Really the global debt and inflation causes the global financial crisis in price values.

The IMF warned of the risks posed by unsustainable public debt levels.

Although UBTech is leaving 10% of work for humans in management, other AI tech is being specifically developed for that niche: OpenAI’s new framework, Swarm, allows AI agents to collaborate and independently execute complex tasks, potentially boosting business efficiency.

Artificial intelligence agents are everywhere, quietly reshaping industries and automating tasks we didn’t think possible a few years ago. Unlike basic automation, these AI agents can handle complex jobs, think independently and learn from their environment. The result? Healthcare, finance and logistics businesses are seeing rapid gains in efficiency — and, in some cases, doing away with manual work altogether.

What are AI agents exactly? They’re software programs that carry out specific tasks without constant supervision. Whether handling customer requests, diagnosing medical conditions or predicting market trends, AI agents are versatile workhorses. Instead of waiting for humans to input every command, these agents operate autonomously, reacting to real-time data and adjusting their actions accordingly.

Microsoft recently unveiled new AI tools allowing healthcare organizations to build customized AI agents for appointment scheduling, clinical trial matching, and patient triage. These agents are designed to streamline workflows and improve efficiency, helping healthcare providers manage workloads and enhance patient care.

If it were up to Larry Ellison, the exorbitantly rich cofounder of software outfit Oracle, all of us will soon be smiling for the camera — constantly. Not for a cheery photograph, but to appease our super-invasive, if not totally omnipresent, algorithmic overseers.

As Business Insider reports, the tech centibillionaire glibly predicts that the wonders of AI will bring about a new paradigm of supercharged surveillance, guaranteeing that the proles — excuse us, “citizens” — all behave and stay in line.

“We’re going to have supervision,” Ellison said this week at an Oracle financial analysts meeting, per BI. “Every police officer is going to be supervised at all times, and if there’s a problem, AI will report that problem and report it to the appropriate person.”

At Impactsure Technologies, we’ve helped clients of banks generate guarantees and contracts through preapproved clauses in a matter of a few seconds without the need to go through a complex process of vetting that would have otherwise taken many days. It not only enhances the customer experience but also makes it easier to manage the processes efficiently. The clients are able to manage their contracts well, manage the content, ensure appropriate vetting and scrutiny are done effectively, manage the timelines, and incorporate the electronic signing options in a seamless way.

As contract management complexities continue to increase in the banking and enterprise sectors, the adoption of GenAI emerges as strategically crucial for organizations seeking to enhance operational efficiency, mitigate risks and maintain regulatory compliance. By harnessing the power of AI-driven automation, banks and enterprises can streamline contract processes, optimize resource utilization and confidently navigate the complicated legal landscape.

A combination of GenAI, NLP and ML represents a paradigm shift in contract management, empowering banks and enterprises to easily manage the complexities of the modern business environment with agility and resilience. By embracing AI-driven solutions, organizations can unlock new opportunities for growth, innovation and sustainable success in an increasingly competitive and rapidly evolving environment.

82K likes, — tradedvc on October 13, 2024: Elon musk’s @spacex caught a 19 story tall rocket booster in mid air.

Credit: Shaun Maguire — X

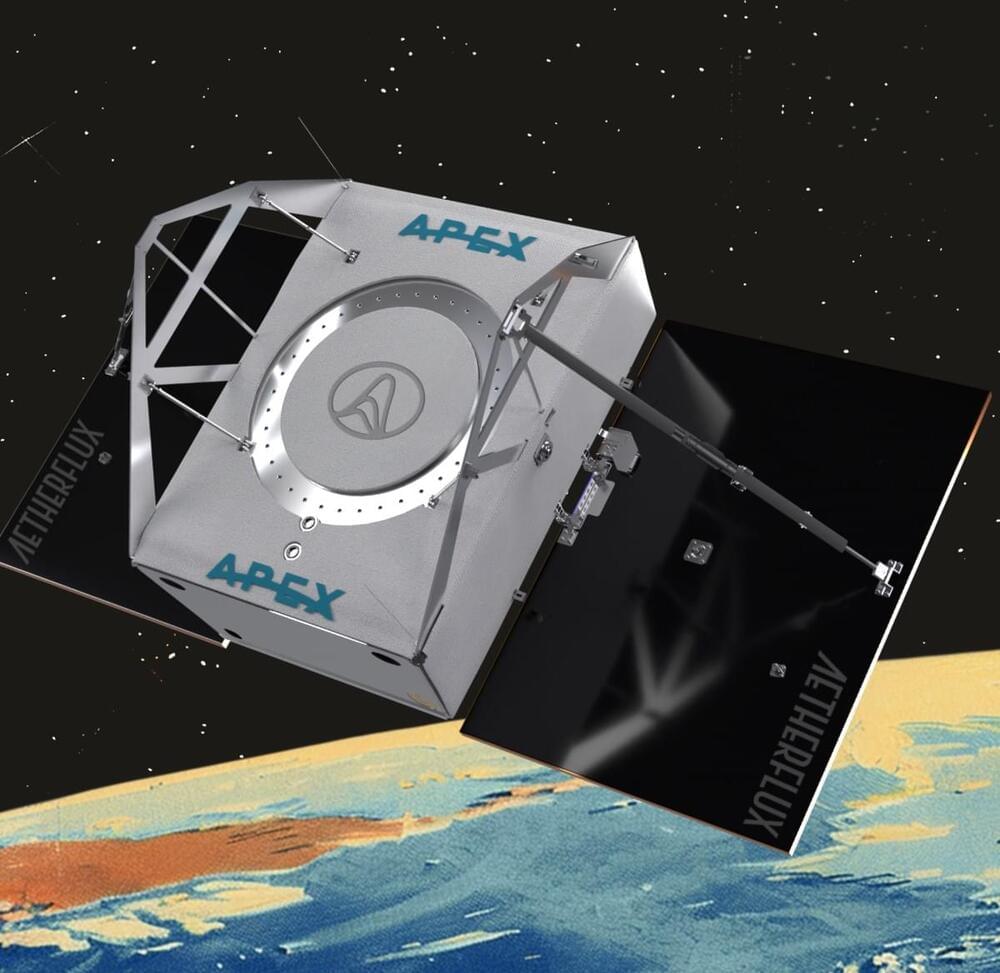

WASHINGTON — A startup led by a founder of a financial services company is taking a new approach to space-based solar power intended to be more scalable and affordable than previous concepts.

Aetherflux announced Oct. 9 plans to develop and ultimately deploy a constellation of satellites in low Earth orbit that will collect solar power and beam it to Earth using infrared lasers. The company is planning to demonstrate this technology with a small satellite launching by early 2026.

The concept is a departure from many previous concepts for space-based solar power (SBSP), which have involved large arrays in geostationary orbit. Those systems would transmit their power using microwaves to large rectennas on the ground. Such concepts have been studied for more than half a century but have not advanced beyond the drawing board.

“What the FBI uncovered in this case is essentially a new twist to old-school financial crime,” Jodi Cohen, the special agent in charge of the FBI’s Boston division, said in a statement. “What we uncovered has resulted in charges against the leadership of four cryptocurrency companies, and four crypto ‘market makers’ and their employees who are accused of spearheading a sophisticated trading scheme that allegedly bilked honest investors out of millions of dollars.”

Liu Zhou, a “market maker” working with MyTrade MM, allegedly told promoters of NexFundAI that MyTrade MM was better than its competitors because they “control the pump and dump” allowing them to “do inside trading easily.”

An FBI spokesperson told CoinDesk that there was limited trading activity on the coin but didn’t share additional information. On a Wednesday press call, Joshua Levy, the acting US attorney for the District of Massachusetts, said trading on the token was disabled, according to CoinDesk.

Billionaires are backing top scientists racing to develop tech that could reverse aging. Cellular reprogramming promises to rejuvenate the body… but how does it work, and is it safe?

00:00 – Introduction.

00:55 – The Role Of Stem Cells.

02:33 – What Is Aging?

03:24 – What Is Cellular Reprogramming?

03:56 – How The Yamanaka Factors Can Rejuvenate Cells.

05:35 – Why Scientists Want To Partially Reprogram Cells.

06:28 – How Humans Could Become More Resilient To Age-Related Diseases.

07:00 – How Johnny Huard Uses Cellular Reprogramming.

08:10 – How Cellular Reprogramming Could Shape The Future.

08:38 – Amazon’s Jeff Bezos Is Investing Billions With Altos Labs.

09:02 – How Harvard Professor David Sinclair Used Cellular Reprogramming on Mice.

10:07 – ChatGPT’s Sam Altman Launched Retro. Biosciences.

10:57 – The Risks of Cellular Reprogramming, Including Cancer.

12:56 – How the Tech World Is Investing In Biotech.

13:50 – Credits.

MORE BUSINESS INSIDER EXPLAINS VIDEOS:

How Food Giants Are Jumping On The Ozempic Game With Frozen Meals | Business Insider Explains.

• How Food Giants Are Jumping On The Oz…

Here’s What Would Happen If We Raised Minimum Wage | Business Insider Explains | Business Insider.

• Here’s What Would Happen If We Raised…

The Rivalry Between Tech Billionaires Bill Gates And Steve Jobs | Business Insider Explains.

• The Rivalry Between Tech Billionaires…

#aging #health #businessinsider.

Business Insider tells you all you need to know about business, finance, tech, retail, and more.

Visit our homepage for the top stories of the day: https://www.businessinsider.com.