Germany’s supreme court recently ruled that an old policy that suspended payments if individuals didn’t actively search for work was unconstitutional.

That might explain things…

There may soon be serious financial and legal ramifications to the proliferation of deepfake technology. The Wall Street Journal reported last week that a UK energy company’s chief executive was tricked into wiring €200,000 to a Hungarian supplier because he believed his boss was instructing him to do so. Instead, it was a thief using deepfake tech.

Let nobody tell you that the second decade of the 21st century has been a bad time. We are living through the greatest improvement in human living standards in history. Extreme poverty has fallen below 10 percent of the world’s population for the first time. It was 60 percent when I was born. Global inequality has been plunging as Africa and Asia experience faster economic growth than Europe and North America; child mortality has fallen to record low levels; famine virtually went extinct; malaria, polio and heart disease are all in decline.

Little of this made the news, because good news is no news. But I’ve been watching it all closely. Ever since I wrote The Rational Optimist in 2010, I’ve been faced with ‘what about…’ questions: what about the great recession, the euro crisis, Syria, Ukraine, Donald Trump? How can I possibly say that things are getting better, given all that? The answer is: because bad things happen while the world still gets better. Yet get better it does, and it has done so over the course of this decade at a rate that has astonished even starry-eyed me.

Perhaps one of the least fashionable predictions I made nine years ago was that ‘the ecological footprint of human activity is probably shrinking’ and ‘we are getting more sustainable, not less, in the way we use the planet’. That is to say: our population and economy would grow, but we’d learn how to reduce what we take from the planet. And so it has proved. An MIT scientist, Andrew McAfee, recently documented this in a book called More from Less, showing how some nations are beginning to use less stuff: less metal, less water, less land. Not just in proportion to productivity: less stuff overall.

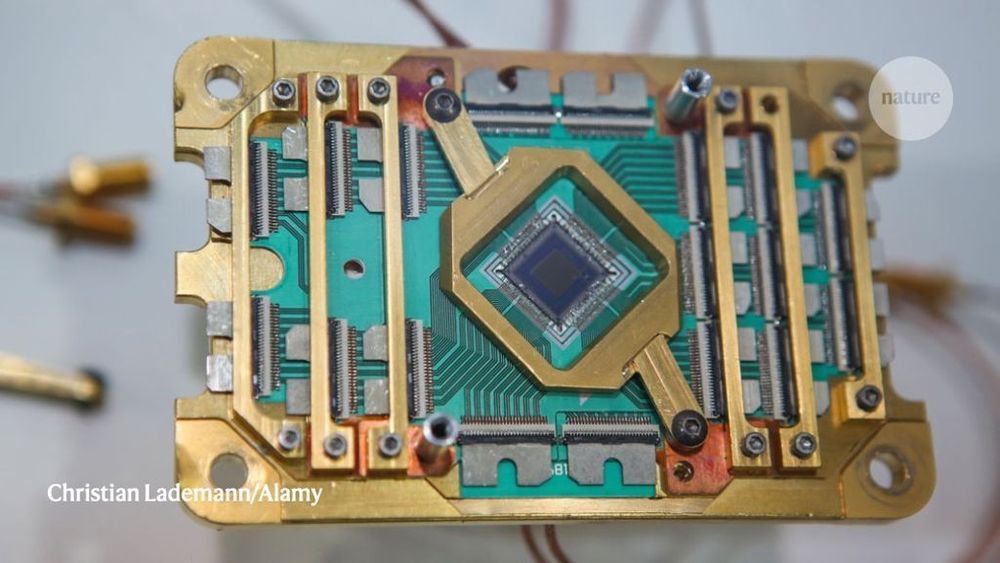

The government will inject around 50 billion roubles (US$790 million) over the next 5 years into basic and applied quantum research carried out at leading Russian laboratories, the country’s deputy prime minister, Maxim Akimov, announced on 6 December at a technology forum in Sochi. The windfall is part of a 258-billion-rouble programme for research and development in digital technologies, which the Kremlin has deemed vital for modernizing and diversifying the Russian economy.

National initiative aims to develop practical technologies that could mine databases and create ultra-secure communication networks.

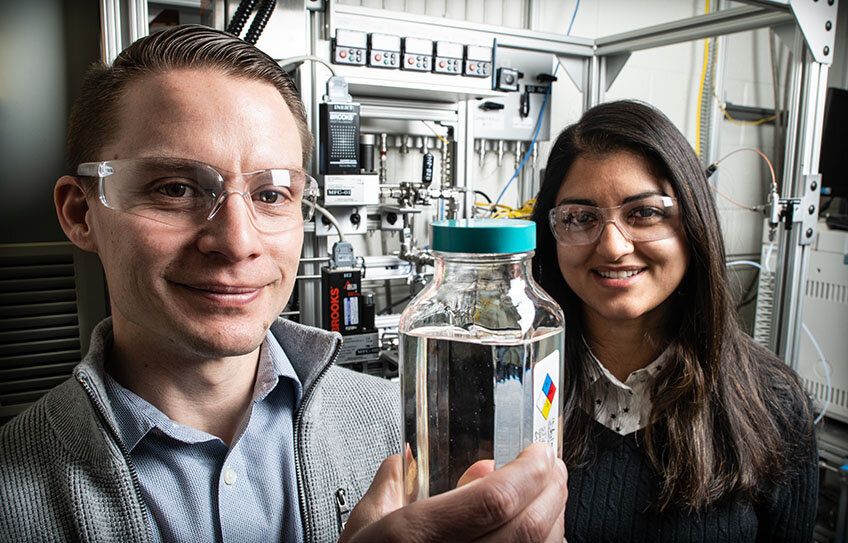

The NREL scientists, along with colleagues at Yale University, Argonne National Laboratory, and Oak Ridge National Laboratory, are part of the Department of Energy’s Co-Optimization of Fuels & Engines (Co-Optima) initiative. Co-Optima’s research focuses on improving fuel economy and vehicle performance while also reducing emissions.

“If you look at biomass, 30% of it is oxygen,” said Derek Vardon, a senior research engineer at NREL and corresponding author of a new paper detailing the Co-Optima research project. “If we can figure out clever ways to keep it around and tailor how it’s incorporated in the fuel, you can get a lot more out of biomass and improve the performance of diesel fuel.” The molecule, 4-butoxyheptane, contains oxygen while conventional petroleum-derived diesel fuel is comprised of hydrocarbons. The presence of oxygen significantly reduces the intrinsic sooting tendency of the fuel upon burning.

The paper, “Performance-advantaged ether diesel bioblendstock production by a priori design,” appears in the journal Proceedings of the National Academy of Sciences. Vardon’s co-authors from NREL are Nabila Huq as the first author, with co-authors Xiangchen Huo, Glenn Hafenstine, Stephen Tifft, Jim Stunkel, Earl Christensen, Gina Fioroni, Lisa Fouts, Robert McCormick, Matthew Wiatrowski, Mary Biddy, Teresa Alleman, Peter St. John, and Seonah Kim.

Nextbigfuture has looked at the likely future of SpaceX up to 2030 and now recaps the view to 2030 and extends the view to 2050.

The Mars aspect of SpaceX future impact will be less important than how 25X the speed of sound travel transforms our world and has huge economic impacts.

Geoffrey West and the Sante Fe Institute performed a study of cities and found that if the size of a city doubles, then, on average, wages, wealth, the number of patents, and the number of educational and research institutions all increase by approximately the same degree, about 15 percent. They refer to this systematic phenomenon as “superlinear scaling”: produces, and consumes, whether it’s goods, resources, or ideas. Reusable rockets could create a global city of 9–10 billion people by 2050. This would be a “city” with ten-doublings over a ten million person city. This would be a 150% boost in per-person income.

While these “moonshots” are still some years away, there are viable applications of 5G in the near term. South Korea launched the world’s first commercial 5G network in April and has seen data transfer rates rise from 50 megabits per second to over 700 Mbps. This enables the delivery of augmented reality, virtual reality and AI-enhanced real-time sports content.

With the arrival of next-generation mobile networks, new services like remote surgery will be suddenly feasible. More immediately, expect a boom in video traffic and augmented reality content.

Last week, the transhumanist activist Zoltan Istvan announced his candidacy for President of the United States in next year’s elections. The writer, humanitarian and outspoken advocate of radical science is no stranger to the issues surrounding Longevity, and has spoken widely on subjects including AI, genetic editing, technology policy, and futurism.

In 2016, Istvan ran as an independent presidential candidate and travelled across the United States, spreading his message from a coffin-shaped bus, known as the “Immortality Bus.” This time he’s on the ballot, running against Donald Trump as a candidate for the Republican party in next year’s primaries. Things are a bit more serious this time.

Among his key policies, Istvan includes transhumanism, universal basic income and the need to beat China in the global innovation race – an issue we addressed in our Jamie Metzl interview. We spoke to him to find out more about his views on the Longevity sector.

As jobs are automated out of existence, the division between the very wealthy and the very poor will grow — and any notion of a comfortable middle class will vanish.

That’s according to Roey Tzezana, a future studies researcher at Israel’s Tel Aviv University, according to Haaretz. That stands in contrast to the common argument that new jobs will emerge as others vanish, painting a grim picture for the workforce and global economy.

The case for creating a United States Space Force is compelling. The United States military’s ability to wage war has become increasingly reliant on satellites. Navigation, reconnaissance, and communications are all handled by space assets. The world economy has become dependent on space satellites. The Internet consists of servers throughout the world linked by satellite constellations. Knock out those satellites and commercial companies’ ability to do business becomes seriously compromised. The space version of Pearl Harbor could reduce the United States to developing-world status in a single blow.

China and Russia, the main enemies of the United States in a potential conflict, are busily developing weapons systems to destroy America’s space infrastructure. Indeed, remote jamming may well do the job without resorting to a direct strike. The potential for jamming is a reason why Pence mentioned the development of jam-proof satellites in his speech. In all, Pence proposed an investment of $8 billion in new space systems during the next five years. The money is likely to be just a down payment for creating a new military branch that would achieve President Trump’s dream of achieving American space dominance.

The idea of a United States Space Force brings science fiction visions of American military personnel doing battle against an enemy in space. Indeed, the joke that has become common on social media is that President Trump is proposing to create nothing less than Star Fleet, the organization made famous in the Star Trek franchise of movies and TV shows.