The question was asked of me as columnist at Quora.com: Will governments eventually ‘approve’ of cryptocurrency? First let’s agree on terminology…

- By “approve”, I assume that you are asking if governments will adopt or at least tolerate the use of crypto as legal tender in commerce. That is, not just as a payment instrument, but as the money itself—perhaps even accepting tax payments in cryptocurrency.

- The word “cryptocurrency” is sometimes applied to altcoins and even to ICOs. These are not the same. Many altcoins meet the criteria of the next paragraph, but none of the ICOs measure up (ICOs are scams). I assume that your question applies to Bitcoin or to a fair and transparent altcoin forked from the original code, such as Bitcoin Cash or Litecoin.

A blockchain-based cryptocurrency that is open source, permissionless, capped, fast, frictionless, with a transparent history—and without proprietary or licensing restrictions is good for everyone. It is good for consumers; good for business; and it is even good for government.

Of course, politicians around the world are not quick to realize this. It will take years of experience, education, and policy experimentation.

Many pundits and analysts have the impression that shifting to cryptocurrency—not just as a payment instrument, but as the money itself—will never be supported by national governments. A popular misconception suggests that a cryptocurrency based economy has these undesirable traits:

- it is deflationary (i.e. that inflation is necessary to promote spending or to accommodate a growing economy)

- it facilitates crime

- it interferes with tax collection

- It interferes with national sovereignty, which leads to “world government”

- It is not backed by anything, or at least not by anything substantial, like the Dollar, Euro, Pound, Yuan or Yen

- it interferes with a government’s ability to control its own monetary policy

Over time, perceptions will change, because only the last entry is true. Adoption of cryptocurrency puts trust into math rather than the whims of transient politicians. It helps governments avoid the trap of hoisting debt on future generations or making promises to creditors that they cannot keep—Yet, it does not lead to the maladies on this list.

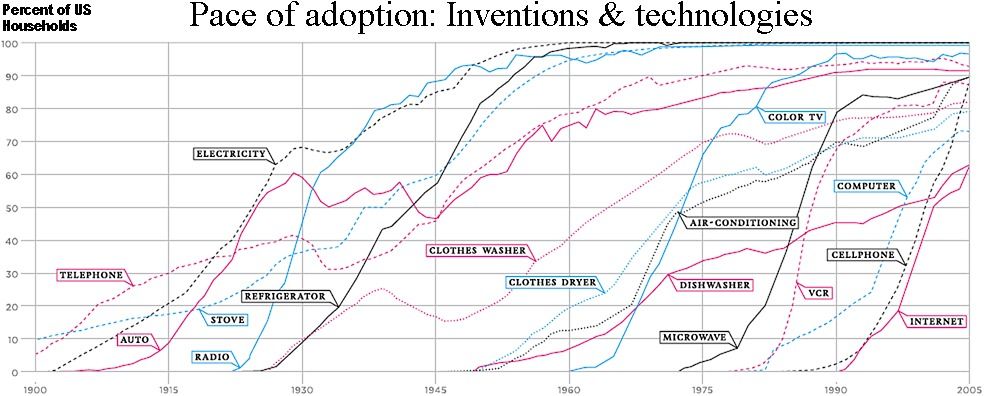

But, what about that last item? Does an open source currency cause a nation to lose control over its own monetary policy? Yes! But it is not bad! Crypto cannot be printed, gamed or manipulated. Despite perception, it is remarkably resistant to loss or theft. Early hacks and fiascos were enabled by a lack of standards, tools and education. As with any new technology—especially one that changes practices or institutions—adoption of radical processes goes hand-in-hand with gradual understanding and acceptance of benefits.

How Does Crypto Help Governments?

Adopting/accepting a national (or international) cryptocurrency is a terrific way for governments to earn the respect and trust of citizens, businesses, consumers and especially creditors. There is no more reason for governments to control their money supply than there is for them to control communication networks, space travel or package delivery services.

You may not agree that cryptocurrency is good for government, and so I expand on the topic here. But your question doesn’t ask if it is good, it asks if governments are likely to approve.

Yes. Eventually…

First, a few forward thinking countries like Iceland, Japan or UAE will spearhead adoption of a true, permissionless cryptocurrency (or at least recognize it as legal tender) . Later, ‘stress-economies’ will join the party: These are countries that need to control either rampant inflation, a reluctance to tax citizens, treasury mismanagement or massive international debt. A solution to these problems requires restoration of public trust. I wouldn’t be surprised to see Greece, Zimbabwe, Venezuela or Argentina in the mix.*

Eventually, G7 countries will tread into a growing ocean. Not now; but in 5 or 8 years. The conditions are not yet right. It requires further vetting by early adopters, continued development, education and then popular consumer adoption. But all of these things are inevitable. Eventually, governments will recognize that a capped, trusted, transparent, math-based money is far better for all stakeholders than money based on intrinsic value, promise-of-redemption or force.

* We are not discussing countries that plan to create their own cryptocurrency. None of these plans involve a coin that is open source, permissionless, decentralized and capped. They are simply replacing paper with a national debit card. But it is not crypto.

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the New Money Systems board of Lifeboat Foundation. Book a presentation or consulting engagement.