc., Fujitsu Limited, Groovenauts, Inc., Hamamatsu Photonics K.K., Hitachi, Ltd., and NEC Corporation.

Researchers in the Netherlands are developing ‘virtually painless’ injections without needles in what they hope is a breakthrough that will ease fear and encourage vaccinations.

#News #Reuters #BubbleGun #NeedleFree #Vaccine.

Subscribe: http://smarturl.it/reuterssubscribe.

Reuters brings you the latest business, finance and breaking news video from around the globe. Our reputation for accuracy and impartiality is unparalleled.

Get the latest news on: http://reuters.com/

Follow Reuters on Facebook: / reuters.

Follow Reuters on Twitter: / reuters.

Follow Reuters on Instagram: https://www.instagram.com/reuters/?hl=en