In the span of 72 hours, both IBM and Amazon backed out of the facial recognition business this week.

It’s a chess match on the geopolitical playing board, with AI ethics and data bias in play.

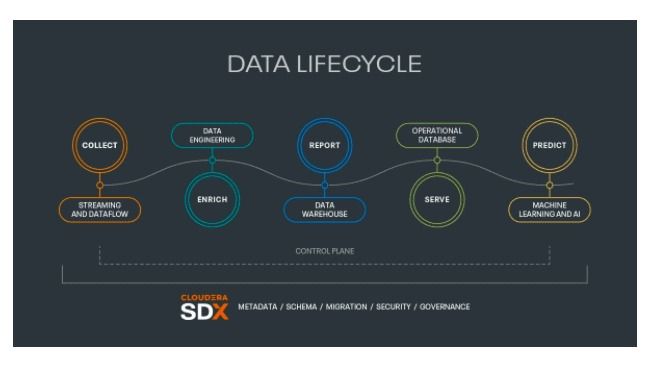

The lifecycle starts when data is collected or ingested from any source. With the advent of 5G, this includes ever more data that’s streamed and generated in real-time.

Companies realize that in order to grow, connect products and services, or protect their business, they need to become data-driven. In selecting the tools to realize these goals, organizations effectively have two choices: a self-selected combination of analytics tools and applications or a unified platform that handles all. In this blog we will discuss the challenges of the former choice that will provide justification for the latter. Let’s take a step back and ask: what do organizations need in terms of analytics to realize their data-driven goals? What is needed to combat customer churn, provide a predictive maintenance service or identify fraud as it happens? One thing is clear: it is not one single analytical capability. Implementing innovative and differentiating business use cases is not simply selecting the perfect data warehouse solution and calling it good. Today’s solutions require more than a better individually functional tool. Going from data to insight to action demands a complete range of capabilities that spans the data life cycle from the edge to AI.

Is Industry 4.0 applicable to only machines or is there scope for businesses to leverage the concept of ‘Connected Workers’?

The shift towards Industry 4.0 is improving manufacturing efficiency and the factory of the future will increasingly be driven by technology like the Internet of Things (IoT), Automation, Artificial Intelligence (AI), and Cloud Computing.

Mars — YES or NOT?

Multi-billionaire founder of SpaceX and Tesla Elon Musk said he believes there is a 70% chance of him getting to Mars on one of his spacecraft. The Independent reports:

Tech entrepreneur Elon Musk has claimed there is a 70 per cent likelihood he will make it to Mars on one of his spacecraft – despite there being “a good chance of death”.

The 47-year-old founder of Tesla, who is among several businessmen seeking to find a way to reach the red planet, said while some consider his vision a fantasy, he thinks making the journey could be possible in as little as seven years from now, with the price of a ticket as low as “a couple of hundred thousand dollars”.

“I know exactly what to do,” Mr Musk told Axios on HBO. “I’m talking about moving there.”

Until recently, there has not been a treatment for the deadly coronavirus. However, that is about to change with the discovery of a new compound: Dexamethosone! With this compound, the worst cases of the coronavirus have seen an increased survival rate.

PS: The stock footage from this photo comes from Videvo!

Discord Link: https://discord.gg/brYJDEr

Patreon link: https://www.patreon.com/TheFuturistTom

Please follow our instagram at: https://www.instagram.com/the_futurist_tom/

For business inquires, please contact [email protected]

Honeywell stock doesn’t trade on quantum fundamentals yet. Shares are down about 16% year to date, worse than the comparable drops of the S&P 500 and Dow Jones Industrial Average. Honeywell is a large aerospace supplier, and the commercial aviation business has been hammered by Covid-19. Boeing (BA) stock, for instance, is off more than 40% year to date.

Honeywell stock is flat in early Friday trading. The S&P is up about 0.8%.

The quantum-computing industry hasn’t yet arrived, despite today’s announcement. But quantum computers are already better than regular computers in certain instances. Google parent Alphabet (GOOGL) demonstrated the ability of its rudimentary quantum computer to beat traditional systems.

SpaceX appears to be on track to complete its third Starship prototype in a month just days after the company finished testing a new steel tank and at the same time as it prepares to roll another full-scale ship to the launch pad.

Postponed by several weeks after the (fleeting) success of the Starship serial number 4 (SN4) prototype, violently destroyed by a minor testing mishap on May 29th, SpaceX’s fifth full-scale Starship tank section (SN5) could roll to an adjacent testing facility at any point in the next few days. In fact, SN4’s successor has likely been ready to begin tank proof and static fire testing for several weeks since it was stacked to its full height on May 12th. SN4 rolled to the launch pad on April 23rd and remained SpaceX’s top Starship priority until its demise more than a month later.

As it turns out, the explosion that destroyed the ship also launched a ~25 metric ton (~55,000 lb) counterweight installed a few days prior some 100m (300+ ft) into the air, where it proceeded to fall back to earth and obliterate the steel mount Starship SN4 sat on. The loss of that pad hardware necessitated its own several-week delay but SpaceX appears to be nearly done installing and outfitting replacements as of June 18th – an incredible turnaround given the scale and complexity of everything involved. Of course, the whole purpose of those rapid repairs is to get back to the business of testing Starships as quickly as possible.

Robotmaker Boston Dynamics has finally put its four-legged robot Spot on general sale. After years of development, the company began leasing the machine to businesses last year, and, as of today, is now letting any US firm buy their very own Spot for $74,500.

It’s a hefty price tag, equal to the base price for a luxury Tesla Model S. But Boston Dynamics says, for that money, you’re getting the most advanced mobile robot in the world, able to go pretty much anywhere a human can (as long as there are no ladders involved).

Although Spot is certainly nimble, its workload is mostly limited right now to surveying and data collection. Trial deployments have seen Spot create 3D maps of construction sites and hunt for machine faults in offshore oil rigs. Less routine tests include helping hospitals triage COVID-19 patients and, somewhat controversially, working with a police bomb squad.

There’s nothing small about the impact small businesses have on local communities. They turn towns into hometowns and strangers into neighbors.

And right now, they need our support.

That’s why we’re bringing you —a one-day musical experience to raise money for Accion Opportunity Fund to provide grants to the most at-risk small businesses hit hardest by COVID-19, with a focus on those run by women and people of color.

Join us as we cross the country to hear top musicians deliver unforgettable performances from unique locations, and share stories of the businesses they know and love.

Act Now. Support Small. Sat. June 20th 4PM — 10PM ET