Finally some regulatory clarity. We can build something and ask the SEC if it’s going to be enforced.

No-action letters may be a way forward for crypto startups hoping to avoid securities classifications.

Finally some regulatory clarity. We can build something and ask the SEC if it’s going to be enforced.

No-action letters may be a way forward for crypto startups hoping to avoid securities classifications.

Join me for a quick review of the spikes & dips in the Bitcoin exchange rate. This time, it’s all about one very simple chart. [continue below graphic]…

The chart below shows a history of BTC price spikes, dips and recovery. Click to enlarge, then start at the top—and move down.

The table at right illustrates why I do not get too worked up over the plunge in the BTC exchange rate. There are no fundamental flaws in Bitcoin math or mechanisms, the market need for benefits conveyed by Bitcoin is terrific, and popular arguments against Bitcoin are severely flawed. Skeptics and Critics typically say this:

The table at right illustrates why I do not get too worked up over the plunge in the BTC exchange rate. There are no fundamental flaws in Bitcoin math or mechanisms, the market need for benefits conveyed by Bitcoin is terrific, and popular arguments against Bitcoin are severely flawed. Skeptics and Critics typically say this:

“Even if blockchain currencies are beneficial and inevitable, Bitcoin can be displaced by another, better cryptocurrency.”

—Or—

“A viable crypto may emerge—but it will be one that is backed by a tangible asset or issued/sanctioned by government.”

These arguments are false. They are made by individuals who don’t yet fully appreciate a distributed, consensus mechanism and, especially, its relationship with trust, value, government and free markets.

What Bitcoin currently lacks is education, familiarity, standards, simple commercial tools (built upon clear analogies), definitive best practices, a widespread understanding of multisig & security, and limited recourse for certain commercial & retail transactions. But Bitcoin is still an infant, just like the early TV or the early telephone. All of these are under development—without a hint of significant obstacles. Even the messy process of democracy among the various stakeholders is heading toward harmony (miners, developers, vendors, exchanges and consumers).

Of course, I am bullish on Bitcoin, and this may color my analysis. But, I try hard to keep an open mind. There have been moments in its history where I have questioned the market need or the potential for a setback in politics, legislation, or the mechanism itself. Those doubts are in the past. Bitcoin has demonstrated the elegance and value of the blockchain—and the ability to evolve beyond the blockchain with SegWit and Lightning Network. It has achieved a fluid, robust and growing two-sided market.

No one holding assets likes to see a big price pullback. It’s natural to look at the market as if we each got in at the peak—and then tally the “losses”. But I, for one, am not glancing toward the exit. I see the future and I sleep well at night. I am comfortable participating in the Bitcoin era.

Philip Raymond co-chairs CRYPSA, hosts the Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He advises The Disruption Experience in Singapore, sits on the New Money Systems board of Lifeboat Foundation and is a top writer at Quora. Book a presentation or consulting engagement.

The reader uses the term “digital wallet” to mean a hosted wallet in which a trusted 3rd party holds the private keys, or aggregates the assets of many customers and tracks their individual ownership in their own accounting system, like a traditional bank or broker. In this case, the 3rd party is trusted to maintain security, privacy, and constant, robust user access.

It is possible that the reader may have used the term “digital wallet” to additionally refer to PC and smartphone applications, such as Bitcoin Core, Armory or Electrum. But, these are really personal and private wallets — because they are created and configured by the owner, and only the owner has the private keys. And so, we classify device wallet applications as “personal/private” along with hardware or paper wallets. Type 2: Personal Wallets are Private —but with privacy comes risk!

Wallets are personal if the private keys are generated and stored by the user, either on paper, in their PC or smart phone, on a thumbdrive, in a hardware wallet, or even uploaded to cloud storage. As long as the asset owner holds the keys and securely encrypted any uploaded file that contains the keys, the assets are accessible only with his consent.

So, which wallet class is better for securing cryptocurrency access credentials? Custodial or Personal? Which of these models best fits your needs? 2. Deciding Factor

There are few individuals for whom direct and private ownership makes sense. In fact, until this month, it did not make sense for me. I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my assets. The reasons boil down to security, forgetfulness, errors, legacy ownership and instant access. The ONLY factor that is arguably better with personal custody & control is privacy.

Due to a lack of education, standards, and definitive best practices, this option makes sense for fewer than 5% of Bitcoin owners. Take me, for example… I have been involved with Bitcoin since the first years of its existence, and have been a Bitcoin educator since shortly after Satoshi’s original bombshell. Today, I am a keynote presenter at blockchain and cryptocurrency conferences. I teach blockchain seminars, design courseware for colleges, and am co-chair of the Cryptocurrency Standards Association and partner in Blockchain Research Council.

Yet, I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my cryptocurrency.

How do I know if I am a candidate for full / private control?

Using an exchange hosted wallet service is best for most individuals. But, for some, it makes sense to maintain private, local control of blockchain assets. If all criteria in the bulleted list below applies to you, then local and private ownership might make sense. But if you fail even one criteria, then WAIT! Wait until multisig becomes uniform and ubiquitous — and wait until a larger fraction of society is comfortable with the concept and practice of managing private keys. These are gradually becoming new norms. But, it will take a few more years for the world to become comfortable with an unfamiliar concept: personal control of a decentralized asset. You are a candidate for using a personal wallet if you plan to control and secure your own private keys, and if you meet all conditions listed below. The technical criteria will not be requisite in the future—but they are necessary today, because the market currently lacks simple, standardized, widespread tools and uniform practices for safely securing, accessing and passing on these credentials to your heirs. Do all of these criteria apply to you?

2. Deciding Factor

There are few individuals for whom direct and private ownership makes sense. In fact, until this month, it did not make sense for me. I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my assets. The reasons boil down to security, forgetfulness, errors, legacy ownership and instant access. The ONLY factor that is arguably better with personal custody & control is privacy.

Due to a lack of education, standards, and definitive best practices, this option makes sense for fewer than 5% of Bitcoin owners. Take me, for example… I have been involved with Bitcoin since the first years of its existence, and have been a Bitcoin educator since shortly after Satoshi’s original bombshell. Today, I am a keynote presenter at blockchain and cryptocurrency conferences. I teach blockchain seminars, design courseware for colleges, and am co-chair of the Cryptocurrency Standards Association and partner in Blockchain Research Council.

Yet, I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my cryptocurrency.

How do I know if I am a candidate for full / private control?

Using an exchange hosted wallet service is best for most individuals. But, for some, it makes sense to maintain private, local control of blockchain assets. If all criteria in the bulleted list below applies to you, then local and private ownership might make sense. But if you fail even one criteria, then WAIT! Wait until multisig becomes uniform and ubiquitous — and wait until a larger fraction of society is comfortable with the concept and practice of managing private keys. These are gradually becoming new norms. But, it will take a few more years for the world to become comfortable with an unfamiliar concept: personal control of a decentralized asset. You are a candidate for using a personal wallet if you plan to control and secure your own private keys, and if you meet all conditions listed below. The technical criteria will not be requisite in the future—but they are necessary today, because the market currently lacks simple, standardized, widespread tools and uniform practices for safely securing, accessing and passing on these credentials to your heirs. Do all of these criteria apply to you?

Philip Raymond co-chairs CRYPSA, hosts the Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He advises The Disruption Experience in Singapore, sits on the New Money Systems board of Lifeboat Foundation and is a top writer at Quora. Book a presentation or consulting engagement.

by Eloisa Marchesoni

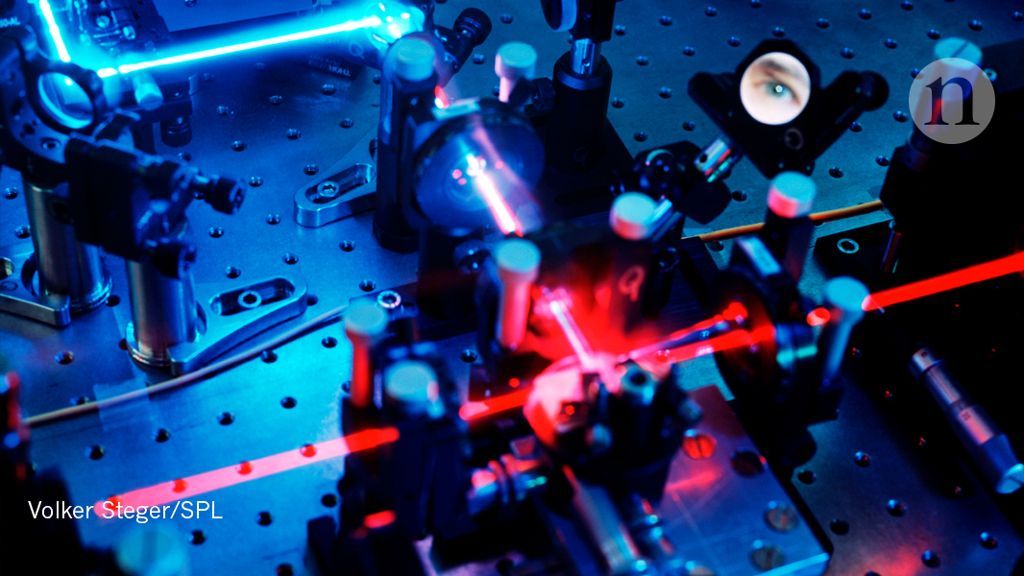

Today, I will talk about the recent creation of really intelligent machines, able to solve difficult problems, to recreate the creativity and versatility of the human mind, machines not only able to excel in a single activity but to abstract general information and find solutions that are unthinkable for us. I will not talk about blockchain, but about another revolution (less economic and more mathematical), which is all about computing: quantum computers.

Quantum computing is not really new, as we have been talking about it for a couple of decades already, but we are just now witnessing the transition from theory to realization of such technology. Quantum computers were first theorized at the beginning of the 1980s, but only in the last few years, thanks to the commitment of companies like Google and IBM, a strong impulse has been pushing the development of these machines. The quantum computer is able to use quantum particles (imagine them to be like electrons or photons) to process information. The particles act as positive or negative (i., the 0 and the 1 that we are used to see in traditional computer science) alternatively or at the same time, thus generating quantum information bits called “qubits”, which can have value either 0 or 1 or a quantum superposition of 0 and 1.

The longer-term answer is to develop and scale up the quantum communication network and, subsequently, the quantum internet. This will take major investments from governments. However, countries will benefit from the greater security offered13. For example, Canada keeps its census data secret for 92 years, a term that only quantum cryptography can assure. Government agencies could use quantum-secured blockchain platforms to protect citizens’ personal financial and health data. Countries leading major research efforts in quantum technologies, such as China, the United States and members of the European Union, will be among the early adopters. They should invest immediately in research. Blockchains should be a case study for Europe’s Quantum Key Distribution Testbed programme, for example.

Bitcoin and other cryptocurrencies will founder unless they integrate quantum technologies, warn Aleksey K. Fedorov, Evgeniy O. Kiktenko and Alexander I. Lvovsky. Bitcoin and other cryptocurrencies will founder unless they integrate quantum technologies, warn Aleksey K. Fedorov, Evgeniy O. Kiktenko and Alexander I. Lvovsky.

Update on bitcoin crash https://www.bloomberg.com/news/articles/2018-11-23/b…tocurrency https://paper.li/e-1437691924

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy.

Following recent trends in state-of-the-art developments, from cryptocurrencies and universal basic income to biohacking and the surveillance state, transhumanism has been moved into the limelight of political discourse to reshape humanity’s future.

Andrew Vladimirov, Information security specialist, biohacker and one of the original members of the Transhumanist Party UK, spoke in-depth with Sputnik about the rise of transhumanism and its implications.

Bitcoin seems largely a ‘psychological’ currency whose value oscillates mostly in response to changes in folk’s opinions rather than shifts in some real underlying store of value, imo https://bitcoinmagazine.com/articles/when-fork-forks-what-yo…-goes-war/ https://paper.li/e-1437691924

Here’s what you need to know to get up to speed.

As a quick reminder, what is Bitcoin Cash again?

Bitcoin Cash (sometimes referred to as “Bcash” or “BCH”) is a cryptocurrency that split off from the main Bitcoin blockchain in August 2017. Culminating from Bitcoin’s years-long scaling dispute, the spinoff project most notably increased its block size limit through a contentious hard fork upgrade, “forking off” to become its own coin — though some of its proponents see it as the “real Bitcoin.” While currently trading at a fraction of bitcoin’s value — around $480 at the time of writing — Bitcoin Cash is the fourth biggest cryptocurrency by market cap and has garnered support from big names in the cryptocurrency space like bitcoin.com CEO Roger Ver and Bitmain co-founder Jihan Wu.

Multinational engineering and electronics giant Bosch recently highlighted a new device connectivity method which will work with the Iota marketplace, among other things, for real-time IoT (Internet of Things) data collection and sales.

Data Collection for the IOTA Marketplace

In a recent blog post the firm opened with a quote from 1999 from Nobel Prize winner Milton Friedman extolling the virtues of anonymously transferring funds on the internet, way before cryptocurrencies were even conceived. It continued to elaborate on the Iota ecosystem, its advantages over Bitcoin, and why it has been chosen as a partner.