From the billionaire VC’s hot takes: Slowing AI innovation will kill people, and universal basic income will turn us into zoo animals.

Where reliability matters, as it does in energy, resilience against cyberattacks enhances a company’s reputation. Disruptions damage that reputation.

In 2021, a ransomware attack shut down Colonial Pipeline operations for six days. Gas shortages in the eastern US, economic turmoil, and eye-catching headlines resulted. Interest in cybersecurity for critical infrastructure intensified — and many leaders seemed to learn the wrong lesson.

Energy sector leaders often take cyber vulnerabilities seriously only after a significant breach. Experiencing a loss (or watching someone else’s) makes companies tighten cybersecurity to avoid similar losses. This pattern emphasizes the loss-avoidance aspects of cybersecurity. Yet thinking of cybersecurity solely as loss avoidance misses a key value generator cybersecurity provides: trust.

Companies that get cybersecurity right earn trust. That trust matters in two ways: It supports brand or company reputation, and it allows for forward innovation.

Core inflation remains elevated in advanced economies, with economists calling for tighter monetary policies in order to improve price and financial stability for sustained economic growth. With inflation only slowly moving towards sustainable targets, investors can leverage insights into teen spending patterns, behaviors, and advancements in technology to identify broader economic and market trends.

In a recent Piper Sandler Taking Stock With Teens survey that analyzed discretionary spending patterns, fashion trends, technology, and brand and media preferences, inflation was determined to be the number two social concern among teens, pointing to initial signs of a slowdown in teen spending.

“Inflation reached its highest mindshare in terms of political and social issues, right behind the environment,” said Edward Yruma, senior research analyst.

The world’s massive human population is leveling off.

Most projections show we’ll hit peak humanity in the 21st century, as people choose to have smaller families and women gain power over their own reproduction. This is great news for the future of our species.

And yet alarms are sounding. While environmentalists have long warned of a planet with too many people, now some economists are warning of a future with too few. For example, economist Dean Spears from the University of Texas has written that an “unprecedented decline” in population will lead to a bleak future of slower economic growth and less innovation.

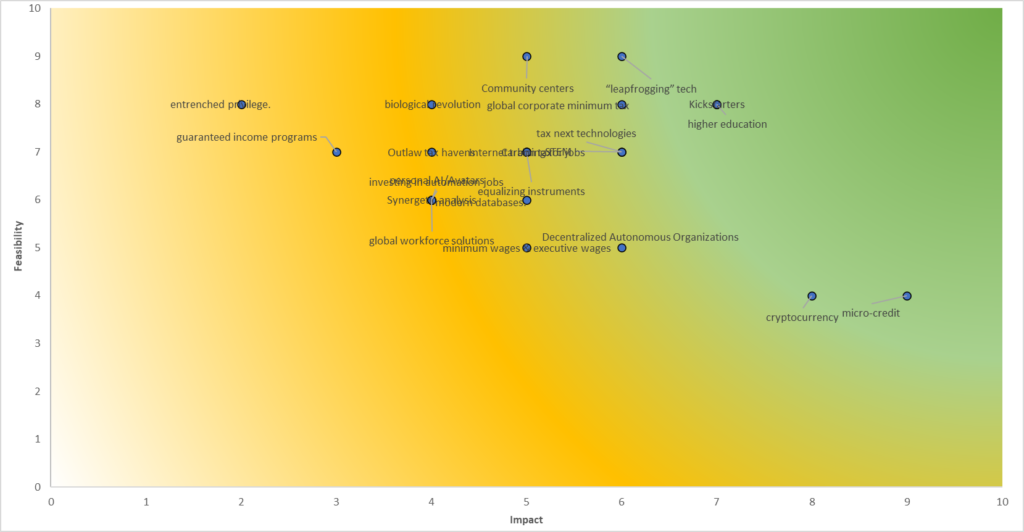

When working at the Millenium Project, a global think tank that publishes reports surrounding global problems, I decided to improve the way reports were presented by ranking the actions provided by the organization to adress the problem. I focused on the 23 actions in global challenge 7 (Rich-poor gap) and created a system focusing on two aspects: feasibility and impact.

Assigning scores from 1–10 for each of these aspects made sense as an action needs to be both implemented and impactful for it to adress the problem. By researching to assign these scores and multiplying them, I could get an overall idea of where an action would compare to another one. Below is a graph summarizing my results, followed by the details behind each ranking.

As we plunge head-on into the game-changing dynamic of general artificial intelligence, observers are weighing in on just how huge an impact it will have on global societies. Will it drive explosive economic growth as some economists project, or are such claims unrealistically optimistic?

Few question the potential for change that AI presents. But in a world of litigation, privacy concerns and ethical boundaries, will AI be able to thrive?

Two researchers from Epoch, a research group evaluating the progression of artificial intelligence and its potential impacts, decided to explore arguments for and against the likelihood that innovation ushered in by AI will lead to explosive growth comparable to the Industrial Revolution of the 18th and 19th centuries.

The 2 SOPS or 2nd Space Operations Squadron commander, Lt Col Robert Wray… More.

Of all the missions the Space Force performs daily for a grateful nation, there is none more ubiquitous and essential than GPS. Today’s soldiers and sailors depend on reliable, accurate, and secure GPS as much as they do any weapon they employ. Meanwhile, the rest of the world is just as dependent on GPS to enable basic mobility and underpins every other sector of the modern global economy. The criticality of secure global navigation and timing to both warfighting and the national economy makes it unique – we simply could not go a day without space. In so few words, GPS’ future is ground zero for the new space race.

The 2 SOPS or 2nd Space Operations Squadron commander, Lt Col Robert Wray reminds me that “14 of the 16 critical infrastructures designated by the Department of Homeland Security rely on 24/7 GPS to operate for the country.” But the newest GPS satellites in use today are the same school bus sized ones Gen. Hyten has lamented are, “juicy targets” for our adversaries – marvels of modern engineering, yes, but no longer sufficient to meet modern needs.

Alternatives to GPS, categorically called Global Navigation Satellite Systems (GNSS), are growing rapidly because the old GPS system we rely on offers neither the precision nor security needed in an increasingly autonomous, rule based, and precisely timed world. What exactly needs to change then, aside from smaller, faster satellites as technology becomes more efficient and readily available? There are major challenges with the current system that today’s Guardians are already working on. But to usher in a new and improved GPS capability, the government needs to adopt artificial intelligence and machine learning to enhance squadron operations, work to better integrate commercial software into current GPS constellation to get the most out of current capabilities, and continue to invest in the next generation of leaders. Private capital has begun aligning with companies aiming to solve these future deficiencies, in a race against pacing threats like China and Russia.

MDPI uses a print-on-demand service. Your book will be printed and delivered directly from one of three print stations, allowing you to profit from economic shipping to any country in the world. Generally, we use Premium shipping with an estimated delivery time of 7–12 business days. P.O. Boxes cannot be used as a Ship-To Address.

Please note that shipping time does not include the time for placing and processing the order or printing. For this, an additional turnaround time of 10 working days should be expected.

And that is just health care. In 1940, there were 42 workers per beneficiary of Social Security. Today, there are only 2.8 workers per beneficiary, and that number is getting smaller. We are going broke, and the young men who will play a huge role in determining our nation’s future are going there with AI girlfriends in their pockets.

While the concept of an AI girlfriend may seem like a joke, it really isn’t that funny. It is enabling a generation of lonely men to stay lonely and childless, which will have devastating effects on the U.S. economy in less than a decade.