In today’s AI news, OpenAI is announcing a new AI Agent designed to help people who do intensive knowledge work in areas like finance, science, policy, and engineering and need thorough, precise, and reliable research. It could also be useful for anyone making major purchases.

In what most would consider a halcyon time for AI, an anachronistic source has just added their two cents to the ethos around the AI revolution. The Vatican released a significant broadside addressing the potential and risks of AI in a new high-tech world. It’s a very interesting look at these new technologies, with a focus on human worth and human dignity.

In other advances, the one-person micro-enterprise is far from a novel concept. Cheap on-demand AI compute, remote collaboration, payment processing APIs, social media, and e-commerce marketplaces have all made it easier to “go it alone” as an entrepreneur. But what about scaling that business into something meatier — a one-person Unicorn.

And, this morning, Brussels announced plans to develop an open source AI model of its own, with $56 million in funding to do it. The investment will fund top researchers from a handful of companies and universities across EU countries as they develop a large language model that can work with the trading bloc’s 30 languages.

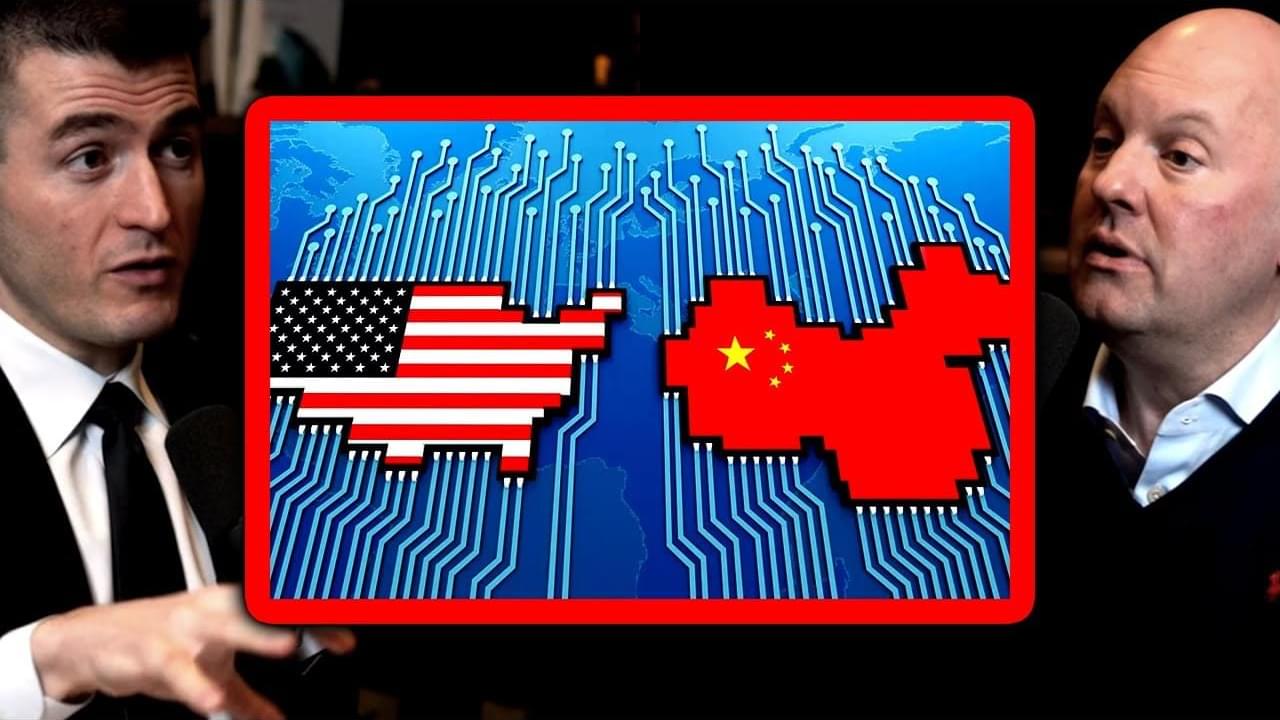

In videos, Lex Fridman speaks with Dylan Patel, Founder of SemiAnalysis, a semiconductor research and analysis company, and Nathan Lambert, a research scientist at Allen Institute for AI (Ai2) and author of an AI blog called Interconnects. They all discuss DeepSeek, China, OpenAI, NVIDIA, xAI, TSMC, Stargate, and AI Megaclusters.

Then we tune into the Big Technology podcast to hear how companies are actually deploying AI agents and what it takes to move beyond proof of concepts to real deployment. Antoine Shagoury, Chief Technology Officer of Kyndryl, an IBM spinoff, joins Alex Kantrowitz show to discuss the real-world implementation of AI in enterprise environments.

And, we take a tour of a fully automated e-commerce warehouse run by AI robots. Brightpick Autopicker is the only autonomous mobile robot (AMR) in the world that robotically picks and consolidates orders directly in the warehouse aisles, like a human with a cart.