Attackers exploit Milesight router flaw to send smishing SMS in Europe, targeting banks and telecoms.

A massive phishing campaign targeted GitHub users with cryptocurrency drainers, delivered via fake invitations to the Y Combinator (YC) W2026 program.

Y Combinator is a startup accelerator that funds and mentors projects in their early stages, and connects founders with a network of alumni and venture capital firms.

The attacker abused GitHub’s notification system to deliver the fraudulent messages, by creating issues across multiple repositories and tagging targeted users.

One often-repeated example illustrates the mind-boggling potential of quantum computing: A machine with 300 quantum bits could simultaneously store more information than the number of particles in the known universe.

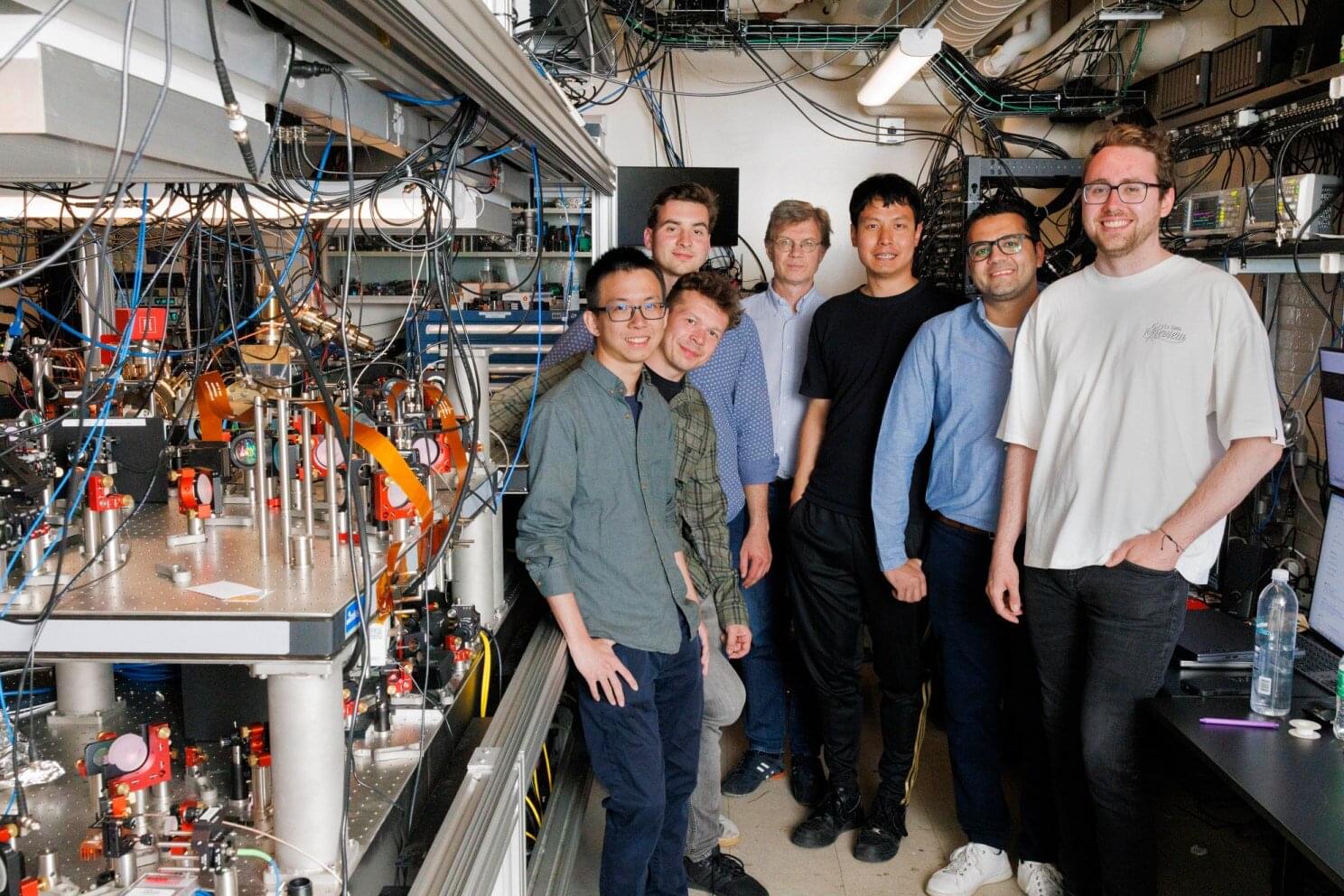

Now process this: Harvard scientists just unveiled a system that was 10 times bigger and the first quantum machine able to operate continuously without restarting.

In a paper published in the journal Nature, the team demonstrated a system of more than 3,000 quantum bits (or qubits) that could run for more than two hours, surmounting a series of technical challenges and representing a significant step toward building the super computers, which could revolutionize science, medicine, finance, and other fields.

Several artificial intelligence models are now advanced enough to pass the three-part chartered financial analyst exam, even the most difficult Level III test.

Previous research, particularly from two years ago, had found AI could clear Levels I and II of the exam, but it struggled with Level III, due to the essay questions.

The new study was developed by researchers from New York University Stern School of Business and Goodfin, an AI-powered wealth-management platform.

For humans to pass the prestigious, three-part chartered financial analyst exam, it typically takes around 1,000 hours of studying over the course of several years. New research found that the technology underpinning a slew of artificial intelligence models is now advanced enough to pass even the most difficult – Level III – mock exams in a matter of minutes.

The new study – developed by researchers from New York University Stern School of Business and GoodFin, an AI-powered wealth management platform – evaluated 23 large language models on their ability to answer multiple choice and essay questions on mock CFA Level III exams. They found frontier reasoning models, including o4-mini, Gemini 2.5 Pro and Claude Opus, were able to use “chain-of-thought prompting” to successfully pass.

Previous research, particularly from two years ago, had found artificial intelligence could clear Levels I and II of the exam, but it struggled with Level III, due to the essay questions. However, the technology has evolved so rapidly that the researchers wanted to know whether the models could handle, “specialized, high-stakes analytical reasoning required for professional financial decision-making.” The third CFA exam is primarily focused on portfolio management and wealth planning.

Tesla’s upcoming robo-taxi milestone of deploying 2,000 vehicles is expected to significantly boost its margins and potentially double or triple its free cash flow, marking a critical point in the company’s expansion and growth ##

## Questions to inspire discussion.

Tesla’s Robo Taxi Strategy.

🚕 Q: What is Tesla’s approach to deploying robo taxis across the US? A: Tesla plans to seed robo taxis across multiple cities nationwide, rather than focusing on a single market, to demonstrate benefits to regional regulators, define drop-off and pickup zones, and establish presence before scaling up.

🏙️ Q: Which cities are part of Tesla’s initial robo taxi expansion plans? A: Tesla’s robo taxi expansion includes Austin, Bay Area, Nevada, Arizona, Florida, and other states, with Austin and Bay Area currently offering invite-only services.

Financial Impact and Pricing.

Hi everybody. I’m writing to you because we are reaching an important moment in our reproduction of Harold Katcher’s seminal study of rats rejuvenation, in which we are only 9 months from starting the injections but we raised 71% of the total cost of the experiment. We already published the article of our 2024 experiment in a peer-reviewed journal (https://journals.tmkarpinski.com/index.php/ejbr/article/view/772), in which we injected the Pig Plasma Extracellular Particles (PPEPs) in young rats to assess a potential acute immunogenicity or toxicity — without any negative effect observed. Nina Torres Zanvettor (cofounder of ICR together with me) and I were interviewed some weeks ago by Eleanor Sheekey in her YouTube channel (https://youtu.be/Q-lS1UMHG1o?si=ImDWycjM8r8-KpyF), as we are trying to spread the word about the experiment and the crowdfunding. We are making the experiment in collaboration with Unicamp university and Dr. Marcelo Mori, a world-class aging scientist. The rats are already aging in the university facility and we are preparing the epigenetic age measurements with Horvath’s foundation (Clock Foundation), but we still have to raise 29% (US$21,000) of the total cost (US$75,000).

We will publish everything (methods, materials and results) immediately, but we need the help of the community too, as we will give back all the information for the community. Could you help us to fund the study? Any amount is important. The link to make a donation is https://www.rejuvenescimento.org/donation. I don’t even consider it precisely a “donation”, but a financial collaboration, as the “donor” would be able to use the information, and maybe they can also use the rejuvenation technology that some day would arise from this research. By the way, if we manage to rejuvenate the rats, we will then try to keep them young as long as we can, in a longevity experiment. Also, if we rejuvenate the rats, we will carry out a safety experiment in a Good Laboratory Practices facility here in Brazil that would allow regulatory approval to try the therapy in human patients who don’t have any other alternative to be kept alive — we expect to be able to carry out those human trials in 2028. So we intend to go all the way to the clinic, if we confirm Katcher’s results.

Slot DANA merupakan bentuk kerja sama situs slot online yang selalu menghadirkan keuntungan besar dalam setiap permainan slot gacor deposit QRIS dana pulsa 10K terbaru bonus scatter hitam.

Cybersecurity researchers have tied a fresh round of cyber attacks targeting financial services to the notorious cybercrime group known as Scattered Spider, casting doubt on their claims of going “dark.”

Threat intelligence firm ReliaQuest said it has observed indications that the threat actor has shifted their focus to the financial sector. This is supported by an increase in lookalike domains potentially linked to the group that are geared towards the industry vertical, as well as a recently identified targeted intrusion against an unnamed U.S. banking organization.

“Scattered Spider gained initial access by socially engineering an executive’s account and resetting their password via Azure Active Directory Self-Service Password Management,” the company said.

FinWise Bank is warning on behalf of corporate customers that it suffered a data breach after a former employee accessed sensitive files after the end of their employment.

“On May 31, 2024, FinWise experienced a data security incident involving a former employee who accessed FinWise data after the end of their employment,” reads a data breach notification sent by FinWise on behalf of American First Finance (AFF).

American First Finance (AFF) is a company that offers consumer financing products, including installment loans and lease-to-own programs, for a diverse range of products and services. Customers use AFF to apply for and manage the loans, with the company handling the services, account setup, repayment process, and customer support.